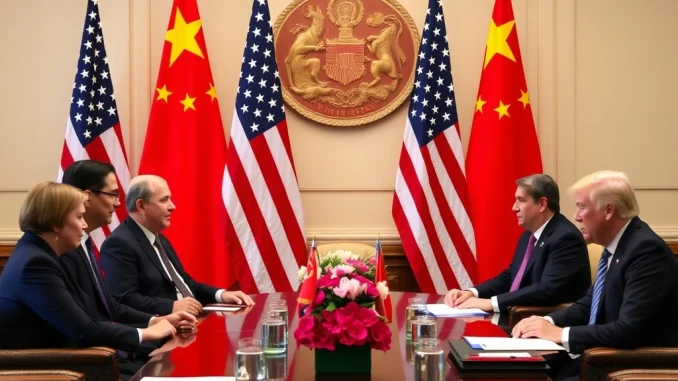

In a pivotal move to stabilize global markets, the U.S. and China have extended their mutual tariff pause, maintaining rates at 30% and 10% respectively. This decision, emerging from high-level talks in Stockholm, aims to prevent market disruptions and foster economic stability. But what does this mean for cryptocurrencies and global trade? Let’s dive in.

U.S.-China Tariff Pause: What’s at Stake?

The agreement, described as “constructive” and “candid,” ensures no immediate changes to existing tariff levels. Here’s what you need to know:

- 30% Tariff: The U.S. will continue applying a 30% tariff on Chinese goods.

- 10% Tariff: China will maintain its 10% tariff on U.S. products.

- Market Stability: The pause aims to avoid disruptions in global supply chains and investor confidence.

How Does the U.S.-China Tariff Pause Impact Cryptocurrencies?

Surprisingly, the cryptocurrency market showed little reaction to the announcement. Analysts attribute this to:

- Detachment from Trade Policy: Cryptocurrencies like Bitcoin and Ethereum have increasingly decoupled from traditional trade policy impacts.

- Anticipated Outcome: Traders had already priced in the likelihood of a tariff pause extension.

Trade Tensions: A Temporary Reprieve or Long-Term Solution?

While the tariff pause offers short-term stability, long-term challenges remain unresolved:

- Core Issues: Intellectual property disputes and market access are still unaddressed.

- No Concrete Plans: The agreement lacks timelines for future negotiations or tariff reductions.

Economic Stability: Why This Matters for Global Markets

The decision reflects a shared commitment to predictable trade relations, which is crucial for:

- Multinational Corporations: Avoiding disruptions in cross-border trade.

- Investor Confidence: Providing a stable environment for long-term investments.

Conclusion: A Pragmatic Step Forward

The U.S.-China tariff pause extension is a pragmatic move to stabilize global markets, but it’s not a solution to deeper trade tensions. For now, businesses and investors can breathe a sigh of relief—but the road ahead remains uncertain.

Frequently Asked Questions (FAQs)

1. How long will the U.S.-China tariff pause last?

The agreement does not specify an end date, leaving it open for future negotiations.

2. Why didn’t cryptocurrencies react to the tariff pause news?

Cryptocurrencies have shown increasing detachment from traditional trade policy impacts, and the outcome was largely anticipated by the market.

3. What are the unresolved issues between the U.S. and China?

Key issues include intellectual property disputes, market access, and structural trade imbalances.

4. How does this tariff pause affect global supply chains?

By avoiding immediate escalations, the pause helps maintain the routine flow of goods and investments across borders.

5. What’s next for U.S.-China trade relations?

Both nations have agreed to continue negotiations, but no concrete plans or timelines have been announced.