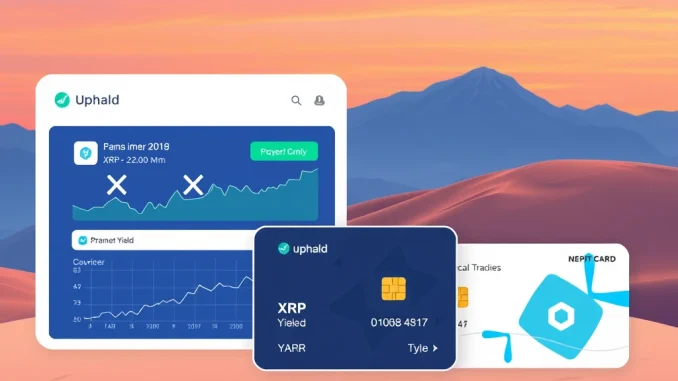

Are you an XRP holder or an Uphold user? Get ready for some potentially exciting developments! Digital trading platform Uphold is making moves that could impact how you earn and spend your digital assets, specifically focusing on **XRP yield** opportunities and expanding access to their **crypto debit card** in the United States.

What’s Happening at **Uphold**?

Uphold, a well-known platform for trading various assets including cryptocurrencies, is actively looking into new ways for users to potentially earn passive income on their holdings. The most notable exploration currently underway is centered around the XRP cryptocurrency.

According to a report by The Block, Uphold is exploring different methods to generate yield for users holding XRP. This initiative aims to provide value beyond simple price appreciation, offering a way to grow your holdings over time.

Exploring **XRP Yield** Opportunities

The concept of earning yield on crypto assets is gaining popularity, allowing users to lend out their holdings or participate in staking mechanisms to earn rewards. Uphold is now investigating how this can be applied to XRP.

One specific avenue being tested is staking through the Flare Network. Flare is designed to bring smart contract functionality to blockchains like XRP Ledger that don’t natively support it, potentially enabling new ways to earn yield or participate in DeFi-like activities.

While details are still emerging, the exploration signals Uphold’s interest in offering competitive yield products for XRP holders on their platform. Users interested in maximizing their XRP holdings will want to follow these developments closely.

Bringing the **Crypto Debit Card** to the States

Beyond yield, Uphold is also addressing how users can spend their crypto more easily. The company has announced plans to relaunch its **crypto debit card** in the **U.S. crypto** market.

Currently available only to users in the UK, this card allows individuals to spend the cryptocurrencies held directly in their Uphold account for everyday purchases. It functions like a standard debit card but draws funds from your digital asset balance after conversion at the point of sale.

The card is offered in both digital and physical formats, providing flexibility for online and in-store transactions. Bringing this service to the U.S. market could significantly enhance the utility of holding crypto on the Uphold platform for American users.

What Does This Mean for **U.S. Crypto** Users?

The planned U.S. launch of the Uphold crypto debit card is a significant step. The United States represents a large and growing market for cryptocurrency adoption, and providing convenient spending solutions is key to mainstream integration.

A crypto debit card removes some friction associated with using digital assets for payments, eliminating the need to first sell crypto for fiat currency and then transfer funds to a traditional bank account before spending. This makes holding crypto on Uphold more practical for daily use.

The Role of the **Flare Network** in Yield Testing

The mention of testing through the Flare Network is notable. Flare aims to provide decentralized access to data and enable smart contracts for non-smart contract chains. Its involvement in Uphold’s XRP yield exploration suggests potential mechanisms might leverage Flare’s capabilities, perhaps related to wrapped XRP (FXRP) or other protocols built on Flare.

Understanding the technical details will require more information from Uphold, but the collaboration with Flare indicates a potential path towards more decentralized or blockchain-native yield generation methods for XRP.

Benefits and Potential Hurdles

- Benefits:

- Potential for passive income on XRP holdings.

- Increased utility and convenience for spending crypto in the U.S.

- Expansion of Uphold’s service offerings.

- Potential Hurdles:

- Regulatory clarity for crypto yield products in various jurisdictions, especially the U.S.

- Technical complexities of implementing and scaling yield programs.

- Market volatility affecting the value of holdings and potential yield returns.

- Logistical challenges of launching a financial product like a debit card in a new market.

Looking Ahead

Uphold’s exploration into XRP yield and the planned U.S. relaunch of its crypto debit card signal the platform’s commitment to expanding its services and providing more ways for users to interact with their digital assets. These developments, if successful, could offer significant benefits to XRP holders and Uphold users in the United States, making earning and spending crypto more accessible.

Keep an eye on official announcements from Uphold for timelines and specific details regarding these exciting initiatives.