Major political events can significantly shape the economic landscape, and understanding these shifts is key for anyone navigating financial markets, including the world of cryptocurrencies. While crypto operates globally, it doesn’t exist in a vacuum, and significant changes in national policies, especially from major economies like the United States, can create ripples. Let’s look at a notable piece of political legislation signed on a significant date.

What Happened with the Trump Tax Cuts on July 4th?

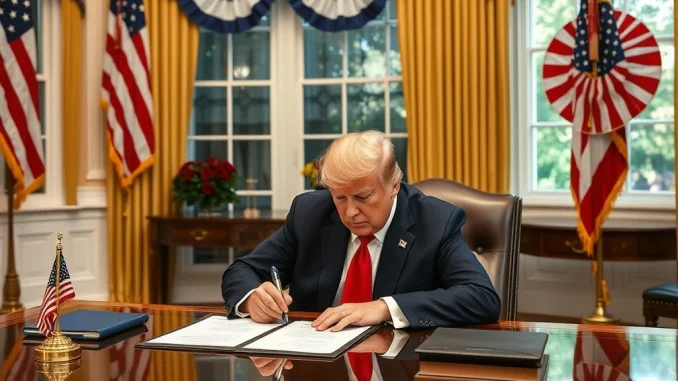

According to reports from CBS News, U.S. President Donald Trump signed a significant piece of legislation, dubbed the ‘One, Big, Beautiful Bill,’ on July 4th during the Independence Day ceremony held at the White House. The timing, coinciding with a national holiday celebrating independence, added a layer of symbolism to the event.

This bill isn’t just a single item; it’s described as a package. The core components highlighted are a series of tax breaks and spending cuts. These two elements represent significant levers of US economic policy, aiming to influence everything from individual household finances to large corporate investments and the overall fiscal health of the nation.

The specific details of the tax breaks and spending cuts within this government spending bill are crucial for understanding its potential effects. Tax breaks can range from cuts for individuals to incentives for businesses. Spending cuts can impact various government programs and departments.

Understanding the balance struck between these two aspects – reducing taxes (potentially stimulating private spending/investment) and cutting government spending (potentially reducing demand or specific program support) – is key to analyzing the bill’s intended and unintended consequences.

Unpacking the Potential Impact of Trump Tax Cuts

Tax cuts are often presented as a way to boost economic activity. The theory suggests that when individuals and businesses pay less in taxes, they have more money available to spend, save, or invest. For businesses, lower taxes can mean more capital for expansion, hiring, or research and development.

The Trump tax cuts included in this bill could have several potential effects:

- Increased Consumer Spending: If individual income taxes are reduced, people might have more disposable income.

- Business Investment: Lower corporate taxes or specific business tax incentives could encourage companies to invest domestically.

- Job Growth: Increased business activity and investment can potentially lead to more job creation.

- Wage Growth: A tighter labor market due to increased hiring might put upward pressure on wages.

However, the actual impact depends heavily on the specifics of *who* receives the tax breaks and *how* significant they are. Tax cuts primarily benefiting high-income earners might have a different economic effect than those targeting middle- or lower-income families. Similarly, tax breaks for specific industries could drive growth in those sectors more than others.

Analyzing the Government Spending Bill Component

The other side of the coin in this legislation is the inclusion of spending cuts. Reductions in government spending can have various goals, such as reducing the national debt, lowering budget deficits, or shifting resources to different priorities.

A government spending bill with significant cuts can impact the economy in different ways:

- Reduced Government Demand: Cuts in spending on infrastructure, defense, or social programs reduce the government’s direct contribution to economic activity.

- Impact on Specific Sectors: Industries that rely heavily on government contracts or funding may see reduced activity.

- Effect on Public Services: Cuts could potentially affect the level or quality of public services provided.

- Fiscal Responsibility: From one perspective, spending cuts are seen as a move towards greater fiscal responsibility and sustainability.

The debate around spending cuts often centers on their necessity, their fairness, and their potential deflationary or recessionary effects if too drastic. Balancing spending cuts with tax breaks is a complex act of fiscal policy.

How Does This Fit into Broader US Economic Policy?

This bill is a clear example of using fiscal policy tools – taxation and government spending – to influence the national economy. It reflects a particular approach to US economic policy, often associated with supply-side economics, which emphasizes tax cuts to stimulate production and investment.

Such legislation is enacted with specific goals in mind, whether it’s boosting GDP growth, reducing unemployment, controlling inflation, or managing the national debt. Economists hold differing views on the effectiveness and consequences of such measures. Some might argue that the tax cuts will spur growth that outweighs the impact of spending cuts, while others might worry about the potential for increased deficits if the tax cuts aren’t offset by sufficient spending reductions or subsequent economic growth.

Understanding this bill requires looking at it within the larger context of current economic conditions, ongoing debates about fiscal responsibility, and the political priorities of the administration in power.

The Significance of Political Legislation and Market Reaction

The signing of this bill as political legislation on July 4th adds a symbolic layer. Independence Day is a time for reflection on the nation’s foundations and future, and signing a major economic bill on this day signals its perceived importance by the administration.

Major legislative changes like this invariably lead to market reaction. Financial markets, including stock markets, bond markets, and currency markets, process the potential implications of the bill for corporate profits, consumer spending, government debt, and economic growth. Investors analyze the details to determine which sectors might benefit or be harmed and how overall economic conditions might change.

For the cryptocurrency market, the connection is often less direct than for traditional assets. However, significant shifts in US economic policy and resulting market reaction can still matter. For example:

- Inflation/Deflation: Policies affecting overall economic activity and money supply can influence the inflation outlook, which some crypto investors watch closely (especially for assets seen as hedges).

- Investor Sentiment: Major economic policy changes can impact overall investor confidence and risk appetite, potentially influencing flows into or out of risk assets like cryptocurrencies.

- Dollar Strength: Changes in US fiscal policy can affect the strength of the U.S. dollar, which has complex relationships with crypto prices.

While the direct impact of these specific Trump tax cuts and government spending bill components on crypto is debatable and indirect, they contribute to the overall macroeconomic environment that crypto markets exist within. Staying informed about major political legislation and its potential economic consequences is part of understanding the broader context for financial markets.

Summary

President Trump’s signing of the ‘One, Big, Beautiful Bill’ on July 4th marks a significant moment in US economic policy. This political legislation, encompassing Trump tax cuts and components of a government spending bill, aims to reshape the nation’s fiscal landscape. While the direct market reaction in traditional finance is expected, those in the cryptocurrency space should also monitor how these large-scale economic shifts might indirectly influence the broader financial climate and investor behavior. The long-term effects of this bill on the US economy will unfold over time, and its impact on various sectors, including the nuanced world of digital assets, remains a subject for ongoing observation and analysis.