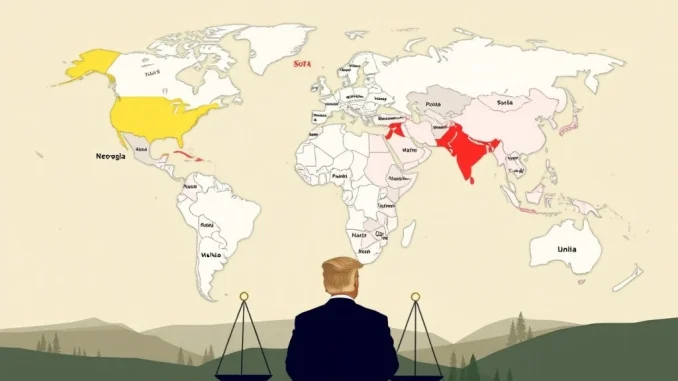

In a move that has sent ripples across international markets, former U.S. President Donald Trump has officially notified eight more countries of impending tariff impositions. This development, announced via his Truth Social platform, adds to a growing list of nations facing economic pressures from Washington. For those closely watching the cryptocurrency space, such significant shifts in traditional finance and global trade can often signal broader market uncertainties, potentially influencing investor behavior and the flow of capital. Understanding the implications of these new Trump tariffs is crucial for grasping the evolving economic landscape.

Understanding the Latest Trump Tariffs and Their Reach

The announcement came directly from Donald Trump’s Truth Social account, detailing the specific countries and the tariff percentages they are set to face. This latest round brings the total number of countries notified so far to 22, underscoring a consistent approach to trade policy that characterized his previous administration. The eight newly notified nations are:

- Brazil: Set to face a substantial 50% tariff.

- Libya: A 30% tariff imposition.

- Iraq: Also facing a 30% tariff.

- Algeria: Included with a 30% tariff.

- Sri Lanka: Another nation with a 30% tariff.

- Brunei: A 25% tariff will be applied.

- Moldova: Also subject to a 25% tariff.

- The Philippines: Will see a 20% tariff.

These figures represent significant economic hurdles for the affected nations, potentially reshaping their trade relationships with the United States. The decision to announce such critical policy shifts on a social media platform also highlights a unique aspect of how information, particularly from influential figures, can directly impact global markets and sentiment.

The Echoes of a Potential Trade War: Are We There Again?

The imposition of tariffs is a powerful economic tool, often used to protect domestic industries, correct perceived trade imbalances, or exert political leverage. During his previous term, Donald Trump frequently employed tariffs, notably against China and European allies, sparking what many termed a trade war. These actions led to retaliatory tariffs from affected countries, creating a cycle of escalating trade barriers.

The latest announcements raise questions about the potential for a renewed or expanded trade war. Such scenarios typically involve:

- Increased Costs: Both for consumers who pay more for imported goods and for businesses relying on imported components.

- Supply Chain Disruptions: Companies may need to find new suppliers or re-route their supply chains, leading to inefficiencies.

- Reduced Global Trade: Overall volumes of goods and services exchanged between nations tend to decrease, impacting economic growth.

- Uncertainty: Businesses and investors become hesitant, leading to reduced investment and hiring.

The prospect of more countries being drawn into this tariff framework could intensify these effects, creating a complex web of economic challenges worldwide.

Navigating the Impact on the Global Economy

When a major economic player like the United States imposes tariffs on multiple countries, the effects reverberate far beyond the directly involved parties. The global economy is an interconnected system, and disruptions in one area can quickly spread. Here’s how these tariffs could play out:

Tariffs are essentially taxes on imported goods. When applied, they make foreign products more expensive in the U.S. market, theoretically making domestic products more competitive. However, the reality is often more complex:

- Consumer Burden: Often, the cost of tariffs is passed on to American consumers through higher prices for goods.

- Producer Strain: U.S. companies that rely on imported raw materials or components face increased costs, potentially reducing their profitability or forcing them to raise prices.

- Retaliation Risks: Affected countries may impose their own tariffs on U.S. exports, hurting American businesses and farmers.

- Currency Fluctuations: Trade tensions can lead to volatility in currency markets, impacting exchange rates and the cost of international transactions.

For the broader global economy, this translates into potential slowdowns in international trade, reduced foreign direct investment, and increased economic nationalism. Developing nations, in particular, might find themselves in a precarious position as they navigate these new trade barriers.

Assessing the Economic Impact: Winners and Losers?

Every significant policy shift creates a spectrum of outcomes. The economic impact of these tariffs will not be uniform. While the stated goal of tariffs is often to protect domestic industries and jobs, the actual results can be varied and sometimes counterintuitive.

Potential Winners:

- Certain Domestic Industries: Industries that directly compete with the tariffed imports might see increased demand for their products. For example, if steel imports are tariffed, domestic steel producers might benefit.

- Governments: The imposing government collects revenue from the tariffs, although this is often offset by other economic costs.

Potential Losers:

- Consumers: Face higher prices for imported goods and potentially for domestic goods if competition is reduced.

- Businesses Relying on Imports: Manufacturers, retailers, and other businesses that depend on components or finished goods from tariffed countries will see their costs rise.

- Exporting Industries: U.S. industries that export goods may suffer if retaliatory tariffs are imposed by other nations.

- Global Supply Chains: The efficiency and cost-effectiveness of global supply chains can be severely disrupted, leading to higher operational costs for multinational corporations.

The long-term economic impact is often a net negative, as tariffs distort market efficiencies and can lead to a reduction in overall economic output and innovation. Businesses are forced to adapt, often at significant cost, and these costs eventually trickle down through the economy.

Unpacking the Geopolitical Shifts Ahead

Beyond the immediate economic consequences, these tariff announcements carry significant geopolitical shifts. Trade policy is inextricably linked with foreign policy, and economic pressure can be a tool for asserting diplomatic influence or responding to perceived grievances.

Consider the broader implications:

- Strained Alliances: Even friendly nations can see their relationships strained when economic interests clash. The inclusion of countries like Brazil and the Philippines, with whom the U.S. has established ties, indicates a broad application of this policy.

- Formation of New Blocs: Countries facing tariffs might seek to strengthen trade ties with other nations, potentially forming new economic alliances that exclude the U.S.

- Challenges to Multilateralism: Tariffs often bypass international trade organizations like the World Trade Organization (WTO), undermining their authority and the rules-based global trading system.

- Domestic Political Ramifications: In the targeted countries, these tariffs could fuel anti-U.S. sentiment and influence domestic political dynamics.

These geopolitical shifts can lead to a more fragmented global order, where economic nationalism takes precedence over international cooperation. For investors, this means increased uncertainty and the need to closely monitor not just economic indicators, but also diplomatic relations and political rhetoric.

Conclusion: Navigating a Shifting Economic Landscape

The latest announcement from Donald Trump regarding tariffs on eight additional countries is a significant development that demands attention. While the immediate focus is on the direct economic implications for the affected nations and U.S. consumers, the broader ripple effects on the global economy and the potential for renewed trade war dynamics cannot be overstated. These actions highlight a persistent willingness to use economic leverage as a primary tool in international relations, leading to notable geopolitical shifts. As the world grapples with these evolving trade policies, businesses, investors, and policymakers alike will need to remain agile and adaptable to navigate the uncertainties ahead. The future of global trade, and indeed the broader economic stability, hinges on how these tariff challenges are addressed and whether new pathways for cooperation can emerge amidst the tensions.

Frequently Asked Questions (FAQs)

Q1: What exactly are tariffs, and how do they work?

A1: Tariffs are taxes imposed by a government on imported goods or services. They increase the cost of foreign products, making them less competitive compared to domestically produced goods. The goal is often to protect domestic industries, generate revenue, or exert political pressure. When a tariff is imposed, importers pay the tax to their government, which then typically passes the cost on to consumers or absorbs it, impacting their profit margins.

Q2: Why did Donald Trump impose tariffs on these specific countries?

A2: While the specific rationale for each country isn’t detailed in the announcement, Trump’s past tariff policies have often been driven by a desire to reduce trade deficits, protect specific American industries (like steel or agriculture), or respond to what he perceives as unfair trade practices. The choice of countries may reflect concerns about trade imbalances, intellectual property issues, or other geopolitical considerations specific to those nations.

Q3: How might these tariffs affect the average consumer in the U.S.?

A3: The average U.S. consumer could be affected in several ways. Firstly, prices for imported goods from the tariffed countries may increase. Secondly, even domestic goods could become more expensive if they rely on imported components or if reduced competition allows domestic producers to raise prices. This can lead to a decrease in purchasing power and potentially impact household budgets.

Q4: What is the difference between a ‘trade war’ and standard trade disagreements?

A4: Standard trade disagreements are common and usually involve negotiations or disputes within established international frameworks like the WTO. A ‘trade war,’ however, implies a more aggressive and escalating cycle of retaliatory tariffs and protectionist measures between countries, often outside or in defiance of these frameworks. It’s characterized by a tit-for-tat approach where each side imposes tariffs in response to the other’s actions, leading to broader economic disruption.

Q5: Can these tariffs be reversed or changed?

A5: Yes, tariffs are policy tools and can be reversed, modified, or lifted by the imposing government. This often happens as a result of negotiations, changes in economic conditions, or a shift in political leadership or priorities. The duration and impact of tariffs depend heavily on ongoing diplomatic efforts and the willingness of all parties to reach new trade agreements.