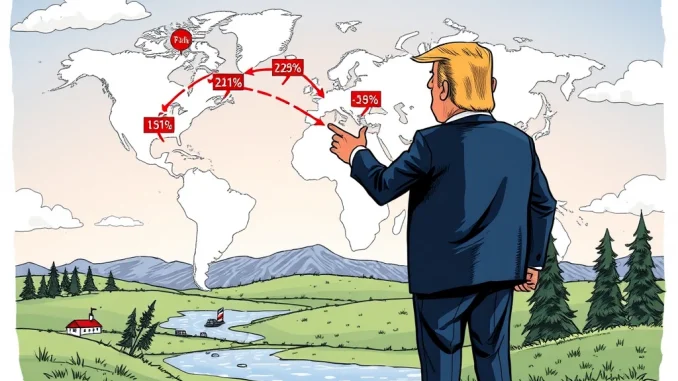

In the fast-paced world of finance and investment, news from political leaders can often send ripples through markets, including the cryptocurrency space. While perhaps not immediately obvious, shifts in global economic policy, like those concerning Trump tariffs, can influence market sentiment, currency stability, and investor behavior. A recent statement attributed to former U.S. President Donald Trump suggests significant potential changes ahead for US trade policy, moving away from previously established baselines and signaling the possibility of more aggressive stances.

What Did Trump Say About Trump Tariffs?

According to reports, including one shared by ‘Solid Intel’ on the platform X, Donald Trump has indicated that the 10% tariff rate, often discussed or implemented during his previous term, should not be viewed as a fixed template for upcoming international trade agreements.

This is a key point because it suggests flexibility, but also a willingness to exceed that figure. The emphasis, according to the statement, is that future trade deals could, and likely would, involve significantly higher rates than this 10% figure.

Let’s break down the core message:

- The 10% rate is not a ceiling or a standard baseline.

- Future negotiations are not bound by this number.

- Expectation is that rates in future deals could be higher.

This perspective sets a potentially different tone for future trade discussions compared to simply maintaining or slightly adjusting existing rates. It positions Trump tariffs as a dynamic tool, ready to be wielded with potentially greater intensity.

Why Are Potentially Higher Tariffs Significant?

When a major global economy like the United States talks about increasing tariffs, it has widespread implications. Tariffs are essentially taxes on imported goods. When they go up, imported products become more expensive. This can have several effects:

For consumers: Higher prices on imported goods, potentially leading to increased costs for everyday items.

For businesses: Increased costs for materials or components sourced from abroad, potentially disrupting supply chains and impacting profitability. Domestic industries might see a competitive advantage, but face risks if other countries retaliate with their own tariffs.

For international relations: Can strain relationships with trading partners, potentially leading to trade disputes or even trade wars.

The statement about potentially higher tariffs signals a willingness to use trade policy as a strong leverage point in negotiations, potentially prioritizing domestic production and aiming to reshape global supply chains.

Understanding the Potential Economic Impact

The potential for higher tariffs carries a significant Economic impact. Beyond the immediate price increases, it can introduce uncertainty into the market. Businesses might delay investment decisions due to unpredictable trade costs. Consumers might curb spending in anticipation of rising prices.

Here are some potential areas of impact:

- Inflation: Increased import costs can contribute to overall price levels rising within the country.

- Supply Chain Disruption: Companies may need to find new suppliers or relocate production, a costly and time-consuming process.

- Retaliation: Trading partners are likely to impose their own tariffs on U.S. exports, harming American industries that rely on foreign markets.

- Currency Fluctuations: Trade tensions can impact currency exchange rates, adding another layer of complexity for international trade and investment.

For those in the crypto market, understanding this Economic impact is crucial. Economic uncertainty, inflationary pressures, and currency volatility are all factors that can influence the attractiveness and performance of cryptocurrencies as alternative assets or hedges.

Navigating the Landscape of Future Trade Deals

The statement that the 10% tariff baseline is not a template for future trade deals suggests a potentially tough negotiating stance ahead. It implies that countries seeking trade agreements with the U.S. might face demands for greater concessions or higher tariff rates on their exports.

This approach could be seen as a tactic to gain leverage in negotiations, pushing partners to agree to terms more favorable to the U.S., such as reducing their own trade barriers or increasing purchases of American goods.

However, it also raises questions about the ease of reaching new agreements and the potential for prolonged trade tensions. The path to securing future trade deals could become more challenging if starting points involve demands for significantly higher tariffs.

Comparing the Stance on Trump Tariffs

While 10% tariffs were implemented or discussed during Trump’s previous presidency on various goods (like steel, aluminum, and some Chinese imports), this new statement clarifies that this wasn’t necessarily the peak or the final form of his tariff policy. It positions the previous actions perhaps as steps towards a potentially more protectionist or aggressive future stance on Trump tariffs.

This approach differs from traditional trade policy, which often aims for gradual tariff reduction through multilateral agreements. Trump’s stated willingness to use tariffs assertively and potentially increase them significantly highlights a focus on bilateral leverage and a readiness to disrupt existing trade norms.

What Does This Mean for Crypto Investors?

While this news is about trade policy, its relevance to the crypto world lies in its potential to increase market volatility and economic uncertainty. Trade tensions, inflation risks, and disruptions to global commerce can lead investors to reconsider their portfolios.

Cryptocurrencies are sometimes viewed as uncorrelated assets or potential hedges against traditional market instability or inflation. Increased economic friction caused by higher tariffs and shifting US trade policy could, in theory, drive interest in digital assets, though this is a complex relationship influenced by many factors.

Staying informed about major economic and political shifts, like the potential direction of Trump tariffs and future trade deals, is part of understanding the broader market environment in which crypto operates.

Conclusion: Watching the Horizon for Trade Shifts

Donald Trump’s reported statement that the 10% tariff baseline is not a fixed rate for future trade agreements, and that higher tariffs are likely, sends a clear signal: be prepared for potentially significant changes in US trade policy. This approach, centered on using Trump tariffs as a strong negotiating tool, could have a substantial Economic impact, affecting everything from consumer prices and supply chains to international relations and the landscape of future trade deals.

For market participants, including those in the cryptocurrency space, this development underscores the importance of monitoring geopolitical and economic news. Increased trade tensions and economic uncertainty are factors that can influence global markets and potentially impact the performance and perception of digital assets. While the direct link isn’t always immediate, the ripples from major policy shifts eventually reach all corners of the financial world.

Keeping an eye on how these potential tariff changes develop will be crucial for understanding the economic backdrop against which all assets, including cryptocurrencies, will perform.