In the world of cryptocurrency, understanding the broader economic landscape is key. And few things influence that landscape more than the actions of the Federal Reserve and the commentary from major political figures like Donald Trump. Recent events saw the former U.S. President take aim directly at Fed Chair Jerome Powell, adding a layer of political drama to the already complex picture of U.S. monetary policy. So, what exactly did Trump say, what did the Fed decide, and why should the Crypto Market pay attention?

Why Donald Trump‘s Criticism of Jerome Powell Matters

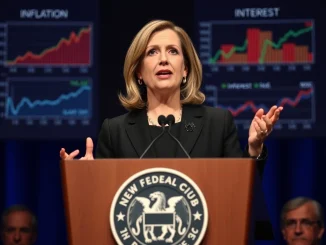

Taking to his Truth Social platform, Donald Trump didn’t hold back his criticism of current Federal Reserve Chair Jerome Powell. His remarks were sharp and personal, labeling Powell with various negative descriptors and attributing significant financial costs to his leadership. This isn’t the first time Trump has publicly disagreed with Powell, but the intensity of his recent comments caught many observers’ attention.

Here’s a quick look at some of Trump’s points:

- Called Powell “Too Late—Powell,” suggesting the Fed was slow to act on economic issues.

- Described him as “the WORST.”

- Referred to him as “a real dummy.”

- Claimed Powell is costing the U.S. billions of dollars.

Adding to the pressure, Trump also shared an article advocating for Powell’s resignation, specifically citing issues related to major mortgage institutions like Fannie Mae and Freddie Mac. Such direct calls for resignation from a former President carry weight and can inject uncertainty into market sentiment, including indirectly impacting the Crypto Market.

The Federal Reserve and Unchanged Interest Rates: What Happened?

Amidst this political noise, the Federal Reserve‘s monetary policy committee, the FOMC, held its scheduled meeting. The key takeaway from their announcement was the decision to keep Interest Rates unchanged. This move was largely anticipated by market analysts, signaling that the Fed is currently comfortable holding rates steady as they assess economic data, particularly inflation and employment figures.

The Fed’s control over Interest Rates is one of its primary tools for managing the economy. Lower rates generally encourage borrowing and spending, stimulating growth, while higher rates tend to slow down the economy and combat inflation. The decision to hold rates steady indicates a cautious approach, neither tightening conditions further nor beginning to loosen them.

How Do Interest Rates Impact the Crypto Market?

So, how does any of this relate to Bitcoin, Ethereum, and the broader Crypto Market? There’s a significant connection:

The Fed’s monetary policy, particularly Interest Rates, directly influences overall market liquidity and investor risk appetite. When interest rates are low, borrowing money is cheaper, and traditional safe investments like bonds offer lower returns. This environment often encourages investors to seek higher returns in riskier assets, including stocks and cryptocurrencies.

Conversely, when the Federal Reserve raises Interest Rates, borrowing becomes more expensive, and safer investments become more attractive. This can lead investors to pull money out of riskier assets like crypto, putting downward pressure on prices. The decision to keep rates unchanged suggests the current level of liquidity and investment incentive remains stable, at least for now. However, political pressure from figures like Donald Trump adds another layer of potential volatility, as it could signal future policy disagreements or changes in approach.

Navigating Uncertainty: Insights for the Crypto Market

For those invested in the Crypto Market, keeping an eye on developments regarding the Federal Reserve and commentary from influential figures is crucial. While Jerome Powell and the Fed operate independently of political pressure, persistent criticism from someone like Donald Trump can still impact market sentiment and future policy expectations.

Key takeaways for crypto enthusiasts:

- The Fed’s decision to hold Interest Rates steady is a key factor influencing current market conditions.

- Political commentary, while not directly controlling the Fed, adds to the overall economic and market uncertainty.

- Understanding the link between macroeconomics (like interest rates) and the Crypto Market is essential for informed decision-making.

In conclusion, the recent clash between Donald Trump and Jerome Powell highlights the ongoing tension surrounding U.S. economic policy. While the Federal Reserve stuck to its path by keeping Interest Rates unchanged, the political backdrop remains dynamic. For participants in the Crypto Market, staying informed about these macro-level events is just as important as following specific crypto news, as they significantly shape the tides of the broader financial sea.