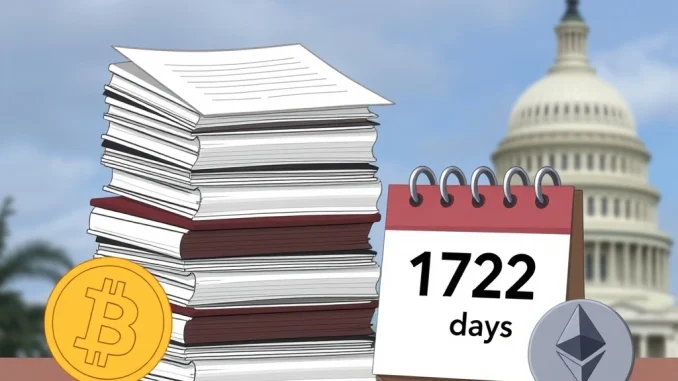

A critical examination of federal digital asset reserves faces significant hurdles. The **US government crypto audit**, initiated by former President Donald Trump, remains conspicuously delayed. This crucial review has now been stalled for 172 days. Its purpose was to survey the cryptocurrency holdings across various federal agencies. This ongoing delay raises important questions about transparency and the government’s approach to digital assets.

Unpacking the Stalled US Government Crypto Audit

The **US government crypto audit** originated from an executive order issued by then-President Donald Trump. This directive aimed to establish a clear picture of the government’s involvement in the burgeoning cryptocurrency space. Specifically, it sought to catalog and assess the Bitcoin and other cryptocurrency reserves held by federal bodies. The initial deadline for this comprehensive review was set for April 5. However, that date passed without any public announcement of results.

To date, no official statement has emerged regarding the audit’s findings. Key figures involved in its oversight have remained silent. Treasury Secretary Scott Bessent, White House AI and crypto chief David Sacks, and President Trump himself have not disclosed any progress. This prolonged silence fuels speculation and concern among industry observers. Many wonder about the reasons behind this significant **crypto audit delay**.

The Significance of Federal Crypto Reserves

Understanding the extent of **federal crypto reserves** is vital for several reasons. First, it offers insight into the government’s strategic interests in digital assets. Such holdings could reflect investments, seized assets, or operational funds. Second, transparency around these reserves is crucial for public trust. Citizens and the market deserve to know how government agencies manage and secure digital currencies. Third, the audit’s findings could inform future regulatory frameworks and policy decisions. A clear inventory is a foundational step for effective governance.

The delay in this audit leaves a void of information. Without a clear report, it is difficult to assess the scope of government involvement. Furthermore, this lack of clarity can create uncertainty within the broader cryptocurrency market. Investors and innovators often look to government actions for signals about future direction. Therefore, the absence of an audit report carries substantial implications.

The Broader Context of Trump Crypto Audit Initiatives

The **Trump crypto audit** initiative was part of a broader push to understand and potentially regulate digital assets. During his presidency, Trump expressed varying views on cryptocurrencies. Nevertheless, the executive order underscored a recognition of their growing importance. This audit was not an isolated event. Instead, it fit into a larger narrative of government bodies grappling with the complexities of blockchain technology and digital currencies. Other nations are also exploring similar audits. This highlights a global trend towards assessing digital asset exposure.

The intention behind the audit was clear: to gain a comprehensive overview. This would allow for informed decision-making regarding national security, financial stability, and technological innovation. The protracted delay, however, contradicts the urgency initially implied by the executive order. This situation presents a challenge for those advocating for clearer governmental policies on digital assets.

Calls for Transparency in Government Crypto Holdings

The extended **crypto audit delay** has led to increased calls for transparency. Industry leaders and privacy advocates emphasize the importance of open government. They argue that the public has a right to know about **government crypto holdings**. This is particularly true given the volatile nature of digital assets and their potential impact on national finances. The lack of an update for 172 days suggests either significant unforeseen complexities or a lack of priority.

Several factors might contribute to such a delay. The sheer volume and decentralized nature of cryptocurrency holdings could complicate the audit process. Additionally, inter-agency coordination can be challenging. Political shifts and changes in administrative priorities may also play a role. Regardless of the reasons, the absence of an official report creates an information vacuum. Stakeholders are keen to understand the scope and security of these assets.

Conclusion: Awaiting Critical Findings

The stalled **US government crypto audit** represents a significant ongoing issue. Its 172-day delay since the original deadline leaves many questions unanswered. This crucial review, ordered by former President Donald Trump, aimed to clarify federal crypto reserves. The continued silence from key officials, including Treasury Secretary Scott Bessent and White House AI and crypto chief David Sacks, remains notable. The cryptocurrency community and the public await the findings of this important audit. Transparency regarding **government crypto holdings** is essential for informed policy-making and maintaining public trust in the evolving digital asset landscape.

Frequently Asked Questions (FAQs)

What was the purpose of the US government crypto audit?

The audit aimed to survey and assess the Bitcoin and other cryptocurrency reserves held by various federal agencies across the U.S. government.

Who ordered the audit?

The audit was ordered by former U.S. President Donald Trump through an executive order.

How long has the audit been delayed?

The audit has been delayed for 172 days past its original deadline of April 5.

Which officials are involved in the audit’s oversight?

Treasury Secretary Scott Bessent, White House AI and crypto chief David Sacks, and former President Trump were involved in initiating and overseeing the audit.

Why is this audit considered important?

It is important for transparency, informing future cryptocurrency policy, understanding government exposure to digital assets, and maintaining public trust.

What are the potential next steps for this audit?

The next steps would typically involve an official announcement of the audit’s findings, potentially followed by policy recommendations or legislative actions based on the discovered federal crypto reserves.