The cryptocurrency market is a dynamic arena where fortunes can shift in an instant. Recently, all eyes have been on Toncoin (TON) as it navigates a critical juncture, testing a crucial support level that could dictate its immediate future trajectory. Investors and traders are closely watching to see if TON is poised for a significant rebound, or if further corrections are on the horizon following its recent dip.

Decoding the Current TON Crypto Price Action

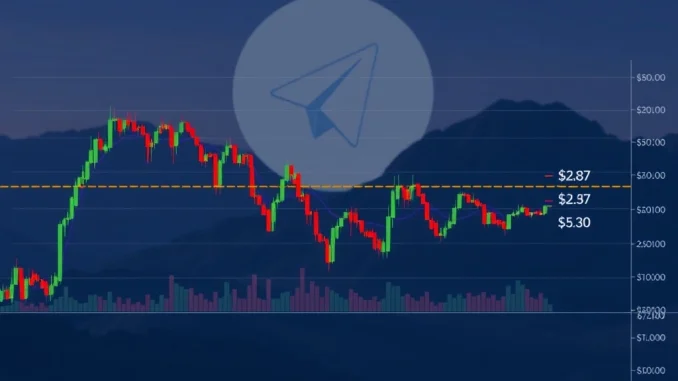

At the time of reporting on Thursday, July 24, 2025, TON crypto was trading at $3.14, reflecting a 5% decline over the past 24 hours and a 4% drop over the last seven days. Its daily trading volume stood at approximately $334 million, indicating active market participation despite the price correction. The focal point for traders remains the $2.87 support level, a key threshold that could determine the continuation of its broader bullish trend.

This level is particularly significant as it sits just above the 0.5 Fibonacci retracement, a technical indicator often used to identify potential support or resistance levels based on previous price movements. Analyst Ali Martinez highlighted the importance of this level, emphasizing that maintaining it is essential for preserving the upward momentum Toncoin has exhibited.

Why is $2.87 a Crucial Toncoin Support Level?

The $2.87 mark is not just an arbitrary number; it represents a vital Toncoin support level derived from technical analysis, specifically Fibonacci retracement. Fibonacci levels are horizontal lines that indicate where support and resistance are likely to occur, based on a mathematical sequence. The 0.5 Fibonacci retracement level often acts as a strong psychological and technical barrier, suggesting that if a price corrects to this point and holds, it signals underlying strength in the asset.

- Historical Significance: This level has likely acted as a pivot point in past price movements, making its current defense critical.

- Analyst Consensus: Prominent analysts like Ali Martinez underscore its importance for sustaining bullish sentiment.

- Fibonacci Alignment: Its proximity to the 0.5 Fibonacci retracement reinforces its technical weight.

Should Toncoin successfully hold this support, the path could clear for a significant upward move. However, a decisive breakdown below $2.87 would expose the next major support level at $2.23, according to various chart analyses, potentially signaling a deeper correction.

Can TON Crypto Reach $5.30? A Look at Technicals and TON Price Analysis

The ambitious target of $5.30 for TON crypto is not without basis. This price point aligns with the 0.786 Fibonacci expansion and a prior supply zone, indicating a strong confluence of technical factors. For Toncoin to reach this target, several technical indicators and market dynamics need to align:

Technical Indicators in Focus:

- Money Flow Index (MFI): Currently at 83.71, the MFI indicates that TON is in overbought territory. This often suggests that the asset has been purchased too aggressively and might be due for a period of consolidation or profit-taking. While not a definitive bearish signal, it warrants caution.

- Relative Strength Index (RSI): The RSI has eased to 62.08. While still above its 54.48 average, this reflects a slowdown in bullish momentum compared to earlier gains. A declining RSI from overbought conditions often precedes a price correction, but a stabilization or upward turn could signal renewed buying interest.

For the rally to $5.30 to materialize, traders will be closely watching for a recovery in trading volume and sustained buyer participation. A rebound above the $3.30 mark would be a positive first step, potentially unlocking resistance zones at $3.57–$3.60 and the psychological $4.00 level. Successful breaches of these resistances would further validate the bullish outlook.

The Telegram TON Wallet Effect: Driving Adoption?

Beyond technical charts, ecosystem developments play a pivotal role in Toncoin’s long-term trajectory. A significant catalyst is Telegram’s ongoing rollout of its native Telegram TON Wallet to U.S. users. This initiative targets a massive 87 million accounts, introducing a self-custodial wallet seamlessly integrated with stablecoin payments and staking features directly within the popular messaging platform.

This move marks a groundbreaking first for a major U.S. messaging platform to embed such comprehensive crypto functionality. TOP CEO Andrew Rogozov attributed this expansion to favorable regulatory shifts and Telegram’s vast user base, highlighting the potential for widespread adoption. While analysts suggest this could significantly drive new users into the TON ecosystem, the direct impact on Toncoin’s price remains contingent on broader market conditions and the actual uptake by Telegram users.

Toncoin Price Prediction: What’s Next?

The immediate future for Toncoin hinges on its ability to maintain the critical $2.87 support. If this level holds firm, the path to a higher valuation, potentially reaching the ambitious $5.30 target, becomes a strong possibility. This Toncoin price prediction is bolstered by the potential for increased adoption driven by the Telegram Wallet integration and renewed buying pressure in the market.

However, it’s crucial for investors to remain aware of inherent risks in the volatile crypto market. These include:

- Potential Offloading by Large Holders: Significant sales by whales could put downward pressure on the price.

- External Market Factors: Broader cryptocurrency market trends, macroeconomic news, and unforeseen global events can all influence TON’s price.

- Regulatory Changes: The evolving regulatory landscape for cryptocurrencies always poses a risk, particularly for new integrations like the Telegram Wallet in the U.S.

For traders, monitoring volume recovery and the successful breach of immediate resistance levels ($3.30, $3.57-$3.60, and $4.00) will be key indicators of sustained bullish momentum. The confluence of strong technical support and significant ecosystem expansion presents a compelling narrative for Toncoin, but vigilance remains paramount in this dynamic market.

Conclusion

Toncoin stands at a pivotal moment, with its price action closely tied to the $2.87 support level. The interplay of technical indicators suggesting a cooling phase and the massive potential of Telegram’s integrated wallet rollout paints a complex yet exciting picture. While the road to $5.30 is paved with both opportunity and challenges, the current resilience at a crucial support level offers a glimmer of hope for investors. As the market watches for renewed buying pressure and the full impact of ecosystem developments, Toncoin’s journey promises to be one to follow closely.

Frequently Asked Questions (FAQs)

1. What is the current status of Toncoin (TON) price?

As of the latest report, Toncoin (TON) is trading at $3.14, experiencing a 5% drop in the past 24 hours and a 4% decline over seven days. It is currently testing the crucial $2.87 support level.

2. Why is the $2.87 level important for TON?

The $2.87 level is considered a crucial Toncoin support level because it is just above the 0.5 Fibonacci retracement. Holding this level is essential for maintaining Toncoin’s broader upward trend, according to market analysts.

3. What are the technical indicators saying about TON?

Technical indicators suggest a cooling phase. The Money Flow Index (MFI) is at 83.71, indicating overbought conditions, while the Relative Strength Index (RSI) has eased to 62.08, reflecting a slowdown in bullish momentum.

4. How does Telegram’s TON Wallet impact Toncoin?

Telegram’s rollout of its TON Wallet to 87 million U.S. users, integrating self-custodial features, stablecoin payments, and staking, is a significant development. This could drive substantial user adoption for Toncoin, although the direct price impact depends on broader market conditions and user uptake.

5. What is the price target for Toncoin if it holds support?

If Toncoin successfully holds the $2.87 support, analysts suggest it could target $5.30. This target aligns with the 0.786 Fibonacci expansion and a prior supply zone.

6. What are the main risks for Toncoin’s price?

Key risks for Toncoin include potential offloading by large holders, broader cryptocurrency market volatility, and unforeseen regulatory changes that could impact its operations or adoption.