Managing the lifecycle of tokens – from initial allocation to distributing them over time or via airdrops – is a fundamental yet often complex task for crypto projects. Manual processes can lead to errors, security risks, and significant administrative overhead. But what if there was a way to bring the familiarity of a spreadsheet together with the power and security of smart contracts? This is where the news from TokenTable comes in, aiming to streamline crucial aspects of token distribution.

Understanding the Challenge of Token Distribution

For any project launching a token, deciding who gets how many tokens and when is critical. This isn’t just about the initial sale; it involves allocating tokens to founders, team members, advisors, early investors, and the community. Managing these allocations, especially with varying vesting schedules and complex airdrop criteria, becomes increasingly difficult as a project grows. Lack of standardization in how these plans are designed and implemented on-chain has been a significant hurdle.

TokenTable Unveils Code-Based Spreadsheet for Crypto Vesting

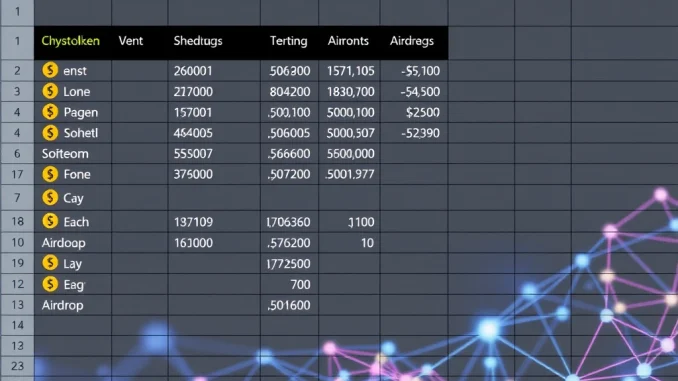

TokenTable, a platform focused on token distribution, has introduced a novel solution: a code-based spreadsheet specifically designed for token issuers. The core idea is to provide a structured, actionable tool that bridges the gap between planning token distribution and executing it securely via smart contracts. This tool aims to standardize the process, making it more accessible and less prone to error.

The spreadsheet covers several key areas vital for managing a token’s journey:

- Initial Token Allocation: Planning how the total token supply is divided among different stakeholders from the outset.

- Targeted Airdrop Design: Creating rules and lists for distributing tokens to specific community members or addresses based on defined criteria.

- On-Chain Vesting: Setting up schedules that automatically release tokens to recipients over time, directly managed by smart contracts. This is a core function for managing team and investor tokens.

- Real-Time Token Cap Table Management: Keeping an up-to-date record of who owns how many tokens, including vested and unvested amounts.

Streamlining Token Airdrops and On-Chain Execution

Designing and executing token airdrops can be logistically challenging. Identifying eligible recipients, calculating amounts, and then securely distributing them to potentially thousands of addresses requires careful planning and execution. TokenTable’s spreadsheet helps structure this process, allowing teams to define parameters within a familiar interface, which then translates into a format suitable for smart contract implementation. This approach reduces the manual steps and potential for errors inherent in traditional methods.

Similarly, managing crypto vesting schedules manually or through fragmented systems is inefficient. TokenTable’s tool allows projects to define complex vesting terms – such as cliffs and linear releases – directly within the spreadsheet environment. This data then serves as the blueprint for creating or interacting with smart contracts that automate the token release, ensuring transparency and adherence to the defined schedule.

TokenTable: A New Standard for Blockchain Tools?

According to YZi Labs, the entity behind TokenTable, this open-source spreadsheet offers a practical and actionable standard for crypto project founders. By providing a clear framework and a code-based approach, they aim to make sophisticated on-chain distribution mechanisms more accessible. The open-source nature suggests a focus on transparency and community-driven improvement, potentially positioning this as a foundational piece among essential blockchain tools for new and established projects alike.

The integration of cap table management within the same tool provides a centralized view of token ownership dynamics. Projects can see at a glance how tokens are distributed, how much has vested, and track the total circulating supply relative to the maximum supply, all in real-time.

What Does This Mean for Projects?

For projects grappling with token management, this tool offers several potential benefits:

- Increased Efficiency: Centralizing planning and execution reduces time spent on manual tasks.

- Reduced Risk: Standardized, code-based processes minimize the chance of human error in critical distribution events.

- Enhanced Transparency: On-chain execution provides verifiable proof of distribution and vesting.

- Improved Organization: A real-time cap table offers a clear picture of token ownership.

While the concept is powerful, adopting new blockchain tools always involves considerations like integration with existing workflows and the technical comfort level of the team. However, the spreadsheet format aims to lower the barrier to entry compared to purely code-based solutions.

In Summary

TokenTable’s introduction of a code-based spreadsheet for token distribution marks a significant step towards standardizing and simplifying a complex but essential part of the crypto ecosystem. By combining the intuitive interface of a spreadsheet with the rigor of smart contracts, the tool promises to make managing initial allocations, crypto vesting, and token airdrops more efficient, secure, and transparent. For founders navigating the intricacies of tokenomics and distribution, this new tool from TokenTable could become an indispensable resource, helping to build trust and manage token flows effectively from day one.