Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Bitcoin (BTC) has surged past the $71,000 mark for the first time since April 12. It is currently trading at $71,200.

This significant milestone comes amid a broader market rally driven by optimism over spot Ethereum exchange-traded fund (ETF) approval. The optimism stems from recent announcements by Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence.

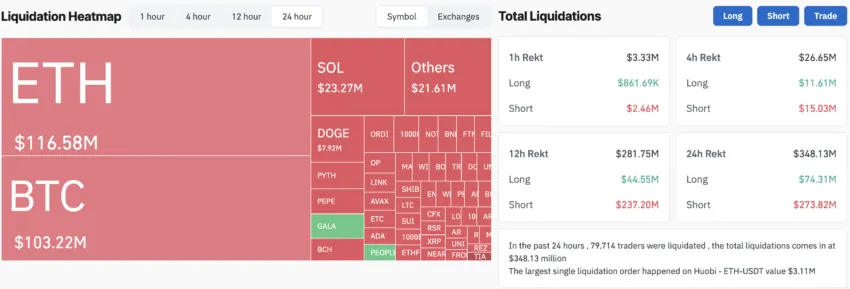

Crypto Market Rally Causes Liquidations Worth Over $348 Million

The ETF analysts have increased their odds of a spot Ethereum ETF approval from 25% to 75%. Balchunas cited increasing political pressure on the SEC for their revised forecast. Moreover, the approval odds increased to over 54% on the prediction platforms like Polymarket.

Amidst these developments, Ethereum (ETH) experienced a nearly 20% rally within 24 hours. Bitcoin followed suit, with its price rising by approximately 7%. This price surge led to significant market liquidations.

Read more: Ethereum ETF Explained: What It Is and How It Works

Data from Coinglass reveals that 79,714 traders faced the wrath of liquidations in the past 24 hours, with total liquidations amounting to $348.13 million. Specifically, short trades saw liquidations of $273.82 million, while long trades saw liquidations of $74.31 million.

“1 month of Bitcoin short position build-up just got liquidated. One more layer to go in order to short-squeeze past all-time highs,” prominent Bitcoin analyst Willy Woo said.

Prior to these events, investors had been accumulating Bitcoin, indicating a bullish sentiment. Over the past week, investors withdrew 30,516 BTC, worth approximately $2.17 billion at current market prices, from 20 crypto exchanges tracked by Coinglass.

The largest outflows were observed on Coinbase Pro, with 14,416.43 BTC withdrawn, followed by Binance, where investors withdrew 8,631.02 BTC.

Crypto outflows from centralized exchanges are generally seen as a positive indicator. It suggests that investors are holding onto their assets, anticipating further price increases rather than planning to sell in the short term.

Read more: Bitcoin Price Prediction 2024/2025/2030

This surge in Bitcoin’s price and the positive sentiment surrounding Ethereum ETFs highlight the ongoing developments in the cryptocurrency market. As regulatory landscapes evolve and investor confidence grows, the market may witness further significant movements.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link