Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Bitcoin Cash’s (BCH) price could note recovery over the next couple of trading sessions if the investors support it.

The cues seem to suggest recovery for BCH, given that accumulation and HODLing are prevalent.

Bitcoin Cash Investors Are Optimistic

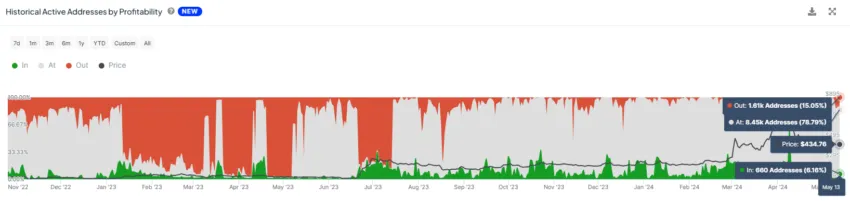

Bitcoin Cash’s price could be viewed as a recovery based on investors’ behavior as well as broader market cues. The first hint comes from the participation of the investors. Upon distributing the active addresses by profitability, it can be noted that investors in profit are not very active right now.

Their participation only dominates 6% of the active addresses. This is a good sign as it means that the investors are not looking to sell their holdings at the moment. Given that more than 75% of BCH holders are currently in profit, it is a big deal that very few are looking to book profits.

This could aid the price should the investors move to accumulate, as signaled in the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit and loss. Currently, Bitcoin Cash’s 30-day MVRV stands at -16%, indicating losses, which may lead to buying pressure. Historically, BCH MVRV between -9% and -25% usually signals the start of recovery rallies, marking an opportunity zone for accumulation.

Read More: How To Buy Bitcoin Cash (BCH) and Everything You Need To Know

Thus, if BCH holders move to add more tokens to their wallets, the Bitcoin namesake could recover.

BCH Price Prediction: Looking at Recovery

Bitcoin Cash’s price is currently at $392 and could close above $400 over the coming days. However, in order to secure a recovery rally, the altcoin would need to close above $420 or $430.

This is possible should the investors continue to HODL and accumulate at the same time. The target price stands at $440 for BCH however, this could take some time.

Read More: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

However, if securing $400 as a support floor fails, Bitcoin Cash’s price could end up falling back to $379. Losing this support would invalidate the bullish thesis, sending BCH to $360.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link