Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Over the past few months, there has been an expectation that Bitcoin (BTC) would lag behind altcoins in terms of performance. However, this hasn’t materialized, as only six out of the top 50 altcoins have outperformed BTC over the last 90 days.

Currently, Bitcoin’s dominance stands at 57.18%, indicating that its market capitalization has been growing faster than that of the average altcoin. Despite this strong performance, BeInCrypto identifies three altcoins that are expected to outperform BTC in the near future, providing detailed analysis and reasoning for this forecast.

Tron (TRX)

Tron (TRX), the cryptocurrency linked to controversial blockchain billionaire Justin Sun, recently hit a three-year high of $0.17. This milestone helped TRX break into the top 10 cryptocurrencies by market capitalization, overtaking Cardano (ADA). Over the last 30 days, TRX’s price has increased by 15%, outperforming Bitcoin (BTC) during the same period.

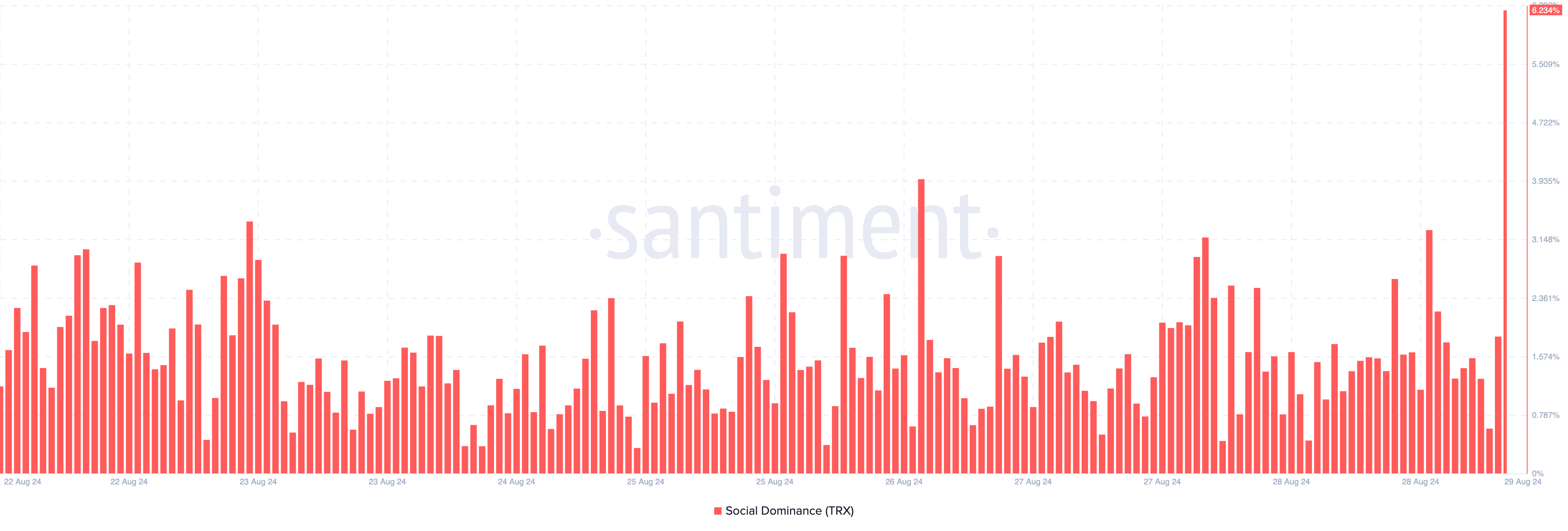

This price surge is largely due to the launch of the meme coin generator SunPump in August, which has driven up demand for TRX. The altcoin’s rising social dominance, now at 6.23%, indicates growing attention toward the project.

From a technical perspective, Tron’s On Balance Volume (OBV) line has been increasing on the daily chart, indicating strong buying pressure. A higher OBV reflects more buying activity, which is often a precursor to further price increases.

If the accumulation of TRX continues, the price could potentially drop to $0.14 before bouncing back to its recent high of $0.17, and possibly even reaching $0.19 in September.

Read more: Who Owns the Most Bitcoin in 2024?

However, this optimistic outlook could be challenged if Bitcoin outperforms top altcoins next month. In that case, TRX’s upward momentum might face resistance, and the predicted price targets could be harder to achieve.

Aave (AAVE)

Over the past 30 days, AAVE’s price has risen by 18.68%. This cryptocurrency, which serves as the governance token for the decentralized finance (DeFi) protocol Aave, has recently attracted significant interest from whales. This surge in interest places AAVE among the bullish altcoins that could potentially outperform Bitcoin (BTC) in September.

Aave has also proposed increasing its involvement with the Real World Assets (RWA) sector by integrating BlackRock’s BUIDL infrastructure. If this proposal is approved soon, it could lead to a spike in demand for AAVE.

On August 5, AAVE’s price dropped below $80. However, the altcoin began forming Higher Lows (HL), eventually reaching $146.49 on August 24. At this level, the Relative Strength Index (RSI) indicated that the token was overbought.

The RSI measures momentum; a reading of 30.00 or below signals that an asset is oversold, while a reading of 70.00 or above indicates that it is overbought. As shown, the RSI hit the overbought region last Saturday.

Following this, AAVE’s price dropped to $118. The RSI has since remained above the 50.00 neutral line, suggesting that a bullish reversal could be possible. For this to happen, bulls need to defend the $118.01 support level and break past the resistance at $129.64.

If successful, AAVE could become one of the altcoins to outperform Bitcoin in September. However, if the support at $118.01 fails, the altcoin’s price might face a significant decline.

Cardano (ADA)

Cardano’s position in this list is largely influenced by its upcoming major upgrade on September 1, known as the Chang hard fork. This upgrade will introduce on-chain governance to the Cardano blockchain for the first time, marking the initial phase toward the project’s ultimate goal, Voltaire.

ADA holders have shown considerable optimism leading up to the event. In 2021, a similar hard fork on the Cardano network led to a 130% price surge within a month. If history repeats itself, ADA could see exceptional price performance in September. Currently, ADA is trading at $0.35, down from $0.40 just three days ago.

The Moving Average Convergence Divergence (MACD) indicator suggests that this recent price dip could be a buying opportunity for market participants. The MACD is used to gauge momentum and helps traders identify potential entry and exit points.

A positive MACD reading indicates bullish momentum, signaling a good time to buy, especially after a downtrend. A negative reading, conversely, points to bearish momentum and a potential time to sell.

Read more: 10 Best Altcoin Exchanges In 2024

For ADA, the MACD currently indicates bullish momentum. If this trend continues, the price could rebound to $0.40 soon, and if buying pressure intensifies, it might even reach $0.44.

However, there is a risk of invalidation if the hard fork becomes a “sell the news” event, where the price drops following the anticipated event. In that case, ADA’s price could decline to $0.32.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link