[ad_1]

Tether, the issuer of the USDT stablecoin, plans to develop a peer-to-peer financial markets terminal leveraging Holepunch technology.

CEO Paolo Ardoino announced on X that Tether will invest substantial resources into this initiative.

Tether Plans P2P Financial Markets Terminal

According to Ardoino, the company would aim to replicate USDT’s success within financial markets by eliminating monopolistic intermediaries.

“Any exchange in the world would maximise the revenues from its own data, while keeping direct control of its usage. Financial markets would be much more resilient as a result of this change, and the world would likely be a better place,” Ardoino added.

While specific product details are unavailable, Ardoino indicated that the P2P platform would decentralize financial market data infrastructure. Furthermore, he said the terminal would be built using Holepunch technology.

Holepunch is a platform designed to create apps without requiring centralized data storage, enabling easy deployment. Tether is a significant investor in this technology.

This announcement shows Tether’s strategy to diversify beyond its flagship USDT stablecoin. The company recently restructured its operations into four distinct sectors—finance, data, education, and power.

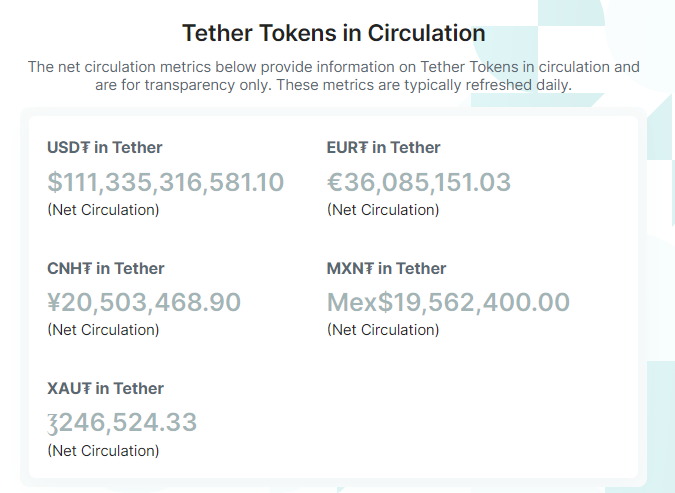

Tether Finance oversees its multibillion-dollar USDT and other digital assets. Meanwhile, the firm’s Power unit focuses on sustainable Bitcoin mining activities.

Read more: How to Buy and Store the Different Types of Tether

On the other hand, Tether Data will invest in P2P technology and artificial intelligence, with existing investments in Northern Data Group and Holepunch.

Remarkably, Tether acquired a majority stake in brain-computer interface company BlackRock Neurotech via its venture capital division, Tether Evo. Ardoino said this investment showed that the firm believed in nurturing emerging technologies with transformative capabilities.

Meanwhile, these diversification efforts come during Tether’s peak financial performance. During the past year, the firm’s USDT market cap has climbed past $110 billion and generated substantial quarterly profits. Additionally, USDT accounts for around 70% of the stablecoin market, according to DeFillama data.

Read more: What Is a Stablecoin? A Beginner’s Guide

However, Tether faces increasing regulatory challenges. Reports emerged that the crypto exchange Kraken could delist the stablecoin for its European users. Ripple CEO Brad Garlinghouse also recently claimed that the US government might target the stablecoin issuer.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link