In a significant move for the digital asset market, Strategy, a leading corporate Bitcoin holder, recently announced its latest Strategy Bitcoin purchase. This strategic acquisition further solidifies the company’s commitment to its digital asset strategy. Last week, between October 20 and October 26, Strategy added an additional 390 BTC to its substantial reserves. This latest purchase amounted to an impressive $43.4 million, reflecting the company’s consistent approach to expanding its cryptocurrency portfolio.

Strategy’s Latest Strategic Bitcoin Acquisition Bolsters Portfolio

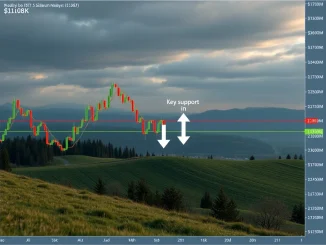

The recent Bitcoin acquisition occurred at an average price of $111,053 per BTC. This figure highlights the prevailing market conditions during the transaction period. Strategy has consistently demonstrated a proactive stance in accumulating Bitcoin, viewing it as a long-term store of value. Furthermore, this purchase underscores the company’s conviction in Bitcoin’s future potential.

This latest addition brings Strategy’s total Strategy holdings to an astounding 640,808 BTC. The total value of these holdings is now estimated at $47.44 billion. Significantly, the average entry price for Strategy’s entire Bitcoin treasury stands at $74,032. This indicates a substantial unrealized gain, reflecting a successful long-term investment strategy. Consequently, the company continues to lead in corporate Bitcoin adoption.

Understanding Strategy’s Unwavering BTC Investment Philosophy

Strategy’s consistent BTC investment strategy is rooted in a clear macroeconomic outlook. The company’s leadership views Bitcoin as a superior alternative to traditional fiat currencies. They believe it offers a robust hedge against inflation and currency debasement. Moreover, this philosophy guides their continuous accumulation efforts.

Several key factors drive this perspective:

- Inflation Hedge: Bitcoin’s finite supply (21 million coins) provides scarcity, protecting against inflation.

- Digital Gold: Many consider Bitcoin a ‘digital gold,’ offering similar safe-haven properties in the digital age.

- Decentralization: Its decentralized nature removes reliance on central authorities, appealing to those seeking financial autonomy.

- Long-Term Value: Strategy prioritizes long-term appreciation over short-term market fluctuations.

Therefore, each Strategy Bitcoin purchase aligns with these core principles. The company’s actions serve as a significant indicator for other institutional investors.

The Broader Impact of Strategy’s Cryptocurrency Investment Strategy

Strategy’s aggressive cryptocurrency investment strategy has profound implications for the wider market. Firstly, it lends considerable credibility to Bitcoin as a legitimate asset class. When a publicly traded company makes such substantial investments, it signals confidence to other corporate treasuries and institutional funds. Secondly, these large-scale purchases reduce the circulating supply of Bitcoin, potentially impacting its price dynamics over time. Thirdly, it encourages greater discussion and adoption of digital assets in mainstream finance.

Analysts often scrutinize Strategy’s moves closely. Their announcements frequently precede or coincide with shifts in market sentiment. For example, a large Strategy Bitcoin purchase can inspire retail and institutional investors alike. This often leads to increased trading activity and positive price movements. Conversely, any perceived pause in their acquisition strategy might cause speculation. However, Strategy has consistently reaffirmed its long-term conviction.

Analyzing the Growth of Strategy’s Bitcoin Holdings Over Time

Examining the trajectory of Strategy holdings reveals a clear pattern of sustained accumulation. The company began its Bitcoin journey in August 2020. Since then, it has executed numerous purchases, often during periods of market volatility. This dollar-cost averaging approach has allowed them to build a significant position. Consequently, their average entry price remains attractive compared to current market levels.

The current valuation of $47.44 billion for their 640,808 BTC highlights the immense success of this strategy. Furthermore, this valuation positions Strategy as one of the largest corporate holders of Bitcoin globally. Their treasury management has become a case study for other companies considering similar moves. They have indeed pioneered a new model for corporate asset allocation.

Future Outlook: What This BTC Investment Means for the Market

The latest BTC investment by Strategy sends a clear message. It reinforces the growing institutional acceptance of Bitcoin. As more corporations consider diversifying their balance sheets, Strategy’s model provides a compelling blueprint. This trend suggests a continued maturation of the cryptocurrency market. It also points towards greater integration of digital assets into traditional finance.

Moving forward, market participants will undoubtedly watch Strategy’s subsequent announcements. Their ongoing commitment serves as a barometer for institutional interest. Ultimately, these large-scale corporate investments contribute to Bitcoin’s long-term stability and growth. The company’s vision continues to shape the narrative around digital assets. This consistent accumulation strategy demonstrates strong belief in Bitcoin’s enduring value proposition.

In conclusion, Strategy’s recent Strategy Bitcoin purchase of 390 BTC for $43.4 million is more than just another transaction. It represents a steadfast commitment to their cryptocurrency investment strategy. With total Strategy holdings now exceeding 640,000 BTC, valued at over $47 billion, the company remains a dominant force. Their consistent Bitcoin acquisition strategy continues to influence market dynamics. It also provides a compelling example for corporate treasury management in the digital age. This ongoing dedication further validates Bitcoin’s role as a crucial asset for the future.

Frequently Asked Questions (FAQs)

Q1: What is the total amount of Bitcoin Strategy now holds?

Strategy now holds a total of 640,808 BTC. This makes them one of the largest corporate holders of Bitcoin globally.

Q2: How much did Strategy pay for its latest Bitcoin acquisition?

Strategy paid $43.4 million for its latest purchase of 390 BTC. The average purchase price was $111,053 per BTC.

Q3: What is Strategy’s average entry price for its total Bitcoin holdings?

The company’s average entry price for its entire Bitcoin treasury is $74,032 per BTC. This reflects a strategic accumulation over time.

Q4: Why does Strategy continue to invest in Bitcoin?

Strategy invests in Bitcoin as a long-term store of value. They view it as a hedge against inflation and a superior alternative to traditional fiat currencies. Their conviction in Bitcoin’s future potential drives their consistent purchases.

Q5: How does Strategy’s Bitcoin acquisition impact the cryptocurrency market?

Strategy’s large-scale Bitcoin acquisitions lend credibility to Bitcoin as an asset class. They signal confidence to other institutional investors. Such purchases can also influence market sentiment and price dynamics by reducing the circulating supply.