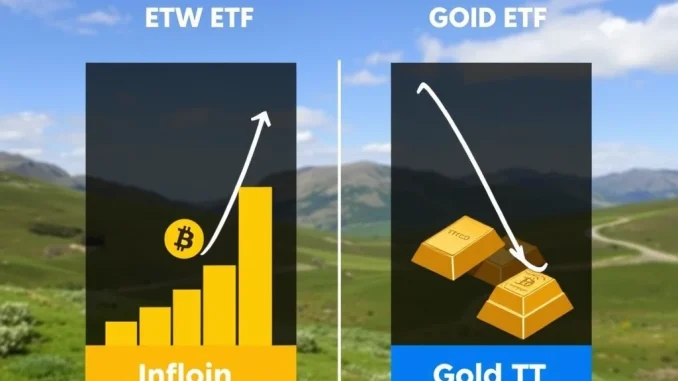

A significant shift appears to be underway in the world of asset allocation. Fresh data highlights a compelling trend: substantial capital is flowing into Spot Bitcoin ETF products, contrasting sharply with outflows from traditional gold-backed investment vehicles.

Spot Bitcoin ETF: What’s Behind the Investment Frenzy?

The recent approval and launch of Spot Bitcoin ETFs in the United States have opened a new avenue for investors to gain exposure to the leading cryptocurrency without directly holding it. This regulatory milestone is proving to be a game-changer, attracting significant interest from both retail and institutional players.

Unlike futures-based ETFs, a Spot Bitcoin ETF aims to track the current market price of Bitcoin by holding actual BTC. This direct exposure is often preferred by investors seeking a more direct correlation to Bitcoin’s price movements.

Tracking the Trend: Massive Bitcoin ETF Inflows Reported

According to data compiled by Unfolded, the scale of recent capital movement is striking. Over a period of just five weeks, Spot Bitcoin ETFs have collectively recorded over $9 billion in net inflows. This rapid accumulation of assets underscores strong investor demand and confidence in Bitcoin as an investment asset class accessible through regulated financial products.

These significant Bitcoin ETF inflows indicate that investors are actively re-allocating capital, seeking exposure to the potential upside and unique characteristics that Bitcoin offers.

The Other Side: Gold ETF Outflows Raise Questions

While Bitcoin ETFs celebrate massive inflows, gold-backed ETFs are experiencing the opposite trend. The same five-week period saw outflows exceeding $2.8 billion from these traditional safe-haven assets, as reported by Unfolded.

These Gold ETF outflows suggest a potential shift in investor preference or strategy. Factors contributing to this might include changing expectations around inflation, interest rates, or a fundamental re-evaluation of gold’s role in a diversified portfolio compared to emerging digital assets.

Bitcoin vs Gold: Is a Great Asset Rotation Underway?

For decades, gold has been considered the premier store of value and a hedge against economic uncertainty. Bitcoin has emerged over the past fifteen years with a similar narrative, often dubbed ‘digital gold’ due to its scarce supply and decentralized nature.

The contrasting flows into Bitcoin ETFs and out of Gold ETFs fuel the narrative that a ‘great rotation’ from traditional assets like gold into digital assets like Bitcoin might be accelerating. Here’s a quick comparison:

- Scarcity: Both are scarce, but Bitcoin’s supply cap (21 million coins) is mathematically enforced and verifiable, unlike gold’s unknown reserves.

- Portability & Divisibility: Bitcoin is easily portable across borders and highly divisible. Gold is physically cumbersome and less divisible.

- Verification: Bitcoin’s authenticity is verified cryptographically on the blockchain. Gold requires physical inspection.

- Market Structure: Gold has a long-established, mature market. Bitcoin’s market is newer, more volatile, but rapidly maturing with new products like spot ETFs.

- Investment Vehicle: Both can be accessed via ETFs, offering ease of investment through traditional brokerage accounts.

While both assets serve different purposes and appeal to different investor profiles, the recent flow data suggests a growing number of investors are choosing the digital alternative.

Implications for Digital Asset Investing

The significant capital movement highlighted by the Unfolded data has important implications for the broader landscape of Digital asset investing. It signals increasing mainstream acceptance and adoption of Bitcoin as a legitimate investment asset class.

The accessibility provided by Spot Bitcoin ETFs is clearly lowering the barrier to entry for traditional investors who may have been hesitant to navigate cryptocurrency exchanges or self-custody. This influx of traditional capital could further enhance liquidity and potentially reduce volatility over the long term as the market matures.

What Does This Mean for Your Portfolio?

For investors considering exposure to either asset, or perhaps re-evaluating their existing holdings, this trend offers several points to consider:

- Evaluate Your Goals: Understand why you are investing in either asset – is it for wealth preservation, growth, diversification, or speculation?

- Understand the Risks: Bitcoin, while gaining acceptance, remains a volatile asset. Gold also has its own set of market risks. Do your research thoroughly.

- Consider Diversification: Both Bitcoin and gold can potentially play a role in a diversified portfolio, depending on your risk tolerance and investment strategy.

- Stay Informed: The regulatory and market landscape for digital assets is constantly evolving. Keep abreast of developments.

Conclusion: A Shifting Tide in Investment Preferences

The data showing billions flowing into Spot Bitcoin ETFs while billions exit Gold ETFs over a short period is more than just a statistic; it’s a potential indicator of a fundamental shift in how investors perceive and allocate capital between traditional safe havens and emerging digital assets. The accessibility and regulatory clarity offered by Spot Bitcoin ETFs are clearly accelerating this trend.

While gold remains a historically significant store of value, Bitcoin’s rise, facilitated by new investment products, presents a compelling alternative gaining traction rapidly. As the financial landscape continues to evolve, understanding the dynamics between assets like Bitcoin and gold will be crucial for investors navigating the future of wealth management.