Buckle up, crypto enthusiasts! The Bitcoin rollercoaster is showing no signs of slowing down, and the latest buzz is coming straight from South Korea, a nation known for its fervent embrace of digital currencies. Are you ready for some audacious predictions? Hold onto your hats because South Korean investors are betting big on Bitcoin hitting a jaw-dropping $136,000 this year! Let’s dive into the details of this electrifying forecast and what it means for the future of BTC.

South Korean Investors’ Optimistic Bitcoin Price Prediction

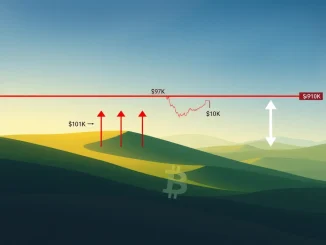

Imagine a scenario where Bitcoin’s value skyrockets to levels previously considered unimaginable. Well, for a significant portion of South Korean crypto investors, this isn’t just a dream – it’s a highly anticipated reality for 2024. According to the newly released “South Korean Crypto Retail Investor Trends Report 2024” by the reputable Web3 consulting firm DeSpread in collaboration with Coin Pulse, a substantial 37.68% of survey respondents believe Bitcoin (BTC) will trade between a staggering 150 million won and 200 million won. To put that into perspective for our global audience, that translates to a price range of approximately $102,000 to $136,000!

But the bullish sentiment doesn’t stop there. An almost equally impressive 37.04% of respondents are even more optimistic, forecasting that Bitcoin will not just reach, but actually surpass the 200 million won mark, exceeding $136,000. This paints a vivid picture of the strong conviction South Korean investors hold regarding Bitcoin’s potential in the current year.

Decoding the Bullish Crypto Outlook for 2024

What fuels this overwhelming optimism from South Korean investors? The DeSpread report sheds light on the broader cryptocurrency outlook as perceived by these investors. An impressive 60.4% of respondents expressed a positive view on the cryptocurrency market for 2024. Furthermore, adding fuel to the fire, a significant 31.56% went a step further, declaring themselves very optimistic. These numbers clearly indicate a strong undercurrent of bullishness sweeping through the South Korean crypto investment landscape.

Let’s break down the key takeaways from this sentiment:

- Dominant Positive Sentiment: Over 90% of surveyed South Korean crypto investors hold a positive to very positive outlook on the crypto market in 2024. This suggests a strong belief in the continued growth and potential of cryptocurrencies.

- Bitcoin as a Key Driver: The specific price predictions for Bitcoin indicate that BTC is likely considered a primary driver of this positive sentiment. Investors are clearly banking on Bitcoin’s performance to lead the crypto market.

- Market Maturity: This level of optimism could also reflect a growing maturity and understanding of the crypto market among South Korean investors. They are potentially looking beyond short-term volatility and focusing on long-term growth prospects.

Investment Plans: Are South Koreans Ready to Double Down on Crypto?

So, are these optimistic predictions translating into concrete investment plans? The survey delved into this crucial aspect as well. When asked about their investment strategies for the year, a substantial 46.2% of respondents stated they plan to maintain their investment levels at a similar pace to 2024. This suggests a steady and continued engagement with the crypto market, rather than a drastic increase or decrease in investment activity.

Here’s a quick look at the investment intentions:

| Investment Plan | Percentage of Respondents |

|---|---|

| Invest at similar levels to 2024 | 46.2% |

| (Other investment plans – details not specified in provided content) | (Details not specified in provided content) |

While nearly half intend to maintain their current investment levels, further details on the remaining respondents’ plans would offer a more complete picture. However, the significant portion planning to maintain their investment underscores a continued commitment to the crypto space.

DeSpread Research: Unveiling South Korean Crypto Investment Trends

The insights we’ve discussed are derived from the “South Korean Crypto Retail Investor Trends Report 2024” by DeSpread, a Web3 consulting firm, and Coin Pulse. This report offers a valuable window into the sentiments and expectations of retail crypto investors in South Korea. The survey itself was conducted over a four-day period, from December 10th to 13th, and garnered an impressive 3,108 valid responses from Coin Pulse users. This robust sample size lends credibility to the findings and provides a statistically significant representation of South Korean retail crypto investor sentiment.

Key Highlights of the DeSpread Research Report:

- Source: “South Korean Crypto Retail Investor Trends Report 2024”

- Conducted By: DeSpread & Coin Pulse

- Survey Period: December 10-13, 2023

- Respondents: 3,108 Coin Pulse users

- Focus: Retail investor sentiment and expectations for the crypto market in 2024.

Why is South Korean Investor Sentiment Important?

South Korea has consistently been a hotbed for cryptocurrency adoption and trading. Known for its tech-savvy population and high internet penetration, the nation has a significant influence on the global crypto market. Tracking the sentiment of South Korean investors provides valuable signals and insights into potential market movements. Their bullish outlook could be a leading indicator of broader market trends and increased investment activity in Bitcoin and other cryptocurrencies.

Conclusion: A Powerful Surge of Optimism for Bitcoin in 2024?

The message from South Korean crypto investors is loud and clear: they are overwhelmingly optimistic about Bitcoin’s prospects in 2024, with a significant portion predicting prices to reach a staggering $136,000. This bullish sentiment, revealed in the DeSpread Research report, underscores the strong belief in Bitcoin’s continued growth and potential. As we move further into 2024, it will be fascinating to witness whether this powerful wave of optimism from South Korea translates into reality and propels Bitcoin to new heights. Keep a close watch on the crypto markets – the year ahead promises to be an exhilarating ride!