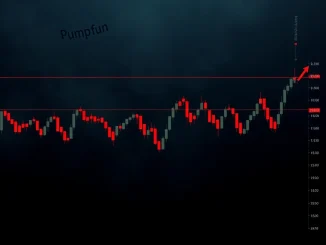

In the fast-paced world of decentralized finance, surprises are common, but few are as stark as the recent turn of events for Pump.fun, a prominent Solana-based meme coin platform. What began as an ambitious $19.5 million token buyback aimed at bolstering value for the PUMP token ended in a dramatic 58% plummet, leaving investors and analysts questioning the effectiveness of such strategies in the highly unpredictable meme coin market. This incident sends a clear signal about the inherent crypto volatility in these retail-driven ecosystems.

The Pump.fun Paradox: A Buyback Gone Wrong

Pump.fun, known for its innovative approach to launching meme coins on Solana, executed a substantial token buyback in late July 2025. Over an 8-10 day period, the platform utilized 120,450 SOL, equivalent to $19.5 million at the time, to acquire 3.07 billion PUMP tokens. The intention behind such a significant move is typically to reduce circulating supply, thereby increasing scarcity and, theoretically, boosting the token’s price. However, the outcome was far from the desired effect.

- Initial Investment: $19.5 million (120,450 SOL)

- Tokens Acquired: 3.07 billion PUMP tokens

- Post-Buyback Value: $8.2 million

- Value Plunge: A staggering 58% decline

This rapid depreciation post-acquisition has sparked intense discussions within the crypto community, highlighting the unique challenges and risks associated with treasury operations in the meme coin space.

Understanding Solana News: Beyond the Headlines

While the Pump.fun event is specific, its repercussions echo across the broader Solana ecosystem. Solana has emerged as a powerhouse blockchain, lauded for its high transaction speeds and low fees, making it a fertile ground for decentralized applications, including meme coins. However, the very accessibility that fuels its growth also exposes it to heightened market sensitivities.

Despite the Pump.fun setback, recent Solana News shows the network itself has demonstrated resilience. In the 24 hours surrounding the event, Solana’s price saw a 5.33% increase, and a remarkable 31.17% surge over the preceding 30 days. Trading at approximately $188.80, with a market capitalization exceeding $101.63 billion, Solana maintains a significant 2.62% dominance in the crypto market. This duality — a robust underlying blockchain facing volatility from its speculative assets — is a constant theme in the crypto landscape.

The Volatile World of Meme Coin Markets

Meme coins, by their very nature, are characterized by extreme price swings, often driven by social sentiment, community hype, and the actions of large investors, commonly referred to as ‘whales.’ The Pump.fun buyback case perfectly illustrates this.

Community analysts identified a specific whale wallet (3vkpy5YHqnqJTnA5doWTpcgKyZiYsaXYzYM9wm8s3WTiG8CcfRffqZWHSAQJXLDfwbAkGE95SddUqVXnTrL4kqjm) as central to the buyback’s dynamics, describing the subsequent price action as ‘whale-driven price cycling.’ This phenomenon underscores how concentrated ownership can dramatically influence market liquidity and price direction, especially when retail investors form the bulk of the market.

As one Institutional Research Analyst from Aggregate Institutional Research noted, “Pump.fun’s buyback demonstrates how meme coin treasuries can be weaponized, but treasury spend doesn’t guarantee price support—especially with retail-driven volatility.” This highlights a critical lesson: while buybacks can reduce supply, they don’t necessarily negate the powerful forces of speculative trading and sentiment that govern meme coin prices.

Token Buyback Strategies: A Double-Edged Sword?

Token buybacks are a common corporate finance tool, often used by traditional companies to return value to shareholders or signal confidence. In the crypto world, they are touted as deflationary mechanisms that can boost token value. However, the Pump.fun incident reveals the complexities and potential pitfalls of implementing a token buyback in a meme coin context.

Coincu research further emphasizes that Solana-based protocols face unique challenges due to the decentralized and retail-centric nature of meme coins. Treasury operations, while potentially stabilizing, demand meticulous management of yield and liquidity provisions to prevent unintended market swings. If not executed with a deep understanding of market psychology and liquidity dynamics, a buyback can paradoxically exacerbate volatility by concentrating token ownership and signaling short-term speculative intent rather than long-term value.

Navigating Crypto Volatility: Lessons Learned

Analyst KKashi highlighted the broader implications for Solana’s ecosystem, noting that significant meme coin movements often spill over into other assets, amplifying systemic risks. The Pump.fun event serves as a stark reminder of the inherent crypto volatility present in nascent and speculative markets.

For investors, the key takeaway is the importance of due diligence and understanding the unique tokenomics of meme coins. While the allure of quick gains is strong, the risks are equally pronounced. Liquidity in these markets is often dictated by high-net-worth actors rather than fundamental metrics or long-term utility.

As platforms like Pump.fun continue to experiment with treasury strategies, the intricate interplay between buybacks, tokenomics, and market psychology will remain crucial for understanding Solana’s evolving role in the crypto landscape. This event is a powerful case study in the fragility of meme coin markets, urging caution and a deeper look into the mechanics behind the hype.

Frequently Asked Questions (FAQs)

Q1: What is Pump.fun and what happened with its token buyback?

Pump.fun is a Solana-based platform for launching meme coins. It executed a $19.5 million buyback of its PUMP tokens in late July 2025. Despite the large investment, the token’s value plummeted by 58% to $8.2 million shortly after, indicating the buyback failed to stabilize or increase its price.

Q2: Why did the Pump.fun token value drop after a buyback, which is usually meant to increase value?

While buybacks aim to reduce supply and increase value, in highly volatile meme coin markets, other factors can dominate. In this case, analysts pointed to ‘whale-driven price cycling,’ where large investors’ actions significantly influenced the market. The buyback may have concentrated ownership or signaled speculative intent, leading to further sell-offs rather than price support, especially given the retail-driven nature of these markets.

Q3: How does this event impact Solana’s reputation or ecosystem?

The Pump.fun incident highlights the inherent crypto volatility within the Solana ecosystem, particularly in its meme coin sector. While Solana itself remains a robust blockchain with strong performance metrics (e.g., recent price increases, large market cap), events like this underscore the risks associated with speculative assets built on the network. It emphasizes that meme coin movements can have broader implications for systemic risk.

Q4: What are the main risks associated with investing in meme coins?

Meme coins carry significant risks due to their extreme price volatility, lack of fundamental utility, and reliance on social sentiment and hype. They are often subject to ‘whale-driven’ price manipulation, concentrated ownership, and abrupt liquidity shifts. As the Pump.fun case shows, even strategies like buybacks, intended to stabilize, can backfire dramatically.

Q5: What can investors learn from the Pump.fun buyback incident?

Investors should exercise extreme caution and conduct thorough due diligence when considering meme coins. The incident underscores that treasury operations, even substantial ones, do not guarantee price support in highly speculative markets. It’s crucial to understand that liquidity in meme coin markets is often dictated by large actors rather than traditional financial metrics, emphasizing the need for a high-risk tolerance and a clear understanding of market dynamics.