Recent market movements have put the spotlight squarely on Solana (SOL). Despite attempts to push higher, the popular cryptocurrency has encountered significant hurdles, leading to a notable increase in *Crypto Selling Pressure*. This *Solana Price Analysis* dives into the key levels and market dynamics currently impacting SOL’s trajectory.

Solana Price Analysis: Why the Recent Rally Stalled

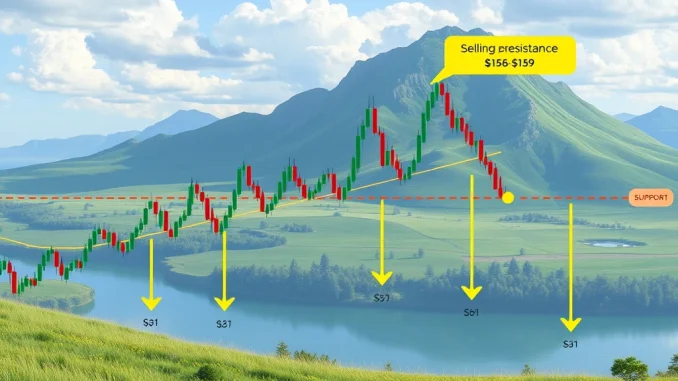

The past few trading sessions have seen Solana (SOL) test a crucial price zone between $158 and $159. Unfortunately for bulls, these attempts did not result in a sustained breakout. Multiple failures at this *Solana Resistance* level have signaled a lack of conviction from buyers at higher prices.

This inability to clear resistance has had a direct consequence: a build-up of selling interest. As CoinDesk reported, the repeated rejections have intensified the pressure from sellers looking to exit positions or short the market.

Key observations from the recent price action include:

- Repeated failures to breach the $158-$159 resistance zone.

- Successive lower highs on the price chart, indicating weakening upward momentum.

- Increasing volume on downward price movements, suggesting seller strength.

Facing Solana Resistance: The $158-$159 Hurdle

The $158-$159 area wasn’t just an arbitrary number; it represented a significant technical and psychological barrier for SOL. Overcoming this level was seen as essential for confirming bullish continuation and potentially targeting higher price points. The failure to do so highlights the strength of the supply waiting at this resistance.

Market participants often watch such levels closely. A clear break above resistance can trigger further buying, while a rejection can lead to pullbacks as traders adjust their strategies based on the failed attempt.

Understanding Crypto Selling Pressure on SOL

When a cryptocurrency fails to break resistance, it often indicates that the number of sellers entering the market at that price point outweighs the buyers. This imbalance creates *Crypto Selling Pressure*. For Solana, this pressure is now pushing the price lower, threatening important support levels.

Factors contributing to this pressure can include:

- Profit-taking by traders who bought at lower prices.

- Short selling by those expecting further declines.

- Broader market sentiment shifts affecting the entire crypto space.

- Specific news or developments related to the Solana ecosystem (though the CoinDesk report focuses on price action).

The current environment suggests sellers are in control in the short term, pushing SOL towards critical support zones.

What SOL Price Prediction Looks Like Now

Based on the recent price movements and the building *Crypto Selling Pressure*, the immediate *SOL Price Prediction* leans bearish unless a key level is reclaimed. Analysts are pointing to the $153.30 mark as particularly important.

This level likely represents a significant support area based on previous price action or technical indicators. Holding above $153.30 is seen as necessary to prevent further downside acceleration. A break below this point could trigger stop losses and attract more sellers, potentially leading to a sharper decline towards the next significant support levels.

Key Levels from SOL Technical Analysis

*SOL Technical Analysis* provides a framework for understanding these critical price points. The failed resistance at $158-$159 is the primary focus, but the support at $153.30 is now paramount.

Think of it like this:

- Resistance ($158-$159): The ceiling that buyers couldn’t break through. It now acts as a strong overhead supply zone.

- Critical Support ($153.30): The floor that bulls need to defend. A break here could open the door to lower prices.

- Next Potential Support: Below $153.30, analysts would look to previous swing lows or Fibonacci retracement levels for the next areas where buying interest might emerge.

Monitoring the interaction with the $153.30 level is crucial for anyone following SOL’s price action.

Summary: A Critical Juncture for Solana

In conclusion, Solana (SOL) is at a critical point following its failure to overcome the $158-$159 resistance. This has intensified *Crypto Selling Pressure*, leading to falling highs and threatening key support lines. According to recent *SOL Technical Analysis*, the $153.30 level is now the immediate focus. Reclaiming this level is vital to alleviate the bearish pressure and improve the short-term *SOL Price Prediction*. Failure to hold $153.30 could signal further declines ahead. Traders and investors should watch this level closely as it will likely dictate the next significant move for Solana.