In a significant development echoing through the crypto and traditional finance worlds, SharpLink Gaming, a Nasdaq-listed entity, has made headlines with a substantial addition to its Ethereum (ETH) treasury. This move isn’t just about numbers; it signifies a deeper commitment to a forward-thinking digital asset strategy that could set a precedent for other corporations. For anyone tracking the convergence of established companies and the volatile yet promising cryptocurrency market, this announcement from Onchain Lens on X is certainly a conversation starter.

SharpLink Gaming’s Bold Vision: Pioneering Corporate Crypto Holdings

SharpLink Gaming has solidified its position as a notable player in the realm of corporate crypto adoption. The company recently announced a significant increase in its Ethereum holdings, adding a staggering 10,614 ETH, valued at approximately $35.62 million. This isn’t their first foray into digital assets; rather, it’s an expansion of an already established and clear ETH-focused treasury strategy. Such a move by a Nasdaq-listed firm highlights a growing confidence in digital assets as a legitimate component of corporate balance sheets, moving beyond speculative ventures to a more integrated financial approach.

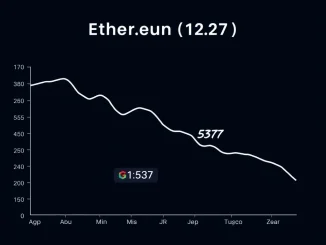

This latest acquisition brings SharpLink Gaming’s total Ethereum reserves to an impressive 296,508 ETH, pushing their total holdings to nearly a billion dollars, approximately $997.26 million. It’s a testament to their long-term conviction in Ethereum’s potential, both as a store of value and as an integral part of the decentralized future.

Unpacking SharpLink Gaming’s Growing Ethereum Holdings: A Billion-Dollar Bet?

When a company like SharpLink Gaming allocates such a substantial portion of its treasury to a single cryptocurrency, it prompts us to examine the rationale. Is it a bet, or a calculated strategic investment? The numbers speak for themselves, illustrating a consistent accumulation strategy:

- Latest Addition: 10,614 ETH (approx. $35.62 million)

- Total Holdings: 296,508 ETH (approx. $997.26 million)

- Strategy Focus: Primarily Ethereum (ETH)

This significant accumulation of Ethereum holdings positions SharpLink Gaming among the leading public companies with substantial crypto reserves. It reflects a belief in Ethereum’s ecosystem growth, its role in decentralized finance (DeFi), NFTs, and Web3 applications, and its potential as an inflation hedge or alternative asset class. Unlike many firms that might dabble in various cryptocurrencies, SharpLink’s focused approach on ETH suggests a deep dive into the asset’s fundamentals and long-term prospects.

Why an ETH Treasury? The Strategic Logic Behind SharpLink’s Digital Asset Play

Why would a Nasdaq-listed gaming company choose to build a substantial ETH treasury? The decision likely stems from several strategic considerations:

- Inflation Hedge: In an era of economic uncertainty, traditional fiat currencies face inflationary pressures. Cryptocurrencies, particularly those with deflationary mechanisms or limited supply, are seen by some as a hedge against this.

- Growth Potential: Ethereum, as the backbone of a vast decentralized ecosystem, offers significant growth potential tied to the expansion of DeFi, NFTs, and dApps.

- Diversification: Adding digital assets to a traditional portfolio can provide diversification benefits, potentially reducing overall portfolio risk and enhancing returns.

- Technological Alignment: For a gaming company, aligning with cutting-edge blockchain technology might also offer future strategic advantages in terms of product development or new revenue streams, even if not directly stated as the primary reason for treasury holdings.

SharpLink’s commitment to its ETH treasury strategy suggests a nuanced understanding of these factors, moving beyond simple speculation to a more integrated financial management approach.

The Rise of Corporate Crypto: SharpLink Gaming Paves the Way for Mainstream Adoption

Corporate crypto adoption is no longer a niche concept. Companies like MicroStrategy, Tesla, and now SharpLink Gaming are increasingly integrating digital assets into their balance sheets. This trend signifies a broader acceptance of cryptocurrencies as legitimate financial instruments and a shift in traditional treasury management:

- Challenges: Volatility, regulatory uncertainty, and accounting complexities remain hurdles for many corporations considering crypto.

- Benefits: Potential for high returns, diversification, and a forward-looking brand image.

- SharpLink’s Role: By openly pursuing an ETH-focused strategy, SharpLink Gaming contributes to normalizing corporate crypto holdings, potentially encouraging other companies to explore similar avenues. Their transparency, facilitated by platforms like Onchain Lens, offers valuable insights into this evolving landscape.

The continued growth in corporate crypto interest suggests that we are witnessing a fundamental shift in how businesses perceive and manage their financial reserves, moving towards a more digitally native future.

Navigating the Future: What Does SharpLink’s Digital Asset Strategy Mean for Investors?

For investors, SharpLink Gaming‘s robust digital asset strategy offers a unique lens through which to view the company. It suggests a management team confident in the long-term value of Ethereum and willing to embrace innovative financial approaches. What does this mean?

- Increased Exposure to ETH: Investors in SharpLink Gaming gain indirect exposure to Ethereum’s price movements.

- Risk & Reward: While offering potential upside, the volatility of crypto assets also introduces a layer of risk to the company’s financial performance.

- Industry Trendsetter: SharpLink’s actions could inspire other companies in the gaming or tech sector to consider similar strategies, creating a ripple effect in the market.

Understanding a company’s digital asset strategy is becoming as crucial as analyzing its core business operations, especially as more firms venture into the crypto space. SharpLink Gaming’s latest move underscores this evolving reality, providing a fascinating case study for both crypto enthusiasts and traditional investors alike.

SharpLink Gaming’s recent acquisition of an additional $35.6 million in ETH is more than just a financial transaction; it’s a powerful statement. It reinforces their commitment to a bold ETH treasury strategy and positions them at the forefront of corporate crypto adoption. As the digital economy continues to evolve, companies like SharpLink Gaming are not just adapting; they are actively shaping the future of corporate finance, demonstrating that a well-executed digital asset strategy can be a significant component of long-term growth and stability. Their increasing Ethereum holdings serve as a clear indicator of their vision for a decentralized future, inviting others to consider the potential of integrating digital assets into their own financial frameworks.

Frequently Asked Questions (FAQs)

What is SharpLink Gaming’s primary business?

SharpLink Gaming is a Nasdaq-listed company primarily focused on sports betting and iGaming technology solutions, providing products and services to the regulated U.S. sports betting and iGaming markets.

How much Ethereum (ETH) does SharpLink Gaming now hold?

With its recent addition, SharpLink Gaming now holds a total of 296,508 ETH, which is valued at approximately $997.26 million at the time of the announcement.

Why are traditional companies like SharpLink Gaming investing in cryptocurrencies?

Companies invest in cryptocurrencies like Ethereum for various strategic reasons, including potential as an inflation hedge, diversification of treasury assets, belief in the long-term growth of the blockchain ecosystem, and alignment with emerging technologies.

Is SharpLink Gaming the only Nasdaq-listed company with significant crypto holdings?

No, SharpLink Gaming is not the only one. Other Nasdaq-listed companies, such as MicroStrategy and Tesla, also hold significant amounts of cryptocurrencies, primarily Bitcoin, as part of their treasury strategies. SharpLink Gaming is notable for its specific focus on Ethereum.

What are the risks associated with a company holding a large ETH treasury?

The primary risks include the inherent volatility of cryptocurrency prices, regulatory uncertainties surrounding digital assets, and potential security concerns related to holding large amounts of crypto. These factors can impact the company’s balance sheet and financial performance.

How does SharpLink Gaming’s digital asset strategy impact its stock?

SharpLink Gaming’s digital asset strategy can influence its stock by offering investors indirect exposure to Ethereum’s performance. It may appeal to investors who believe in the long-term value of crypto, but it also introduces an element of cryptocurrency market volatility to the company’s financial profile, which can be seen as both an opportunity and a risk.