Big news is shaking up the crypto regulatory world, especially for those following the long-running legal saga between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs. Just when it seemed a potential resolution was in sight regarding penalties, a senior voice within the SEC itself has raised significant objections. This development in the SEC Ripple settlement adds another layer of complexity to the case.

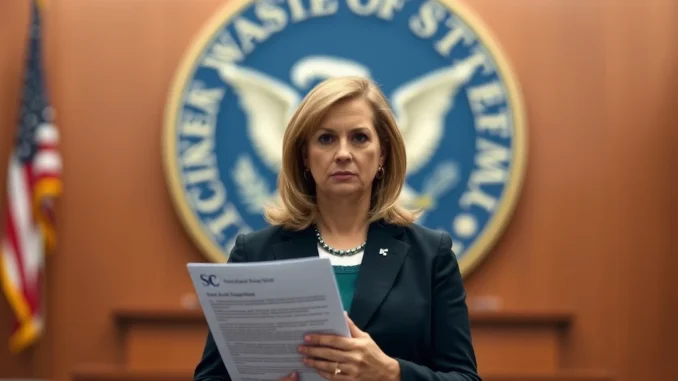

Why is SEC Commissioner Caroline Crenshaw Opposing the Deal?

Commissioner Caroline Crenshaw isn’t holding back. In a public statement, she expressed her strong disagreement with the SEC staff’s decision to propose a settlement letter to Ripple in the New York court. Her core argument centers on the potential negative ramifications of the proposed terms.

According to Crenshaw, approving this specific settlement could have two major negative consequences:

- It risks undermining the court’s crucial role in interpreting and applying securities laws to digital assets.

- Crucially, she believes it fails to adequately protect investors and the broader markets, which is a primary mandate of the SEC.

Her stance highlights internal debate within the regulatory body on how best to handle enforcement actions against crypto companies.

Understanding the Proposed SEC Ripple Settlement Terms

The settlement proposal that drew Commissioner Crenshaw’s opposition aimed to address specific aspects of the ongoing legal battle. While the main case has seen significant rulings, this particular proposal focused on resolving matters related to an August 2024 injunction and the return of civil penalties held in escrow.

Key elements of the proposed settlement reportedly included:

- Dissolving a previously ordered injunction set for August 2024.

- Returning a significant portion of civil penalties paid by Ripple – specifically, $75 million out of $125 million held in escrow.

It’s these terms, particularly the return of funds and the implications for future enforcement, that appear to be the source of Crenshaw’s concern regarding investor protection and the precedent it might set.

What Does This Mean for XRP News and the Market?

For anyone following XRP news, this development is significant. While it doesn’t directly impact the court’s prior ruling that programmatic sales of XRP were not securities, it introduces uncertainty regarding the final resolution of the case’s penalty phase.

The market often reacts to news related to regulatory actions and the Ripple case. An internal disagreement within the SEC, especially one voiced by a commissioner, could be interpreted in various ways by investors. It underscores that even as the case nears its conclusion, surprises can still emerge, potentially influencing market sentiment around XRP.

The Importance of Investor Protection in Crypto Regulation

Commissioner Crenshaw’s focus on investor protection is central to the SEC’s mission. In the evolving and often volatile cryptocurrency market, ensuring investors are protected from fraud, manipulation, and unregistered securities offerings is a key challenge for regulators worldwide.

Her argument suggests that the proposed settlement terms might not go far enough in holding Ripple accountable in a way that deters future violations or fully compensates potentially affected parties. This highlights the ongoing tension between fostering innovation in the crypto space and implementing robust safeguards for market participants.

Navigating SEC Enforcement Actions in the Crypto Space

The Ripple case is one of the most high-profile examples of SEC enforcement actions targeting cryptocurrency companies. The SEC has used its authority to bring cases against various projects and platforms, arguing that many digital assets are unregistered securities subject to its jurisdiction.

These enforcement actions have created significant debate and, at times, uncertainty within the crypto industry. Commissioner Crenshaw’s dissent in the Ripple case illustrates that there can be differing views even within the SEC on the appropriate strategy and outcome for these complex legal battles. It suggests that the path forward for crypto regulation and enforcement remains a subject of internal, as well as external, discussion and disagreement.

Conclusion: A Lingering Question Mark

Commissioner Caroline Crenshaw’s opposition casts a notable shadow over the proposed SEC Ripple settlement. By raising concerns about undermining the court’s authority and failing investor protection, she injects a note of caution into what some might have seen as a final chapter approaching. For those interested in XRP news, this means the regulatory picture remains slightly clouded. The outcome of this internal SEC disagreement and how the court ultimately views the proposed terms will be critical for both Ripple and the broader landscape of SEC enforcement in the crypto market. It serves as a reminder that the journey toward regulatory clarity is still underway.