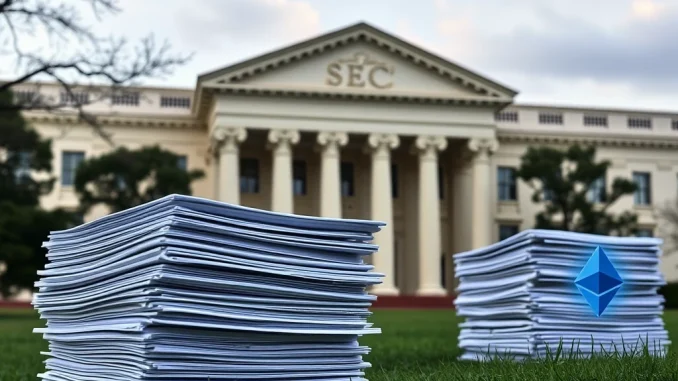

Major players in the asset management space, including VanEck, 21Shares, and Canary Capital, have made a significant move regarding the future of **SEC ETF approval**. They’ve formally requested the Securities and Exchange Commission (SEC) reconsider and reinstate a key principle in the ETF review process: ‘first to file, first to approve’. This development, reported by Bloomberg ETF Analyst James Seyffart via X, highlights ongoing industry efforts to shape **Crypto ETF regulation** and bring more predictability to the market.

Understanding the ‘First to File, First to Approve’ Principle

What exactly does the **First to file first to approve** principle mean? Historically, this guideline suggested that among multiple applications for similar exchange-traded funds, the SEC would prioritize the review and potential approval of the application submitted first. It rewarded firms for being early movers and completing their paperwork efficiently.

This principle was a standard practice for various traditional asset classes. However, its application became less consistent or was effectively abandoned during the review process for novel products like spot Bitcoin and Ethereum ETFs. The shift created uncertainty among issuers regarding the timeline and criteria for approval, regardless of when their application was initially submitted.

The VanEck 21Shares Letter: A Direct Appeal to the SEC

The **VanEck 21Shares letter**, also signed by Canary Capital, is a direct appeal to the regulatory body. The firms argue that reinstating the ‘first to file, first to approve’ principle would:

- Introduce greater predictability and fairness into the **SEC ETF approval** process.

- Incentivize issuers to dedicate resources to preparing comprehensive and high-quality applications promptly.

- Potentially streamline the review process by providing a clear framework for prioritizing applications.

- Align the treatment of crypto-related ETFs more closely with that of traditional asset class ETFs, fostering consistency in **SEC ETF principle** application.

The letter implicitly suggests that the deviation from this principle during the review of spot crypto ETFs led to a less transparent or less predictable outcome for applicants.

Why This Matters for Crypto ETF Regulation

The request to revive this principle is significant for the evolving landscape of **Crypto ETF regulation**. While spot Bitcoin and Ethereum ETFs have now been approved in the U.S., the regulatory path for other cryptocurrencies or more complex crypto-related investment products remains unclear. A predictable framework for **SEC ETF approval** is essential for market participants planning future product launches.

Issuers invest considerable time and capital in preparing ETF applications. Knowing that being first in line provides a potential advantage under the ‘first to file, first to approve’ rule can influence strategic decisions and resource allocation. Without it, firms might feel less urgency or face uncertainty about whether their early efforts will be recognized.

Potential Impact on Future SEC ETF Approval

Should the SEC heed the request presented in the **VanEck 21Shares letter**, it could signal a return to a more structured approach for reviewing novel asset class ETFs. This could have several potential impacts:

Benefits:

- Increased certainty for issuers.

- Encouragement of timely and thorough application submissions.

- Potential acceleration of approval timelines for subsequent crypto or other innovative ETFs, provided they meet all regulatory requirements.

Challenges:

- Could pressure firms to rush applications to be first, potentially impacting quality.

- The SEC might still retain discretion to delay or reject applications based on other regulatory concerns, even if they were filed first.

- Applying the principle to truly novel or complex structures might still pose challenges for regulators.

The request highlights the industry’s desire for clearer rules of engagement with regulators as crypto assets become more integrated into traditional financial structures. The outcome of this appeal could set a precedent for how future applications for a variety of crypto-linked investment products are handled by the SEC.

A Crucial Request for Predictability

The joint letter from VanEck, 21Shares, and Canary Capital represents a crucial industry plea for the SEC to reinstate the ‘first to file, first to approve’ principle. This move aims to restore predictability and fairness to the **SEC ETF approval** process, particularly relevant in the context of future **Crypto ETF regulation**. While the SEC’s response remains to be seen, the **VanEck 21Shares letter** underscores the industry’s push for clearer guidelines following the precedent set (or unset) during the review of spot Bitcoin and Ethereum ETFs. A return to this principle could significantly shape the strategy and timelines for asset managers looking to bring innovative investment products to market.