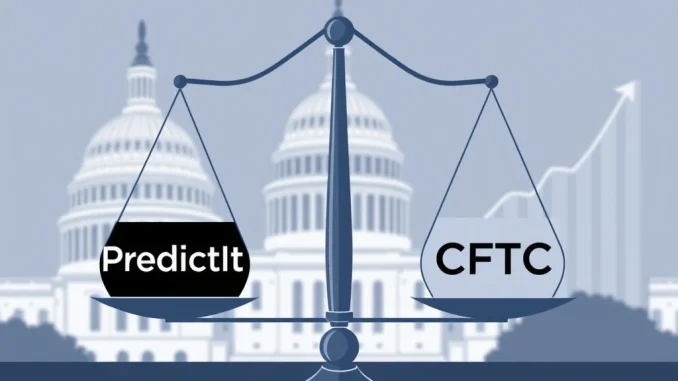

In a significant development for the burgeoning world of online prediction markets, U.S. political betting platform PredictIt has achieved a landmark agreement with the Commodity Futures Trading Commission (CFTC). This isn’t just another regulatory update; it’s a pivotal moment that could redefine the landscape for platforms where users bet on future events, including political outcomes. For anyone following the intersection of finance, technology, and regulation, especially within the crypto space where decentralized prediction markets are gaining traction, this news carries considerable weight.

What Does the New PredictIt Agreement Mean?

The core of this new agreement, as reported by Bloomberg, is a game-changer: it permits an unlimited number of participants to trade in each market hosted by PredictIt. Previously, the platform operated under a No-Action Letter from the CFTC that limited participation to 5,000 traders per market. This cap significantly constrained liquidity and the overall scale of the markets. The removal of this barrier is expected to have several profound effects:

Increased Liquidity: More participants mean more bids and asks, leading to tighter spreads and more efficient pricing in the markets.

Enhanced Price Discovery: With a broader base of traders, the collective wisdom of the crowd becomes more accurate, making the prices on PredictIt potentially better indicators of future events.

Greater Accessibility: The platform can now appeal to a much wider audience without fear of market caps being hit, opening up opportunities for more users to engage with political betting.

Operational Freedom: PredictIt gains more flexibility in how it structures and promotes its markets, no longer constrained by the previous participant limit.

This development is particularly interesting given the CFTC’s historical stance on prediction markets, often viewing them with caution due to their resemblance to gambling, despite their potential for academic research and economic forecasting.

Understanding the Role of the CFTC in Prediction Markets

The Commodity Futures Trading Commission (CFTC) is an independent agency of the U.S. government that regulates the U.S. derivatives markets, including futures, options, and swaps. Its primary goal is to foster open, transparent, competitive, and financially sound markets, and to protect market users and the public from fraud, manipulation, and abusive practices. When it comes to platforms like PredictIt, the CFTC steps in because these markets involve contracts based on future events, which can sometimes be classified as unregulated swaps or gambling.

PredictIt, operated by Victoria University of Wellington in New Zealand, has historically operated under a specific No-Action Letter from the CFTC. This letter essentially stated that the CFTC would not take enforcement action against PredictIt, provided it adhered to certain conditions, including the aforementioned participant limit and restrictions on the amount of money individuals could invest ($850 per market). The new agreement signifies a re-evaluation of these conditions, suggesting a more nuanced understanding or acceptance of the role these platforms can play, particularly when structured for research purposes.

Why Are Prediction Markets Gaining Traction?

Prediction markets, also known as information markets or idea futures, are speculative markets created for the purpose of trading contracts whose payoffs are tied to the outcome of future events. The market price of a contract at any given time can be interpreted as the crowd’s aggregated probability of the event occurring. They offer several unique benefits:

Information Aggregation: They are often touted as superior to traditional polling or expert opinions in aggregating dispersed information and predicting outcomes.

Economic Research: Academic institutions often use them for research into collective intelligence, behavioral economics, and political science.

Risk Management: In some contexts, they can serve as a form of hedging against future uncertainties.

Engagement: They provide an engaging way for individuals to interact with current events and test their foresight.

The increasing interest in these markets, both centralized like PredictIt and decentralized like those on blockchain platforms, underscores a growing demand for novel ways to forecast and engage with future events. This agreement with the CFTC could set a precedent for how similar platforms, including those leveraging blockchain technology for decentralized governance and betting, might navigate the complex US regulation landscape.

What Are the Implications for US Regulation and Beyond?

This agreement between PredictIt and the CFTC is more than just a win for one platform; it could signal a broader shift in how U.S. regulators view prediction markets. While the specifics of the agreement are crucial, the general move towards allowing greater participation suggests a potential softening of the regulatory stance, or at least a willingness to explore frameworks that permit these markets to operate at a larger scale.

For the cryptocurrency space, where decentralized prediction markets (e.g., Augur, Gnosis) are a significant use case, this development is particularly noteworthy. While decentralized platforms aim to circumvent traditional regulatory bodies, the evolving regulatory environment for centralized counterparts could indirectly influence the broader perception and eventual treatment of these novel financial instruments. It highlights the ongoing dance between innovation and oversight, and the constant need for regulatory bodies to adapt to new technologies and market structures.

Challenges certainly remain. Regulators will continue to be concerned about market manipulation, consumer protection, and the potential for these markets to be perceived primarily as gambling rather than legitimate forecasting tools. However, the PredictIt agreement suggests a pathway for increased legitimacy and scale within a regulated framework.

The Road Ahead: What’s Next for Prediction Markets?

The PredictIt-CFTC agreement marks a significant milestone, potentially paving the way for more robust and liquid prediction markets in the United States. It underscores the growing recognition of these platforms as valuable tools for information aggregation, moving beyond their simplistic classification as mere gambling sites. As the regulatory environment continues to evolve, we can expect to see further innovations in this space, both from centralized entities seeking compliance and decentralized protocols pushing the boundaries of what’s possible without intermediaries.

This development is a testament to the persistent efforts of platforms like PredictIt to operate within a regulated framework while simultaneously demonstrating the utility and demand for prediction markets. It’s a fascinating area to watch, as it bridges traditional finance, political science, and cutting-edge technology.

Frequently Asked Questions (FAQs)

Q1: What is PredictIt?

A1: PredictIt is a U.S.-based online political betting platform operated by Victoria University of Wellington in New Zealand. It allows users to trade contracts on the outcome of future political and current events, often used for academic research and forecasting.

Q2: What is the CFTC’s role in regulating PredictIt?

A2: The Commodity Futures Trading Commission (CFTC) is the U.S. government agency that regulates derivatives markets. It oversees platforms like PredictIt because their contracts on future events can resemble regulated financial instruments, ensuring market integrity and protecting participants.

Q3: What is the significance of the new agreement between PredictIt and the CFTC?

A3: The new agreement removes the previous limit of 5,000 participants per market, allowing an unlimited number of traders. This is expected to significantly increase liquidity, improve price discovery, and enhance the overall accessibility and utility of PredictIt’s political betting markets.

Q4: How does this agreement impact the broader prediction market landscape?

A4: This agreement could set a precedent for how U.S. regulators view and regulate other prediction markets, including decentralized ones built on blockchain. It suggests a potential shift towards allowing greater scale and legitimacy for these platforms, provided they meet regulatory requirements.

Q5: Are there still limitations on PredictIt?

A5: While the participant limit has been lifted, PredictIt still operates under a No-Action Letter, which typically includes other conditions such as limits on individual investments (e.g., $850 per market) and the primary purpose being academic research. The full details of the new agreement would clarify any remaining restrictions.