In the fast-evolving world of decentralized finance, strategic moves by major players often signal broader market trends and future directions. A recent monumental transaction has sent ripples through the blockchain community: Polychain Capital’s decisive exit from its significant TIA holdings, transferring a staggering $62.5 million stake to the Celestia Foundation. This isn’t just a sale; it’s a profound strategic pivot with far-reaching implications for the Celestia ecosystem and the broader landscape of blockchain asset management.

Diving Deep into the **Polychain TIA Sale**

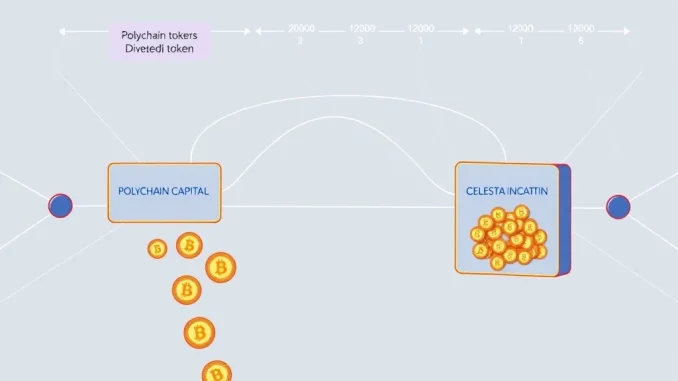

The cryptocurrency market is no stranger to large-scale transactions, but the recent $62.5 million Polychain TIA Sale to the Celestia Foundation stands out. This meticulously planned divestment involved 43,451,616 TIA tokens, executed over a phased unlock schedule from August 16 to November 14. For Polychain Capital, an early investor in Celestia, this marks a complete exit from its staked TIA holdings, consolidating capital for new ventures and demonstrating a mature approach to portfolio management in the digital asset space.

Key details of the transaction:

- Total Value: $62.5 million

- Tokens Transferred: 43,451,616 TIA

- Seller: Polychain Capital

- Buyer: Celestia Foundation

- Unlock Schedule: Phased, from August 16 to November 14

- Polychain’s Status: Complete exit from staked TIA holdings

This phased approach is crucial. By gradually releasing tokens, the Celestia Foundation aims to mitigate sudden supply shocks, which could otherwise lead to significant price volatility. This thoughtful execution reflects an understanding of market dynamics and a commitment to maintaining investor confidence, distinguishing it from typical large-scale market sell-offs.

The Strategic Role of the **Celestia Foundation**

With Polychain’s exit, the Celestia Foundation steps into a significantly expanded role. This non-profit entity now holds substantial governance authority and liquidity control over these TIA tokens. Their primary objective? To redistribute these tokens to new investors in stages, fostering broader participation and decentralization within the Celestia ecosystem. This move aligns perfectly with the foundational principles of blockchain: promoting distributed ownership and community-driven development.

The Foundation’s expanded responsibilities include:

- Governance Authority: Directly influencing future decision-making processes on the Celestia blockchain.

- Liquidity Control: Managing the flow of a significant portion of TIA tokens to ensure market stability.

- Ecosystem Growth: Attracting new participants and investors, thereby strengthening the network’s resilience and decentralization.

- Stakeholder Engagement: Actively managing relationships with a diverse set of token holders and community members.

Analysts are closely watching how this shift in power will influence Celestia’s governance structure. While specific impacts remain speculative, the foundation’s direct control over such a large token pool undoubtedly positions it as a central figure in shaping the project’s future trajectory. This could lead to more community-centric initiatives and a more robust, decentralized governance model.

Unpacking **TIA Token Governance** and Market Impact

The transfer of 43 million TIA tokens has immediate and long-term implications for TIA Token Governance and its market dynamics. The shift of governance power from an institutional investor (Polychain) to a non-profit foundation is a significant development. It suggests a move towards a more decentralized and community-oriented governance model for Celestia, potentially leading to more democratic decision-making and a stronger alignment with the broader community’s interests.

From a market perspective, the phased unlock schedule is a strategic masterstroke. Instead of a sudden influx of tokens, which could depress prices, the gradual release aims to:

| Aspect | Impact of Phased Release |

|---|---|

| Supply Shock Mitigation | Prevents a sudden surge in available tokens, reducing downward price pressure. |

| Investor Confidence | Demonstrates careful management, reassuring existing and potential investors. |

| Market Stability | Contributes to a more predictable and less volatile market environment for TIA. |

| Broader Distribution | Allows for a more equitable distribution of tokens to a wider range of new investors over time. |

This transaction also highlights the increasing sophistication of institutional crypto dealings, where structured transfers are becoming preferred over direct public market sales for large positions, especially to manage market impact.

A Landmark in **Blockchain Asset Reallocation**

This Polychain-Celestia deal serves as a significant case study in Blockchain Asset Reallocation. It’s not merely a financial transaction but a strategic repositioning for both parties. For Polychain, it represents a successful monetization of an early investment, freeing up capital for new opportunities in the dynamic blockchain sector. For Celestia, it’s an opportunity to consolidate control over its native token, strengthening its capacity to manage stakeholder engagement and ensure regulatory compliance.

The deal underscores several evolving trends in the blockchain space:

- Institutional Liquidity: Demonstrates a growing need and mechanism for institutional investors to exit large positions without disrupting markets.

- Foundation’s Role: Highlights the critical and expanding role of non-profit foundations in managing and decentralizing blockchain ecosystems.

- Strategic Pivots: Showcases how early investors can strategically divest, allowing projects to mature into more community-driven entities.

However, the transaction also raises pertinent questions about potential regulatory scrutiny, particularly concerning token unlock protocols and their adherence to market stability standards. As the crypto industry matures, such large-scale, structured transfers will likely attract more attention from regulators seeking to ensure fair and transparent market practices.

What This Means for Your **Crypto Investment Strategy**

For individual investors and those shaping their Crypto Investment Strategy, this transaction offers several valuable insights. Firstly, it reinforces the importance of understanding a project’s tokenomics and governance structure. The shift in governance power to the Celestia Foundation could lead to more robust, community-aligned development, potentially enhancing TIA’s long-term value proposition.

Secondly, the meticulous, phased nature of the sale provides a blueprint for responsible large-scale token distribution. This approach, aimed at mitigating market shocks, is a positive sign for TIA’s stability, making it a more attractive asset for long-term holders. Investors should look for projects that demonstrate similar foresight in managing their token supply and community engagement.

Actionable insights for investors:

- Monitor Governance Changes: Keep an eye on how the Celestia Foundation utilizes its increased governance power. This could indicate future developments and strategic directions.

- Assess Token Distribution: Understand the mechanisms by which tokens are distributed and unlocked. Phased unlocks are generally more favorable for price stability.

- Evaluate Foundation’s Role: Consider the strength and strategy of the project’s foundation or core development team. Their ability to manage large token supplies and foster community growth is crucial.

- Look Beyond Price: While price is important, analyze the underlying strategic moves, decentralization efforts, and long-term vision of projects.

This deal sets a precedent for how large institutional stakes in nascent blockchain projects can be transitioned, emphasizing controlled distribution and a shift towards more decentralized control. It’s a clear signal that the blockchain space is maturing, with strategic asset management becoming as critical as initial innovation.

In conclusion, the Polychain Capital TIA sale to the Celestia Foundation is more than just a financial transaction; it’s a significant event that redefines governance dynamics, highlights sophisticated asset reallocation strategies, and offers crucial lessons for market stability and investor confidence in the blockchain ecosystem. As the industry continues to evolve, such strategic maneuvers will undoubtedly become more common, shaping the future of decentralized finance.

Frequently Asked Questions (FAQs)

Q1: What was the main purpose of Polychain Capital selling its TIA stake to the Celestia Foundation?

Polychain Capital sold its TIA stake to fully exit its staked holdings, consolidating capital for other ventures. For the Celestia Foundation, the purpose was to gain greater governance authority and liquidity control over TIA tokens, enabling them to redistribute the tokens to new investors and foster broader participation in the ecosystem.

Q2: How will the phased unlock schedule impact the TIA token’s market?

The phased unlock schedule, spanning from August 16 to November 14, is designed to mitigate sudden supply shocks. By gradually releasing 43,451,616 TIA tokens, the Celestia Foundation aims to prevent a rapid influx that could depress prices, thereby maintaining market stability and investor confidence.

Q3: What does this transaction mean for Celestia’s governance?

This transaction transfers significant governance power from Polychain Capital to the Celestia Foundation. This shift is expected to lead to a more decentralized and community-oriented governance model, potentially influencing future decision-making processes on the Celestia blockchain and fostering broader community engagement.

Q4: Is this type of large-scale, structured sale common in the crypto market?

While large transactions are common, structured transfers like this, involving phased unlocks and direct sales to foundations rather than public markets, are becoming increasingly preferred for managing significant institutional exits. They demonstrate a growing sophistication in handling large token positions to minimize market disruption.

Q5: How does this deal affect potential regulatory scrutiny?

The transaction, particularly its token unlock protocols and phased distribution, could attract regulatory scrutiny. Regulators are increasingly focused on market stability standards and transparency in large-scale token movements, making such deals important precedents for compliance in the evolving crypto regulatory landscape.