A colossal movement of cryptocurrency recently captured the attention of the digital asset community. Specifically, a massive OKB transfer, valued at an astonishing $302 million, has moved from an undisclosed wallet directly to the OKX exchange. This event, flagged by the prominent blockchain tracking service Whale Alert, immediately sparked widespread discussion among investors and analysts alike. Such significant transactions often signal important shifts within the crypto ecosystem.

Unpacking the Monumental OKB Transfer

On [Insert Date of Report if available, otherwise omit], Whale Alert, a renowned blockchain analytics platform, detected and reported a substantial transaction. Approximately 2,660,388 OKB tokens were transferred. The sender’s address remains unidentified, simply labeled as an ‘unknown wallet.’ Conversely, the recipient was clearly identified as the OKX exchange. This single transaction’s valuation stands at approximately $302 million, making it one of the largest on-chain movements reported recently.

Such a large-scale OKB transfer naturally prompts questions. Is this an internal consolidation by the exchange? Could it be a major institutional player depositing funds? Perhaps it represents an over-the-counter (OTC) trade settlement. Understanding the implications of these large movements is crucial for market participants. Indeed, the transparency of blockchain technology allows us to observe these transfers, even if the identities behind them remain anonymous.

Understanding OKB and the OKX Exchange

To fully grasp the significance of this event, one must understand the entities involved. OKB is the native utility token of the OKX ecosystem. OKX stands as one of the world’s leading cryptocurrency exchanges. The OKB token offers various benefits to its holders, including:

- Reduced trading fees on the OKX platform.

- Access to exclusive features and services.

- Participation in the OKX Jumpstart program for new token listings.

- Potential for passive income through staking or yield farming.

The OKX exchange itself provides a comprehensive suite of services. It offers spot trading, derivatives, lending, and mining. Its global reach and extensive user base make it a key player in the crypto space. Therefore, any major activity involving its native token or its platform garners significant attention. The movement of such a large quantity of OKB tokens directly impacts the perception of the exchange’s liquidity and operational status.

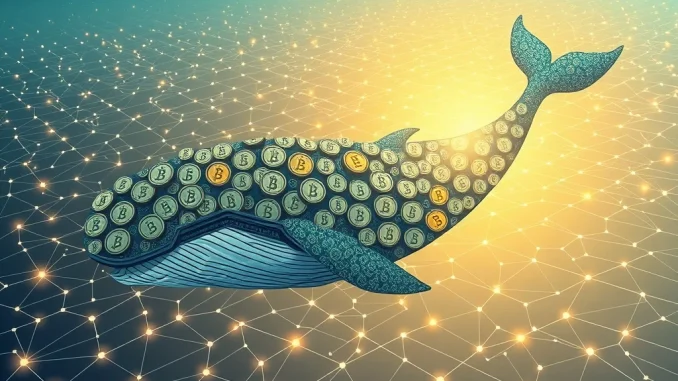

The Enigma of the Crypto Whale

The term ‘crypto whale‘ refers to an individual or entity holding a vast amount of cryptocurrency. These whales can significantly influence market dynamics. Their large transactions often precede notable price movements. Therefore, tracking their activity provides valuable insights into potential market shifts. Whale Alert specializes in monitoring these substantial transfers across various blockchains.

When a whale moves a significant sum, it can be interpreted in several ways:

- **Accumulation:** Moving funds from an exchange to a cold wallet often suggests long-term holding.

- **Distribution:** Transferring funds to an exchange might indicate an intent to sell.

- **Internal Transfers:** Exchanges frequently move funds between their own wallets for operational purposes.

- **OTC Deals:** Large, private transactions outside the open market.

The recent OKB transfer to OKX falls into a category that requires further analysis. Without clear communication from the parties involved, the exact reason remains speculative. However, the sheer size of this particular movement makes it impossible to ignore. It highlights the continued concentration of wealth within the crypto market.

Potential Reasons Behind the OKB Transfer

Several theories could explain this substantial OKB transfer. Each theory carries different implications for the market and the OKB token itself:

- **Exchange Liquidity Management:** OKX might be consolidating funds or adjusting its hot and cold wallet balances. Exchanges routinely move large sums for security and operational efficiency.

- **Institutional Deposit:** A large institutional investor or a high-net-worth individual might be depositing OKB to the exchange. This could be for trading purposes, staking, or participating in specific OKX programs.

- **Over-the-Counter (OTC) Deal Settlement:** A private, off-exchange deal involving a large block of OKB could have just concluded. The transfer to OKX would then facilitate the final settlement or distribution.

- **Preparation for Listing/Partnership:** Less likely but possible, the funds could be moved in preparation for a major listing or a strategic partnership announcement involving OKB.

- **User Consolidation:** A very large user might be consolidating their OKB holdings onto the OKX platform for easier management or access to exchange services.

It is important to note that these are plausible scenarios. Without official confirmation, the precise motivation behind this specific OKB transfer remains unknown. However, the movement itself confirms significant activity around the OKB ecosystem.

Market Reaction and Future Outlook for OKB

Typically, large transfers to exchanges can sometimes trigger concerns about potential selling pressure. Conversely, they might also indicate increased liquidity or institutional interest. The market’s immediate reaction to this particular OKB transfer will be closely monitored. Traders will observe OKB’s price action and trading volume in the coming days. A sudden increase in sell orders could suggest distribution, while stable prices might indicate internal or strategic movements.

The continued growth of the OKX exchange and the utility of the OKB token remain key factors for its long-term outlook. This large transaction underscores the active nature of the cryptocurrency market. It also highlights the critical role of blockchain analytics services like Whale Alert. These services provide transparency in an otherwise opaque financial landscape. Investors should remain vigilant, watching for further developments that might shed light on this significant movement.

Conclusion

The transfer of over 2.6 million OKB tokens, valued at $302 million, from an unknown wallet to the OKX exchange represents a notable event in the cryptocurrency world. This substantial movement, detected by Whale Alert, prompts various questions about its underlying purpose. While the exact reasons remain undisclosed, it undoubtedly signifies major activity involving a significant crypto whale. The crypto community will continue to monitor OKB’s performance and OKX’s activities. This event serves as a powerful reminder of the dynamic and often mysterious nature of large-scale digital asset movements.

Frequently Asked Questions (FAQs)

Q1: What is OKB and why is this transfer significant?

OKB is the native utility token of the OKX exchange. This transfer is significant due to its immense size, approximately $302 million, making it one of the largest single movements of the token. Such large transactions often indicate major market activity or strategic maneuvers by large holders.

Q2: What is Whale Alert and how does it track these transactions?

Whale Alert is a popular blockchain tracking service. It monitors and reports large cryptocurrency transactions across various blockchains in real-time. It identifies these movements by analyzing public ledger data, providing transparency on significant fund transfers.

Q3: What are the potential reasons for such a large OKB transfer to OKX?

Potential reasons include exchange liquidity management, a large institutional deposit, settlement of an over-the-counter (OTC) deal, or even preparation for a new listing or partnership. The exact reason remains unconfirmed.

Q4: Does this OKB transfer necessarily mean the tokens will be sold?

Not necessarily. While transfers to exchanges can sometimes precede selling, they can also be for internal exchange operations, staking, participation in exchange programs, or settling private deals. The intent behind the transfer is not explicitly clear from the transaction data alone.

Q5: How do crypto whale movements affect the market?

Crypto whale movements can significantly influence market sentiment and price. Large deposits to exchanges might create fear of selling pressure, potentially leading to price drops. Conversely, withdrawals from exchanges can signal accumulation and a potential price increase. Their actions are closely watched by traders.

Q6: What is the role of the OKX exchange in the cryptocurrency ecosystem?

OKX is one of the world’s leading cryptocurrency exchanges, offering a wide range of services including spot trading, derivatives, lending, and more. It plays a crucial role in providing liquidity and access to various digital assets for millions of users globally.