Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Key Takeaways

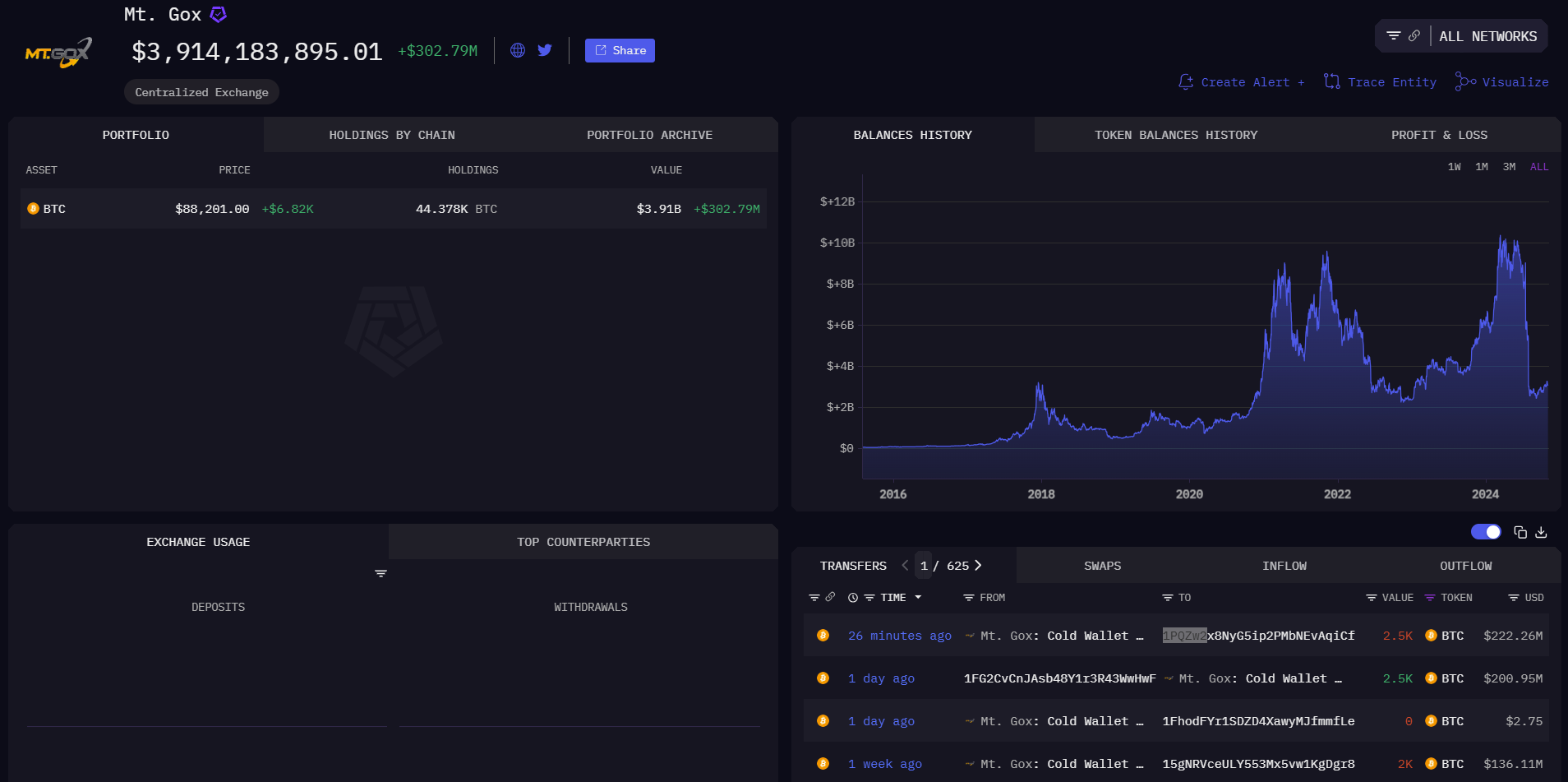

Mt. Gox transferred 2,500 Bitcoin worth about $222 million as Bitcoin neared $89,000.

The exchange holds around 44,378 BTC valued at approximately $3 billion.

Share this article

A Mt. Gox-labeled wallet just transferred 2,500 Bitcoin, worth around $222 million, to an unidentified address starting with “1PQZw2” in the last 30 minutes, according to data tracked by Arkham Intelligence. The new transaction was made amid Bitcoin’s surge to $89,000, CoinGecko data shows.

At the time of reporting, the defunct crypto exchange still holds around 44,378 BTC in its wallets, valued at approximately $3 billion.

The latest move follows a larger transfer on November 5, when Mt. Gox moved 32,371 Bitcoin, worth about $2.2 billion, to an unknown address. The new wallet activity continues to draw attention as the exchange has yet to fully resolve compensation claims from its former users.

The timeline for complete payouts has been extended. Originally expected to conclude by October 31, 2024, the deadline has now been pushed back to October 31, 2025, due to ongoing verification and processing requirements for claimants.

Some creditors have reported receiving fiat currency payments into their bank accounts as part of the reimbursement process. However, many users are still waiting for their full compensation in Bitcoin or Bitcoin Cash.

Bitcoin tends to quickly react to Mt. Gox’s Bitcoin transfers in the past. However, recent activities appear to barely budge the Bitcoin market.

Following the latest transfer earlier this month, Bitcoin dipped below $68,000, but it has since jumped over 30%, driven by Donald Trump’s election victory and global monetary adjustments, CoinGecko data shows.

Yet, there are concerns that when full compensation is eventually distributed, some creditors may choose to sell their Bitcoin holdings, potentially impacting market prices due to increased selling pressure.

Bitcoin was trading at around $88,500 at press time, up 9% in the last 24 hours.

Share this article

[ad_2]

Source link