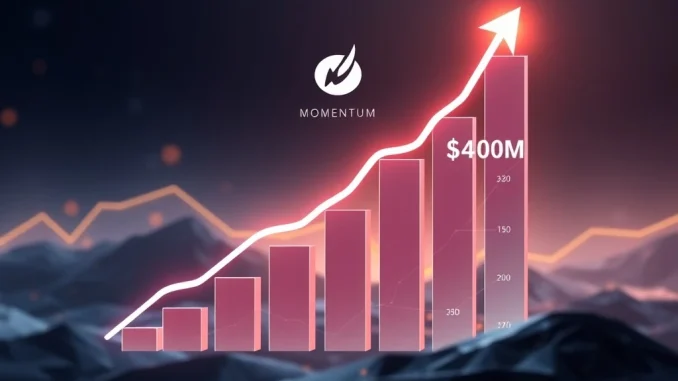

The decentralized finance (DeFi) landscape continually evolves. One platform now commands significant attention. Momentum TVL recently achieved a remarkable milestone. Its Total Value Locked (TVL) soared past $400 million. This positions Momentum as a dominant force. It operates as the largest ve(3,3) decentralized exchange (DEX) and crucial liquidity hub within the rapidly expanding Sui ecosystem. This achievement highlights its swift ascent in the competitive DeFi space.

Momentum TVL Skyrockets: A Deep Dive into Rapid Growth

Momentum’s growth trajectory is nothing short of impressive. The platform rapidly broke through key thresholds. It moved from $200 million to $300 million, and then to $400 million in TVL. This all occurred within a short span of days. The initial $200 million mark was only crossed on September 25. This rapid acceleration signals strong user confidence and increasing capital inflows. Such swift expansion is a testament to Momentum’s effective design and growing utility. It demonstrates a powerful network effect taking hold within the Sui ecosystem.

Total Value Locked (TVL) serves as a critical metric in DeFi. It represents the total amount of assets currently staked or locked in a protocol. A higher TVL indicates greater liquidity and user engagement. For Momentum, surpassing $400 million means substantial resources are now managed on its platform. This enhanced liquidity benefits all users. It allows for more efficient trading and reduced slippage. Consequently, this makes Momentum an even more attractive venue for DeFi participants. The platform’s ability to attract and retain such significant capital underscores its growing influence.

Understanding Momentum: The Premier ve(3,3) DEX on Sui

Momentum operates as a ve(3,3) DEX. This specific model combines elements of Curve’s vote-escrowed tokenomics with OlympusDAO’s (3,3) game theory. Essentially, users can lock their governance tokens for a period. This grants them voting power and boosted rewards. The (3,3) aspect encourages cooperative behavior. It rewards users for actions that benefit the protocol’s long-term health. This innovative tokenomic model often leads to deeper liquidity and more stable growth. Momentum leverages this design effectively. It incentivizes long-term participation and alignment with the protocol’s success. Therefore, its architecture plays a vital role in its impressive TVL accumulation.

As a leading decentralized exchange, Momentum provides essential services. Users can swap various tokens without intermediaries. It also facilitates liquidity provision, allowing users to earn fees. The platform’s user-friendly interface simplifies these complex operations. Furthermore, its integration within the Sui blockchain offers unique advantages. Sui is known for its high throughput and low latency. These technical capabilities support a smooth and efficient trading experience on Momentum. This synergy between Momentum and the underlying Sui blockchain is a key factor in its appeal.

The Sui Ecosystem: A Fertile Ground for DeFi Innovation

Momentum’s success is deeply intertwined with the burgeoning Sui ecosystem. Sui is a layer-1 blockchain developed by Mysten Labs. It aims to provide a high-performance, scalable, and secure platform for Web3 applications. Its object-centric data model and parallel execution capabilities differentiate it. These features enable Sui to handle a large volume of transactions concurrently. Such robust infrastructure is crucial for DeFi protocols. It ensures transactions are processed quickly and reliably. Momentum benefits directly from Sui’s advanced architecture.

The growth of Momentum also reflects the overall health and expansion of the Sui network. As more projects launch on Sui, the demand for a reliable liquidity hub increases. Momentum fulfills this need effectively. It provides the necessary infrastructure for token swaps and capital allocation. This symbiotic relationship drives mutual growth. Sui’s developer-friendly environment attracts innovative projects. Momentum then provides the financial rails for these projects to thrive. Consequently, the entire ecosystem benefits from Momentum’s expanding liquidity and user base.

Why Momentum’s $400M TVL Matters for the Future of DeFi

Surpassing $400 million in Momentum TVL is more than just a number. It signifies several important trends. Firstly, it validates the effectiveness of the ve(3,3) model. This tokenomic structure continues to attract significant capital. Secondly, it highlights the increasing maturity and adoption of the Sui blockchain. Sui is proving itself as a viable alternative to established chains. Thirdly, it solidifies Momentum’s position as a critical piece of DeFi infrastructure. Its role as a primary liquidity hub on Sui is now undeniable. This milestone suggests a promising future for the platform and the broader ecosystem.

The rapid accumulation of TVL also indicates strong community trust. Users are comfortable locking substantial assets into Momentum. This trust is vital for any decentralized protocol. It demonstrates confidence in the platform’s security and long-term viability. As Momentum continues to grow, it will likely attract even more users and projects. This creates a positive feedback loop. Increased liquidity leads to better trading conditions. Better conditions attract more users, further deepening liquidity. Therefore, this $400 million achievement is a powerful indicator of future potential within the Sui ecosystem.

The Competitive Landscape: Momentum’s Edge as a Decentralized Exchange

The DeFi sector is highly competitive. Numerous decentralized exchange platforms vie for market share. Momentum distinguishes itself through its specific design and ecosystem focus. Its ve(3,3) model provides a unique incentive structure. This encourages long-term liquidity provision and governance participation. Many other DEXs lack this sophisticated mechanism. Furthermore, its tight integration with the Sui blockchain offers a performance advantage. Sui’s technical capabilities allow Momentum to offer a superior user experience. These factors combine to give Momentum a significant edge.

Momentum’s focus on becoming the definitive liquidity hub for Sui also sets it apart. Instead of attempting to be a general-purpose DEX, it specializes in its native ecosystem. This focused approach allows for deeper integration and optimized services. It caters directly to the needs of Sui users and projects. This strategic positioning has clearly paid off. The rapid TVL growth confirms its success in capturing a dominant market share on Sui. Consequently, Momentum is not just another DEX; it is a foundational component of the Sui DeFi landscape.

Conclusion: Momentum’s Trajectory and the Sui Ecosystem’s Future

Momentum’s journey past the $400 million Momentum TVL mark is a significant achievement. It underscores the platform’s robust growth and strategic importance. As a leading ve(3,3) DEX and vital liquidity hub, Momentum is central to the Sui ecosystem. Its innovative tokenomics and seamless integration with Sui’s high-performance blockchain create a compelling offering. This rapid expansion signals strong confidence from users and investors alike. The future looks bright for Momentum as it continues to drive innovation within the decentralized exchange landscape on Sui.

Frequently Asked Questions (FAQs)

What is Momentum TVL?

Momentum TVL refers to the Total Value Locked in the Momentum decentralized exchange (DEX). It represents the aggregate amount of cryptocurrency assets deposited or staked within the Momentum protocol. A higher TVL generally indicates greater liquidity and user trust in the platform.

What is a ve(3,3) DEX?

A ve(3,3) DEX is a type of decentralized exchange that combines ‘vote-escrowed’ tokenomics with ‘(3,3)’ game theory. Users lock their governance tokens (vote-escrowed) to gain voting power and boosted rewards. The (3,3) mechanism incentivizes cooperative behavior, aiming for mutual benefit among participants and the protocol’s stability.

How does Momentum benefit the Sui ecosystem?

Momentum serves as a critical liquidity hub and the largest ve(3,3) DEX within the Sui ecosystem. It provides essential infrastructure for token swaps and capital allocation, attracting users and projects to the Sui blockchain. This enhances Sui’s overall utility and economic activity.

What does the $400 million TVL milestone signify for Momentum?

The $400 million TVL milestone signifies Momentum’s rapid growth, strong user confidence, and its established position as a leading DeFi protocol on Sui. It demonstrates the effectiveness of its ve(3,3) model and its ability to attract substantial capital, leading to deeper liquidity and a more robust platform.

Is Momentum a secure decentralized exchange?

As a decentralized exchange, Momentum operates on the Sui blockchain, benefiting from its underlying security features. While specific security audits and practices would need to be reviewed for a full assessment, its significant TVL suggests a high level of trust from its user base. Users should always conduct their own research on any DeFi platform.

What are the advantages of using Momentum on the Sui blockchain?

Using Momentum on the Sui blockchain offers several advantages, including high transaction throughput and low latency provided by Sui’s advanced architecture. This results in faster and more efficient trading experiences. Momentum’s specialized focus within the Sui ecosystem also ensures optimized services tailored to Sui users and projects.