Hold onto your hats, crypto enthusiasts! The ever-watchful eyes of the blockchain analytics world have spotted something truly massive. A mysterious, anonymous whale just executed a staggering $198 million transaction in Solana (SOL), sending ripples across the crypto sphere. This isn’t just pocket change; we’re talking about a move that could potentially signal shifts in the market. Let’s dive deep into what we know about this intriguing crypto whale’s activity and what it might mean for you.

What Exactly Happened with this Crypto Whale and Solana (SOL)?

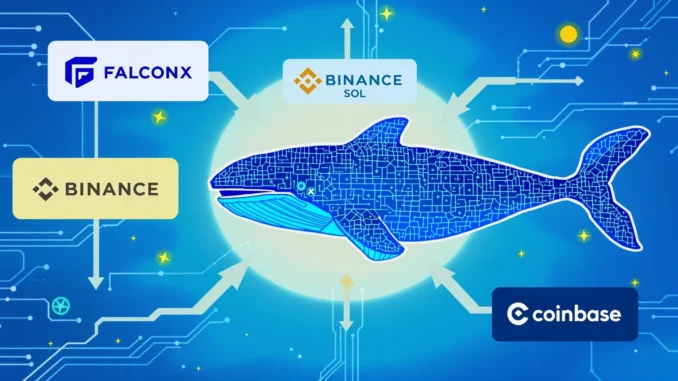

According to the eagle-eyed team at Lookonchain, a prominent blockchain analytics firm, a crypto whale recently unstaked a colossal 1,366,028 SOL tokens. To put that into perspective, at the time of the transaction, this stash was worth a jaw-dropping $198 million! This crypto whale then swiftly moved this enormous sum to FalconX, a well-known crypto prime brokerage. The timeline? All within a mere seven hours, according to Lookonchain’s report on X (formerly Twitter).

But the story doesn’t end there. FalconX, receiving this massive influx of SOL, then proceeded to deposit a significant portion – 440,202 SOL, valued at approximately $62.6 million – into two major crypto exchanges: Binance and Coinbase. This multi-stage transaction has sparked considerable discussion and speculation within the crypto community.

[img] [/img]

Why FalconX? Understanding the Role of Prime Brokerages in Crypto

FalconX, the recipient of the initial whale transfer, plays a crucial role in the crypto ecosystem. But what exactly is a crypto prime brokerage, and why might a whale choose to use one like FalconX?

- Institutional-Grade Services: Prime brokerages like FalconX cater primarily to institutional investors and high-net-worth individuals. They offer a suite of sophisticated services beyond basic exchange functionalities.

- OTC Trading: They often facilitate Over-the-Counter (OTC) trading, allowing large volume transactions to occur off public exchanges, minimizing market slippage and impact.

- Custody Solutions: Secure custody of digital assets is paramount for large holders. Prime brokers offer robust custody solutions, ensuring the safety of vast crypto holdings.

- Liquidity and Execution: They provide access to deep liquidity pools and advanced execution strategies, crucial for efficiently managing and trading large positions.

For a crypto whale moving such substantial amounts of Solana (SOL), using a prime brokerage like FalconX makes perfect sense. It allows for discreet and efficient handling of large transactions, minimizing market disruption and maximizing execution quality.

Binance and Coinbase Deposits: What Does it Mean for the Market?

The subsequent deposits of SOL into Binance and Coinbase by FalconX are perhaps the most intriguing part of this saga. Why move such a significant amount of Solana to major crypto exchanges? Let’s explore some potential implications:

- Potential Selling Pressure: The most immediate concern is the potential for increased selling pressure. Depositing large amounts of crypto onto exchanges is often a precursor to selling. If the whale (or FalconX on their behalf) intends to sell these SOL tokens, it could exert downward pressure on the price of Solana.

- Liquidity Provision: Alternatively, the deposits could be for liquidity provision. Market makers and large traders often deposit funds onto exchanges to provide liquidity and facilitate trading activity. This could be a less bearish scenario, suggesting the whale is preparing for trading rather than outright selling.

- Strategic Repositioning: It’s also possible that this move is part of a broader strategic repositioning of assets. The whale might be rebalancing their portfolio, shifting funds between different cryptocurrencies or preparing for other market maneuvers.

Solana (SOL) Price Impact and Market Speculation

Naturally, a transaction of this magnitude involving Solana (SOL) has sent ripples through the market. Traders and analysts are closely watching the price action of SOL to gauge the immediate impact and potential future trajectory.

While the immediate price reaction might be volatile, it’s crucial to remember that a single whale transaction doesn’t always dictate long-term market trends. However, it does serve as a reminder of the significant influence large holders can have on the relatively young and often sensitive cryptocurrency markets.

Actionable Insights: What Should Crypto Investors Watch For?

So, what can crypto investors glean from this crypto whale activity? Here are some actionable insights:

- Monitor Exchange Flows: Keep an eye on exchange flow data, particularly for SOL on Binance and Coinbase. Significant increases in deposits could indicate potential selling pressure.

- Track Whale Wallets: Blockchain analytics tools allow you to track the movements of large wallets. Following the whale’s subsequent transactions can provide clues about their intentions.

- Stay Informed: Follow reputable crypto news sources and analytics firms like Lookonchain for real-time updates and insights on market-moving events.

- Manage Risk: Events like these highlight the inherent volatility of the crypto market. Ensure your portfolio is diversified and risk is appropriately managed.

The Unfolding Mystery of the Solana Whale

The movement of $198 million in Solana (SOL) by a crypto whale is undoubtedly a noteworthy event. Whether it signals impending selling pressure, strategic repositioning, or simply liquidity provision remains to be seen. What is clear is that these large transactions underscore the dynamic and sometimes unpredictable nature of the cryptocurrency market. As the situation unfolds, staying informed and vigilant is key for navigating the ever-evolving world of crypto investments. Keep watching this space for further updates and analysis as we continue to track the ripple effects of this massive whale maneuver!