In a shocking turn of events, LUMIA has plummeted by -614.04% in just 24 hours, sending shockwaves through the cryptocurrency market. This unprecedented crash comes amid heightened regulatory scrutiny and extreme volatility, leaving investors scrambling for answers. What caused this dramatic collapse, and what does it mean for the future of LUMIA?

LUMIA Crash: Understanding the Sudden Drop

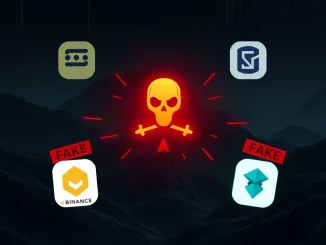

The LUMIA crash is one of the most severe single-day declines in cryptocurrency history. Several factors contributed to this dramatic event:

- Intensified regulatory actions targeting LUMIA’s operations

- Forced liquidations triggering a cascade of sell orders

- Sharp decline in market liquidity exacerbating price movements

- Absence of corporate communication fueling uncertainty

Regulatory Scrutiny Reaches Critical Levels

Financial authorities have significantly increased their oversight of LUMIA, with multiple enforcement actions underway. This regulatory pressure has created a climate of uncertainty, with investors concerned about:

| Regulatory Concern | Potential Impact |

|---|---|

| Compliance requirements | Increased operational costs |

| Market conduct rules | Restricted trading activities |

| Investor protection | Reduced market participation |

Cryptocurrency Volatility Reaches Extreme Levels

The LUMIA crash highlights the inherent volatility in cryptocurrency markets. Key observations include:

- Price swings became increasingly unpredictable

- Liquidity dried up during the steepest declines

- Traditional valuation metrics failed to predict the crash

Investor Sentiment Turns Dangerously Bearish

Market participants have adopted a defensive stance, with many exiting positions entirely. The rapid price movement triggered:

- Widespread stop-loss orders

- Margin calls and forced liquidations

- Reduced open interest across exchanges

Market Liquidity Concerns Come to Forefront

The LUMIA crash revealed significant liquidity challenges:

| Liquidity Metric | Pre-Crash | Post-Crash |

|---|---|---|

| Order Book Depth | Healthy | Thin |

| Bid-Ask Spread | Narrow | Wide |

| Trade Execution | Instant | Delayed |

What’s Next for LUMIA?

The coming weeks will be critical for LUMIA’s recovery prospects. Market observers are watching for:

- Official corporate communications addressing the situation

- Clarification on regulatory status

- Signs of institutional support or abandonment

- Technical indicators of potential stabilization

The LUMIA crash serves as a stark reminder of the risks inherent in cryptocurrency investing. While the potential for massive gains exists, so too does the possibility of catastrophic losses. Investors must carefully weigh these factors and maintain appropriate risk management strategies.

Frequently Asked Questions

What caused the LUMIA price to crash?

The crash resulted from a combination of regulatory pressure, forced liquidations, and deteriorating market sentiment that created a perfect storm of selling pressure.

Is this the end for LUMIA?

While the crash is severe, cryptocurrencies have recovered from similar situations before. Much depends on how the project addresses regulatory concerns and restores investor confidence.

Should I buy the dip in LUMIA?

Extreme caution is advised. Without clear signs of stabilization or resolution of regulatory issues, attempting to catch the falling knife could be exceptionally risky.

How does this affect other cryptocurrencies?

While there may be some spillover effect, most major cryptocurrencies have shown relative stability during LUMIA’s crash, suggesting the issues may be project-specific.

What lessons can investors learn from this event?

The crash underscores the importance of diversification, position sizing, and understanding the regulatory environment surrounding cryptocurrency investments.