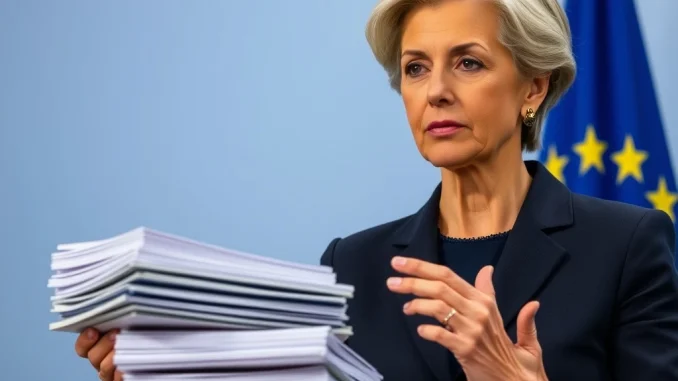

For those navigating the dynamic world of digital assets, a recent statement from European Central Bank (ECB) President Christine Lagarde sends a clear message. She has forcefully reiterated the urgent need for strong stablecoin regulation within the European Union (EU). This stance aims to prevent the uncontrolled circulation of these digital currencies, which could impact the region’s economic stability. Indeed, this development directly affects the future landscape for stablecoin users and issuers across Europe.

Why Robust Stablecoin Regulation is Crucial for the EU

ECB President Christine Lagarde continues to champion a proactive approach to digital asset oversight. She firmly believes that stablecoins should operate in Europe only under stringent conditions. Specifically, these conditions involve either robust regulations from other jurisdictions or the implementation of adequate safeguards within the EU itself. This position underscores a deep concern regarding potential systemic vulnerabilities.

Moreover, Lagarde’s repeated calls highlight a critical priority for European financial authorities. They seek to maintain control over monetary policy. Therefore, clear legislative measures are seen as essential. Without them, the proliferation of unregulated stablecoins could erode the ECB’s ability to manage inflation and ensure price stability. This focus on strong oversight aims to protect the broader financial ecosystem from unforeseen disruptions.

Understanding the Risks: Monetary Policy and Financial Stability

Lagarde’s warnings are not new. Previously, she emphasized that stablecoins could pose significant risks to both monetary policy and overall financial stability. These digital assets, designed to maintain a stable value, often peg to fiat currencies or other assets. However, their widespread adoption without proper controls could introduce new complexities into the financial system.

Consider these key concerns:

- Monetary Policy Impact: Large-scale stablecoin use might diminish the effectiveness of central bank interest rate decisions. This could weaken the ECB’s control over the economy.

- Systemic Risk: A sudden loss of confidence in a major stablecoin could trigger a ‘run’ on its reserves. Consequently, this could destabilize traditional financial markets.

- Liquidity Issues: If stablecoin reserves are not sufficiently liquid, redemptions could become problematic during periods of stress. This creates further instability.

Thus, preventing these potential issues requires comprehensive legislative action. The goal is to integrate stablecoins safely into the financial framework, not to stifle innovation completely.

ECB Lagarde’s Stance on Cross-Border Operations and Privacy

The complexities of stablecoins extend beyond national borders. ECB Lagarde has consistently pointed out the unique challenges posed by cross-border stablecoin operations. When these assets move seamlessly across different jurisdictions, regulating them becomes significantly harder. This lack of coordinated oversight creates regulatory gaps. These gaps could be exploited, leading to illicit activities or uneven consumer protection.

Furthermore, Lagarde has raised alarms about privacy risks. Specifically, stablecoins offered by large technology companies (often termed ‘big tech’) could exacerbate these concerns. These companies often possess vast amounts of user data. Integrating financial services through stablecoins could potentially centralize even more personal information. This raises serious questions about data security, consumer rights, and the potential for misuse. Consequently, strict rules are imperative to safeguard individual privacy in the digital age.

The Path Forward: Crafting Effective EU Stablecoin Law

The push for robust EU stablecoin law reflects a broader global trend towards regulating digital assets. European policymakers are actively working to establish a clear and comprehensive framework. This framework aims to balance innovation with necessary consumer and financial protection. The ultimate goal is to ensure that any stablecoin operating within the EU adheres to the highest standards of transparency, accountability, and resilience.

Indeed, the legislative efforts focus on several critical areas:

- Issuer Requirements: Establishing strict rules for stablecoin issuers regarding their capital, governance, and operational resilience.

- Reserve Management: Mandating transparent and liquid reserve requirements to back stablecoins effectively.

- Supervisory Framework: Designing a clear supervisory structure to monitor stablecoin activities and enforce compliance.

Therefore, the EU aims to create a secure environment for digital currencies. This approach ensures they complement, rather than undermine, the existing financial system.

Addressing Digital Currency Risks in an Evolving Landscape

The rise of stablecoins is just one aspect of the evolving digital finance landscape. Central banks worldwide are grappling with various digital currency risks, from volatility in unbacked cryptocurrencies to the potential for new forms of financial crime. Lagarde’s statements underscore a broader strategy to manage these challenges effectively. The ECB recognizes the transformative potential of digital assets. However, it prioritizes the stability and integrity of the financial system above all else.

Ultimately, a balanced approach is essential. This involves fostering innovation while mitigating significant risks. The EU’s efforts in stablecoin regulation serve as a blueprint for how major economic blocs can adapt to the digital age. They seek to harness new technologies responsibly. This proactive stance helps prepare the region for a future where digital currencies play an increasingly important role.

ECB President Christine Lagarde’s persistent call for stringent stablecoin regulation in the EU signals a clear intent. European authorities are determined to ensure that digital currencies operate within a secure and controlled environment. This commitment aims to protect monetary policy, safeguard financial stability, and uphold consumer privacy. As the digital asset space continues to mature, robust legislative frameworks will remain paramount for a safe and prosperous future.

Frequently Asked Questions (FAQs)

1. What is Christine Lagarde’s main concern regarding stablecoins?

Christine Lagarde’s primary concern is preventing the uncontrolled circulation of stablecoins within the EU. She worries these assets could pose risks to monetary policy, financial stability, and consumer privacy if not properly regulated.

2. Why does the ECB believe stablecoins threaten monetary policy?

The ECB believes widespread, unregulated stablecoin use could diminish its ability to manage interest rates and control inflation. This might weaken its influence over the economy, making it harder to ensure price stability.

3. What are the specific financial stability risks associated with stablecoins?

Stablecoins could introduce systemic risks, such as a ‘run’ on reserves if confidence erodes. Furthermore, issues with the liquidity of stablecoin reserves could destabilize traditional financial markets during periods of stress.

4. How do cross-border stablecoin operations complicate regulation?

Cross-border stablecoin operations make regulation difficult due to varying national laws and a lack of coordinated oversight. This creates regulatory gaps that could lead to illicit activities or inconsistent consumer protection.

5. What privacy concerns does Lagarde have about stablecoins from big tech companies?

Lagarde fears that big tech companies, already possessing vast user data, could centralize even more personal financial information through stablecoins. This raises significant concerns about data security, consumer rights, and potential misuse of data.

6. What is the EU’s goal for future stablecoin legislation?

The EU aims to create a comprehensive framework for stablecoins. This framework will ensure transparency, accountability, and resilience. It will also require strict issuer requirements, transparent reserve management, and a clear supervisory structure. This approach balances innovation with financial and consumer protection.