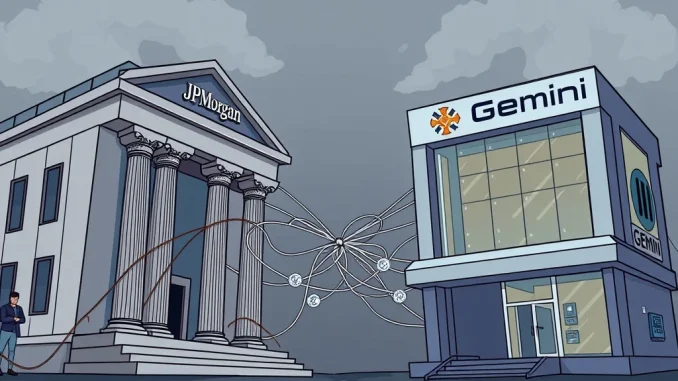

The world of cryptocurrency is no stranger to dramatic headlines, but a recent development involving financial giant JPMorgan Chase and crypto titan Gemini has sent ripples across the digital asset landscape. The news that JPMorgan has suspended new account onboarding for Gemini Trust Co. due to a public dispute over data access fees isn’t just a corporate squabble; it’s a profound moment that underscores the escalating tensions between legacy finance and the burgeoning crypto ecosystem. For anyone invested in the future of digital assets, understanding the intricacies of this JPMorgan Gemini conflict is absolutely crucial.

The Genesis of the Fintech Dispute: What Are Data Access Fees?

At the heart of this high-stakes standoff lies a contentious new policy by JPMorgan: charging fintech firms for access to customer banking data. This isn’t just about a few dollars; it’s about control, revenue, and the fundamental infrastructure that allows crypto platforms to connect with traditional bank accounts. Tyler Winklevoss, co-founder of Gemini, has been vocal in his opposition, alleging that JPMorgan retaliated against Gemini for voicing concerns about these charges. He famously claimed these fees could “bankrupt fintechs” and severely limit consumer access to vital crypto services.

So, what exactly are these data access fees?

- The Mechanism: These fees are levied on data aggregators, such as Plaid, which act as intermediaries, facilitating the secure transfer of customer banking data from traditional banks to third-party financial applications, including crypto platforms. This data is essential for services like linking bank accounts for deposits and withdrawals.

- JPMorgan’s Rationale: The bank frames these fees as necessary for security, cost predictability, and managing the increasing volume of data requests. From their perspective, providing this data access incurs operational costs and introduces potential risks that need to be mitigated.

- Fintech’s Counter-Argument: Fintech firms, including Gemini, view these fees as a “punitive tax.” They argue that such charges stifle innovation, create significant operational burdens, and ultimately harm consumers by making crypto services more expensive or less accessible. It’s seen as a move by traditional banks to erect barriers rather than foster open financial ecosystems.

This isn’t an isolated incident. The broader context includes ongoing legal challenges to the Trump-era Consumer Financial Protection Bureau’s (CFPB) Section 1033 rule, which mandates free data sharing. JPMorgan’s stance aligns with a risk-averse strategy in an uncertain regulatory climate, with CEO Jamie Dimon emphasizing security and cost predictability.

Navigating the Treacherous Waters of Crypto Banking

The suspension of Gemini’s account onboarding by JPMorgan isn’t merely a bump in the road; it’s a significant indicator of the volatile relationship between traditional finance and the crypto sector. Access to reliable banking services is the lifeblood of any financial institution, and crypto firms are no exception. This incident highlights the precarious position many crypto-native firms find themselves in, relying on partnerships with traditional banks for institutional services while facing increasing scrutiny and, now, new financial hurdles.

The history of crypto banking has been fraught with challenges:

- Operation ChokePoint 2.0: This informal regulatory campaign from years past severely restricted crypto firms’ access to banking services, leading to the shutdown of major crypto-friendly banks like Silvergate and Signature Bank. This left a concentrated market, with a few remaining providers like Cross River Bank bearing much of the industry’s banking needs.

- Systemic Risks: The concentration of banking services for crypto firms under a handful of providers creates systemic risks. Should one of these providers face issues, the ripple effect across the entire digital asset market could be severe.

- The Search for Stability: Crypto exchanges and custodians like Gemini require stable, compliant banking relationships to operate effectively, facilitate fiat on-ramps and off-ramps, and offer institutional-grade services. Disruptions to these relationships can delay expansion plans and impact liquidity.

JPMorgan’s move could signal a broader trend: traditional banks potentially shifting towards in-house solutions or reducing their exposure to the crypto sector’s volatility and regulatory complexities. This could lead to increased operational costs for fintechs if data fees become an industry-wide norm, potentially stifling innovation and liquidity across major exchanges.

The Broader Impact: How Does This Affect Crypto Regulation and Innovation?

This specific fintech dispute has far-reaching implications that extend beyond just JPMorgan and Gemini. It touches upon the very fabric of financial innovation and how regulators will ultimately shape the future of digital assets.

Consider the potential ramifications:

| Aspect | Potential Impact |

|---|---|

| Innovation | Increased operational costs for fintechs may reduce their ability to invest in new technologies and services, potentially slowing down the pace of innovation in the crypto space. |

| Market Concentration | Smaller fintechs might struggle to bear the new costs, leading to market consolidation where only larger, well-funded entities can survive. |

| Consumer Access | Higher costs for platforms could translate to higher fees for consumers, or even a reduction in available services, making crypto less accessible. |

| Regulatory Precedent | The resolution of this dispute, or lack thereof, could set a precedent for how data access is priced and governed across the entire financial industry, influencing future crypto regulation efforts. |

| Decentralization Push | This could accelerate the adoption of decentralized finance (DeFi) solutions, as firms and users seek to bypass traditional banking gatekeepers and their associated fees and restrictions. |

The incident underscores the interdependencies between traditional finance and crypto infrastructure. While JPMorgan’s core operations are unlikely to be significantly disrupted, Gemini’s institutional expansion plans could face delays. The industry will be watching closely to see if other major banks follow suit or if regulatory bodies intervene to clarify data sharing rules.

What Does This Mean for Investors and the Future of Digital Assets?

For investors, the JPMorgan Gemini dispute serves as a stark reminder of the unique risks and evolving landscape of the cryptocurrency market. It highlights that the digital asset ecosystem, while striving for decentralization, is still deeply intertwined with traditional financial rails. Understanding these interdependencies is key to navigating investment decisions.

Key takeaways for investors:

- Infrastructure Risk: Recognize that access to banking services is a critical piece of the crypto infrastructure. Disruptions here can impact liquidity, trading volumes, and the ability of platforms to onboard new users.

- Regulatory Headwinds: The ongoing tension between regulators, traditional banks, and crypto firms indicates that the regulatory environment is still maturing and can introduce unexpected challenges.

- Diversification: Consider diversifying not just across different cryptocurrencies but also across different platforms and access points to mitigate risks associated with specific service providers.

- DeFi as an Alternative: The dispute may bolster the case for decentralized finance, which aims to reduce reliance on traditional intermediaries. Investors might increasingly explore DeFi protocols as an alternative to centralized exchanges.

The resolution of this fee dispute may very well set a precedent for future negotiations, influencing how data access is priced and governed across financial institutions. It’s a critical moment for the industry, pushing it to adapt and potentially accelerate its journey towards greater independence from legacy systems.

Conclusion: A Crossroads for Crypto and Traditional Finance

The suspension of Gemini’s accounts by JPMorgan over data access fees is more than just a corporate spat; it’s a powerful symbol of the ongoing clash between traditional finance and the innovative, yet often disruptive, world of cryptocurrency. This fintech dispute highlights the fundamental disagreements over data ownership, access, and the very cost of doing business in a digitally interconnected world.

As the industry watches closely, the outcome of this particular conflict, and the broader push for clear crypto regulation, will undoubtedly shape the future of crypto banking. Whether this leads to increased decentralization, a more formalized partnership between old and new finance, or continued friction, one thing is clear: the digital asset landscape is constantly evolving, demanding vigilance and adaptability from all its participants. This incident serves as a powerful reminder that the journey towards a fully integrated and robust crypto ecosystem is still very much in progress, marked by both incredible innovation and significant challenges from established players.

Frequently Asked Questions (FAQs)

Q1: Why did JPMorgan suspend Gemini’s accounts?

A1: JPMorgan suspended new account onboarding for Gemini due to a public dispute over data access fees. Tyler Winklevoss, Gemini’s co-founder, criticized JPMorgan’s new policy requiring fintech firms to pay for access to customer banking data, alleging retaliation from the bank.

Q2: What are data access fees and why are they controversial?

A2: Data access fees are charges imposed by banks like JPMorgan on data aggregators (e.g., Plaid) that facilitate crypto platforms’ access to customer banking data. Fintech firms and industry associations criticize these as a “punitive tax” that could stifle innovation and hinder consumer access to crypto services, while banks argue they are necessary for security and cost predictability.

Q3: How does this dispute relate to broader crypto banking challenges?

A3: This incident is part of a larger trend of traditional banks re-evaluating their relationships with crypto firms. Past regulatory campaigns (like Operation ChokePoint 2.0) have already limited crypto firms’ banking access, leading to market concentration. The dispute highlights the ongoing struggle for crypto firms to secure stable and affordable banking services.

Q4: What are the potential implications for crypto regulation?

A4: The dispute could influence future crypto regulation, particularly concerning data sharing rules like the CFPB’s Section 1033. It may prompt regulators to intervene to clarify policies, potentially setting precedents for how data access is governed and priced across the financial industry.

Q5: Will this accelerate the adoption of DeFi?

A5: Yes, by increasing the friction and costs associated with traditional banking rails, this dispute may encourage more crypto firms and users to explore and adopt decentralized finance (DeFi) solutions, which aim to operate independently of traditional financial intermediaries.

Q6: What does this mean for investors?

A6: For investors, this dispute underscores the interdependencies between traditional finance and crypto infrastructure. It highlights potential infrastructure risks and regulatory headwinds. It may encourage investors to consider diversification across platforms and explore DeFi alternatives to mitigate reliance on centralized banking services.