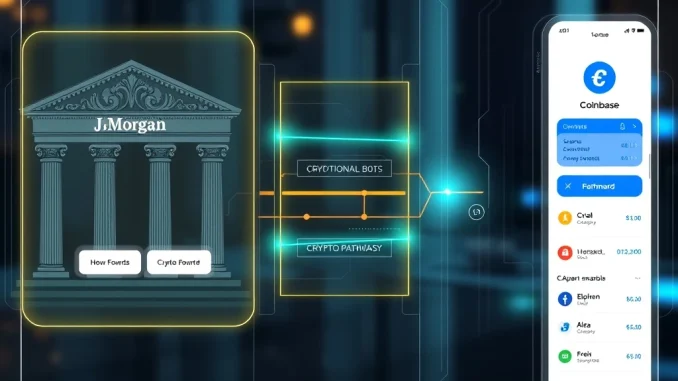

In a groundbreaking move, JPMorgan Chase and Coinbase have joined forces to simplify crypto funding and rewards conversion for millions of users. This partnership marks a significant step toward mainstream adoption of digital assets.

How JPMorgan and Coinbase Are Simplifying Crypto Funding

The collaboration introduces several innovative features:

- Direct bank-to-wallet transfers via JPMorgan’s secure API

- 1:1 conversion of Chase Ultimate Rewards points to cryptocurrency

- Coinbase account funding through Chase credit cards

The Future of Crypto Rewards Conversion

For the first time, Chase customers can convert their Ultimate Rewards points directly into digital assets at a 1:1 ratio (100 points = $1 in crypto). This integration bridges traditional loyalty programs with the crypto economy.

Key Benefits of the Partnership

| Feature | Benefit | Availability |

|---|---|---|

| Direct Bank Transfers | Seamless funding without intermediaries | 2026 |

| Rewards Conversion | New utility for loyalty points | Fall 2025 |

| Credit Card Funding | More payment options for crypto | Fall 2025 |

What This Means for Digital Assets Adoption

This partnership signals growing institutional acceptance of cryptocurrency and creates new pathways for mainstream users to enter the digital asset space with confidence and ease.

Frequently Asked Questions

When will the direct bank transfers be available?

The feature is expected to launch in 2026 through JPMorgan’s secure API.

How does the rewards conversion work?

Chase Ultimate Rewards points convert at a 1:1 ratio, where 100 points equal $1 in cryptocurrency.

Can I use any Chase credit card to fund my Coinbase account?

Yes, starting Fall 2025, all Chase credit cards will support Coinbase funding.

Are there any fees for these services?

Fee structures haven’t been announced yet, but Coinbase’s standard trading fees will apply.

Will this partnership expand to other cryptocurrencies?

While initial details focus on general crypto access, the partnership may expand to support more digital assets over time.