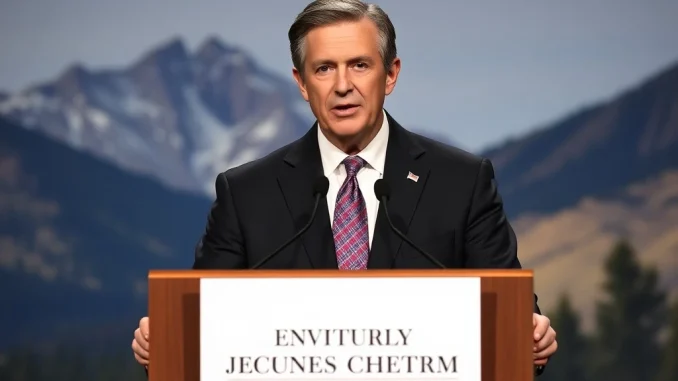

The financial world keenly awaits insights from US Federal Reserve Chair Jerome Powell. His upcoming speech at the prestigious Jackson Hole Economic Symposium is highly anticipated. However, market observers anticipate a cautious approach from Powell. He is expected to avoid providing any firm guidance on future interest rates, particularly regarding a September cut.

Understanding Jerome Powell’s Strategic Caution at Jackson Hole

Financial markets often react significantly to signals from central bank leaders. Therefore, Powell’s address at Jackson Hole holds immense importance. This annual symposium brings together central bankers, finance ministers, academics, and financial market participants. It serves as a critical platform for discussing long-term policy issues. In previous years, major policy shifts or strong indications of future monetary policy have emerged from this event. Yet, this year appears different.

Research firm LH Meyer, as reported by Walter Bloomberg on X, suggests Powell will likely keep his options open. This strategic ambiguity is a common tactic for central bankers. It allows for flexibility in response to evolving economic data. Markets currently lean towards an easing of monetary policy. Many investors hope for a reduction in borrowing costs soon. However, the Federal Reserve faces a complex balancing act.

The Fed must manage inflation while supporting economic growth. Providing clear guidance too early could limit its ability to respond effectively. Thus, Powell’s measured tone aims to temper these market expectations. This cautious approach is particularly relevant before the Fed’s upcoming blackout period. During this time, officials refrain from public comments on monetary policy. This silence ensures market stability ahead of critical policy meetings.

The Federal Reserve’s Delicate Balance on Interest Rates

The current economic landscape presents significant challenges for the Federal Reserve. Inflation remains a persistent concern for policymakers. Conversely, there are also signs of slowing economic activity. This creates a dilemma for the central bank. Should it prioritize curbing inflation with higher rates? Or should it support growth by easing policy? Powell’s speech will reflect this ongoing debate.

Analysts suggest Jerome Powell will emphasize economic uncertainty. Global factors, geopolitical tensions, and domestic data all influence the Fed’s decisions. Therefore, a data-dependent approach is crucial. This means policy adjustments will hinge on incoming economic indicators. These indicators include inflation reports, employment figures, and consumer spending data. The Fed’s dual mandate requires careful consideration of both price stability and maximum employment.

A lack of firm guidance on interest rates allows the Fed maximum maneuverability. It avoids committing to a path that might need swift reversal if economic conditions change. This flexibility is vital in an unpredictable global economy. Market participants, consequently, must remain attentive to future data releases. These will ultimately dictate the Fed’s next moves.

Navigating Market Expectations and Future Fed Policy

Despite market expectations for easing, the Federal Reserve has consistently reiterated its commitment to bringing inflation down. This commitment often involves maintaining a restrictive policy stance for longer than some market participants desire. Jerome Powell will likely reinforce this message at Jackson Hole. He aims to ensure that inflation expectations remain anchored.

The symposium provides a platform for Powell to clarify the Fed’s strategy. He might reiterate that future policy decisions will be entirely data-dependent. This means the Fed will react to economic developments rather than pre-committing to a specific timeline for rate cuts. Such a stance underscores the Fed’s determination. It prioritizes its inflation target above short-term market pressures.

For investors, understanding this nuanced approach is essential. A cautious Fed means continued vigilance. It also suggests that significant shifts in Fed policy will only occur once there is clear and sustained evidence of progress on inflation. This measured strategy aims to prevent premature celebrations or excessive market volatility. It ensures a stable path towards the Fed’s economic goals.

Implications of Jackson Hole and Broader Monetary Policy

The Jackson Hole symposium is more than just a speech; it is a gathering of influential minds. Discussions here often shape future economic thought and policy frameworks. While Jerome Powell may not offer explicit rate guidance, his broader comments on the economy will be scrutinized. His assessment of current economic conditions and the challenges ahead will provide valuable insights into the Fed’s thinking.

The cautious tone signals that the Fed is not yet ready to declare victory over inflation. It suggests that while progress has been made, the fight is not over. This consistent message is a cornerstone of current Fed policy. It helps manage public and market expectations effectively. Investors should therefore prepare for a period of continued uncertainty regarding the precise timing of rate adjustments.

Ultimately, the Fed’s actions on interest rates will continue to be guided by its dual mandate. This includes achieving maximum employment and maintaining price stability. Powell’s speech at Jackson Hole will serve as a crucial update on how the Fed intends to balance these objectives in the coming months. His words will set the stage for upcoming FOMC meetings, influencing global financial markets, including the broader cryptocurrency ecosystem, which often reacts to macroeconomic shifts.

Frequently Asked Questions (FAQs)

What is the Jackson Hole Economic Symposium?

The Jackson Hole Economic Symposium is an annual conference sponsored by the Federal Reserve Bank of Kansas City. It brings together central bankers, finance ministers, academics, and financial market participants from around the world to discuss economic issues, challenges, and policy options.

Why is Jerome Powell’s speech at Jackson Hole important?

Jerome Powell’s speech is crucial because it often provides insights into the Federal Reserve’s current economic outlook and future monetary policy direction. While he may not give firm guidance, his remarks can significantly influence market expectations and investor sentiment.

What does it mean for the Fed to ‘keep options open’ on interest rates?

When the Fed ‘keeps options open,’ it means they are not committing to a specific path for interest rates. Instead, they will make decisions based on incoming economic data. This approach provides flexibility to respond to changing economic conditions without being locked into a pre-announced policy.

How might the Fed’s cautious stance impact financial markets?

A cautious stance from the Federal Reserve, avoiding firm rate-cut guidance, could lead to continued market volatility. It might temper expectations for immediate rate cuts, potentially affecting bond yields, stock prices, and even indirectly influencing cryptocurrency markets, which are sensitive to macroeconomic shifts.

What is the Fed’s ‘blackout period’?

The Fed’s ‘blackout period’ refers to the time, typically about a week and a half before a Federal Open Market Committee (FOMC) meeting, when Fed officials refrain from making public comments about monetary policy. This silence is intended to prevent misinterpretations or unintended market reactions ahead of formal policy announcements.