Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Bittensor (TAO), the leading AI coin, has risen 76.64% this year but currently faces bearish pressure. Its price has dropped below crucial support levels, with indicators pointing to continued challenges.

However, momentum signals hint that this downward trend could be waning, suggesting a possible reversal. Investors should monitor key support and resistance levels closely for potential entry or exit points.

TAO Ichimoku Cloud Shows a Bearish Sentiment

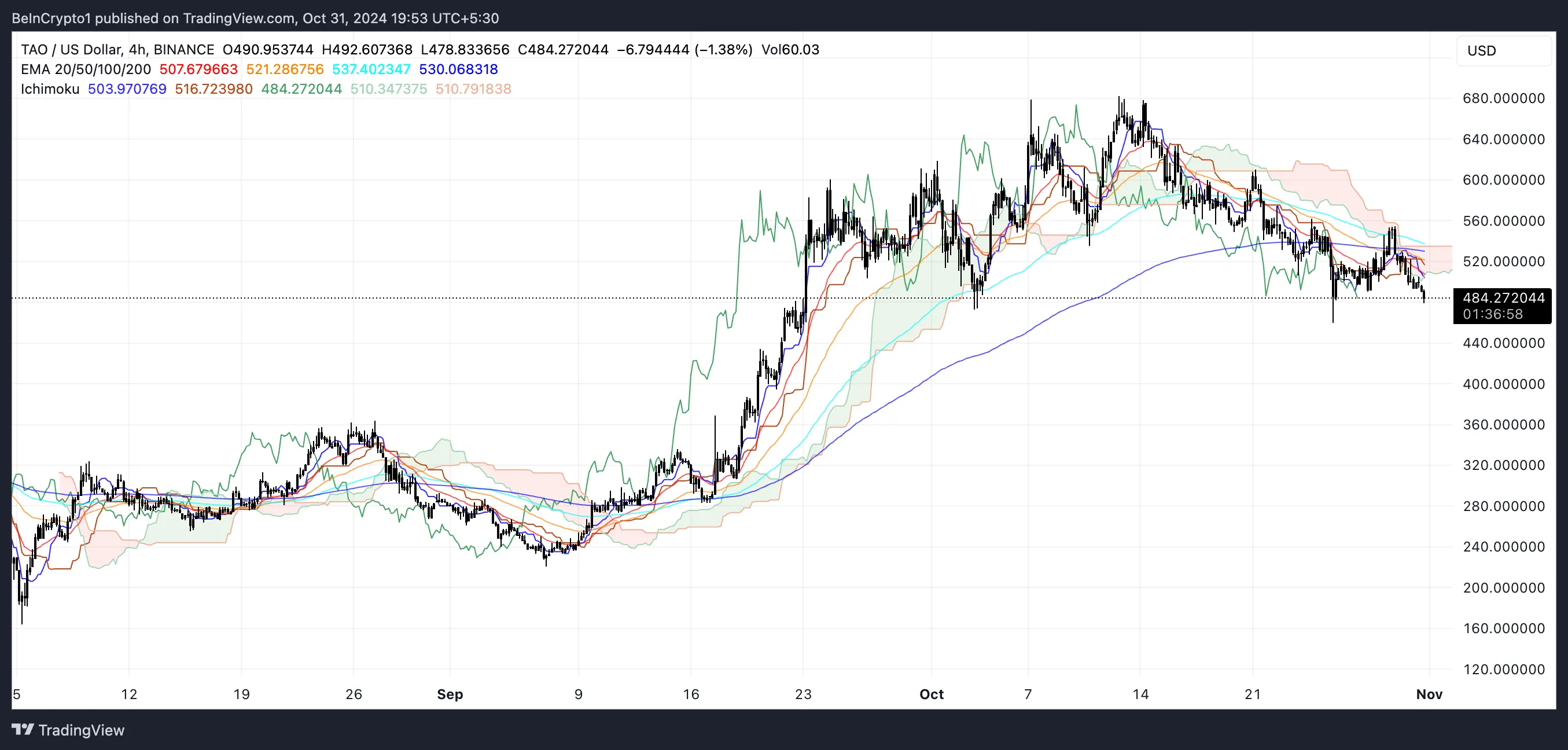

TAO price has recently broken below the Ichimoku Cloud, signaling a potential bearish sentiment. The cloud, which serves as a zone of support and resistance, has turned from green to red, further suggesting a change in momentum.

The price trading below both the conversion and base lines implies that selling pressure is dominant. This indicates that TAO is struggling to find upward traction and could continue to face downward pressure in the short term.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Additionally, the lagging span is positioned below the price, which aligns with a bearish outlook. The thin cloud in the upcoming periods suggests a lack of strong support, which means that TAO may continue to see more downside unless significant buying activity kicks in.

Bittensor Current Downtrend Is Not That Strong Anymore

TAO’s Average Directional Index (ADX) has fallen to 18.53 from nearly 35 just days ago, signaling a notable decrease in trend strength. This drop suggests that the momentum driving the recent correction is weakening, potentially leading to reduced volatility in the short term.

The ADX is an indicator used to measure the strength of a trend, regardless of its direction. Values above 25 indicate a strong trend, while values below 20 suggest a weak trend. TAO’s ADX, currently at 18.53, shows that the bearish trend, although still ongoing, is losing strength.

This means the downtrend might not be as forceful anymore, and the price could see some stabilization or even a potential reversal if buying pressure returns.

TAO Price Prediction: More Correction or a 23,9% Surge?

TAO’s EMA lines currently show a bearish setup, with the price positioned below all moving averages and long-term EMAs above the short-term ones.

This alignment points to a prevailing downtrend, where sellers are in control, keeping downward pressure on the price.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

If the downtrend persists, TAO price may test key support levels around $473 and $459. However, with the ADX indicating that the downtrend is losing momentum, there is a chance of a potential reversal.

If buying pressure increases, TAO could target resistance at $561. If that level is surpassed, the price could rise to $600, representing a 23.9% gain.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link