Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

On November 1, Toncoin (TON) price slipped below $5 after holding the line for several days. Following this drop, traders are betting on further declines, reflecting broader market sentiment as Bitcoin (BTC) and other cryptocurrencies have also faced recent losses.

However, in TON’s case, this analysis suggests that a recovery may remain challenging, even if the broader market rebounds.

Toncoin Market Sentiment Shifts Bearish

Derivatives information portal Coinglass shows that Toncoin’s Long/Short ratio has dropped to 0.88. The Long/Short ratio is a metric used to assess the balance between long-positioned traders (buyers) and shorts (sellers) in the market.

When the Long/Short ratio is above 1, it indicates more long positions than short, suggesting that most traders anticipate a price increase. Conversely, a ratio below 1 indicates more shorts, implying a bearish outlook.

According to BeInCrypto’s analysis, 53% of Toncoin traders with open positions are going short, while about 47% are long. This distribution reflects a generally bearish sentiment around the altcoin.

Read more: What Are Telegram Bot Coins?

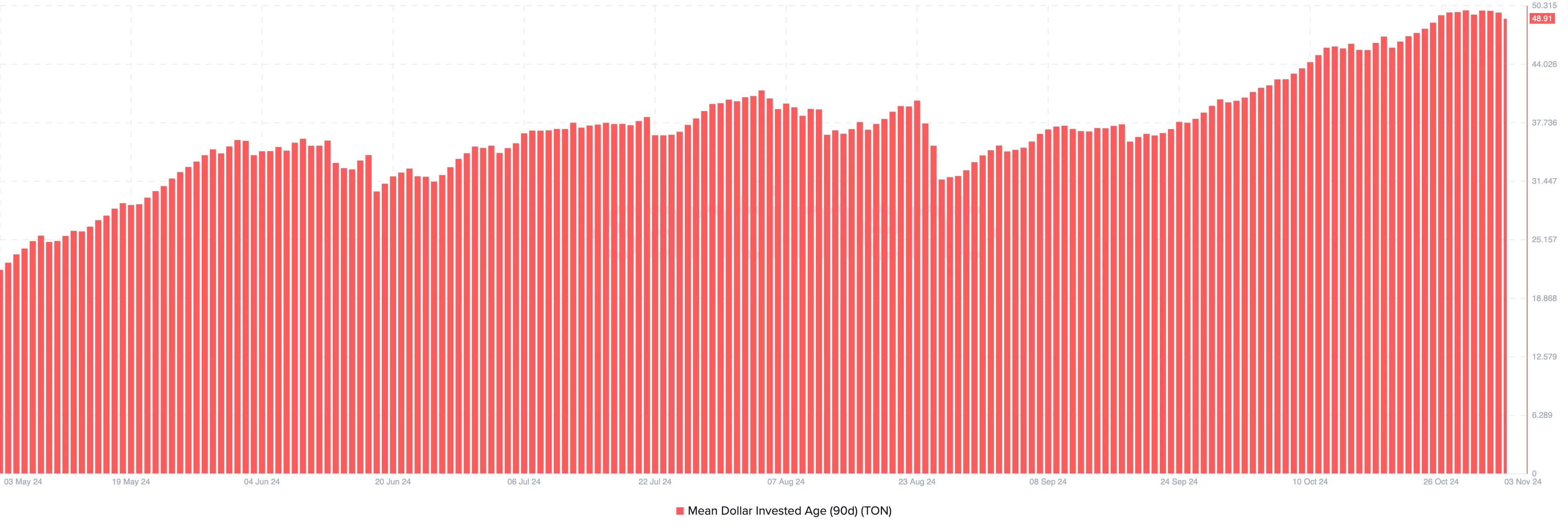

Furthermore, there seems to be a strong rationale behind traders’ positions. On-chain data from Santiment reveals a substantial increase in the Mean Dollar Invested Age (MDIA)—the average age of all tokens on a blockchain, weighted by purchase price.

A declining MDIA typically indicates active movement of tokens, which can boost the chances of a price surge.

However, the recent rise in MDIA suggests that most TON tokens have remained dormant. If this trend continues, Toncoin’s price could struggle to gain upward momentum.

TON Price Prediction: No Bounce Yet

Toncoin’s price as of this writing is $4.87. According to the daily chart, the altcoin fell below the threshold due to a lack of buying volume. Following this, TON has dropped below the key Exponential Moving Averages (EMAs).

A rising EMA generally backs an uptrend, acting as a dynamic support level, while a falling EMA often serves as resistance, hindering upward movement.

As seen below, TON’s price is below the 20 (blue) and 50 (yellow) EMAs. This indicates that the trend around Toncoin is bearish, and the price is likely to keep dropping. Should that be the case, then the altcoin might decline to $4.46, making most Toncoin traders profitable.

Read more: 6 Best Toncoin (TON) Wallets in 2024

On the other hand, if the cryptocurrency retests the 23.6% Fibonacci retracement level, the price might bounce to $6.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.