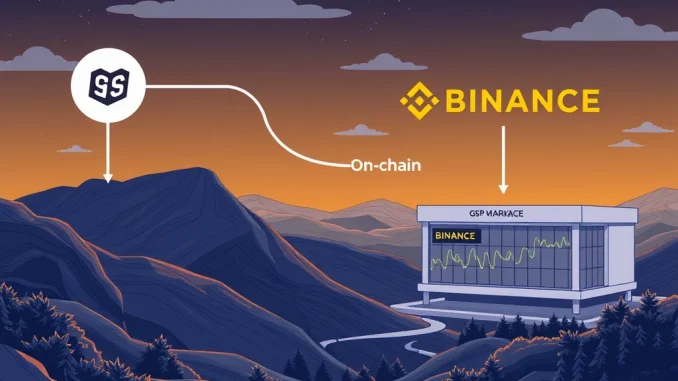

Is there a new player orchestrating the movements of WalletConnect Token (WCT)? Recent on-chain data is causing a stir in the crypto community, pointing towards a potential market maker behind WCT’s trading activities. The spotlight is now intensely focused on GSR Markets, a prominent firm in the digital asset space, following significant deposits of WCT to Binance. Let’s dive into the details and explore what this could mean for WCT and the broader crypto market.

Unveiling the Suspected Market Maker: GSR Markets and WCT

The crypto world thrives on transparency, and on-chain data often provides crucial insights into market dynamics. According to The Data Nerd, a well-known crypto data analysis platform on X (formerly Twitter), evidence suggests that GSR Markets is likely operating as the market maker for WalletConnect Token (WCT). This revelation comes after a series of substantial Binance deposits originating from a wallet reportedly linked to GSR Markets.

But what exactly does it mean for GSR Markets to be a market maker, and why is this significant for WCT?

- Market Maker Defined: In essence, a market maker plays a vital role in providing liquidity to a specific asset. They do this by consistently placing buy and sell orders, narrowing the gap between the bid and ask prices (known as the spread). This tighter spread makes it easier and more efficient for traders to buy and sell the asset, reducing volatility and ensuring smoother trading.

- GSR Markets – A Key Player: GSR Markets is a well-established and respected firm in the cryptocurrency market. They are known for providing liquidity, trading, and risk management solutions to institutional clients and token projects. Their involvement as a market maker can bring credibility and stability to a token.

- The Suspicion Arises: The suspicion of GSR Markets acting as the market maker for WCT isn’t just based on speculation. It stems from concrete on-chain data that reveals significant movements of WCT tokens from a wallet linked to GSR Markets to the Binance exchange.

Decoding the Binance Deposits: $3.82 Million in WCT

The crux of the suspicion lies in the substantial deposits of WalletConnect Token (WCT) made to Binance from a wallet associated with GSR Markets. Let’s break down the key numbers and what they signify:

- Recent Transaction: Approximately six hours prior to The Data Nerd’s report, a wallet linked to GSR Markets deposited a significant 4 million WCT to Binance. At the then-current price, this tranche was valued at around $1.61 million.

- Cumulative Deposits: Zooming out to the broader picture, the total deposits on April 17 alone reached a staggering 7.8 million WCT. This aggregate amount translates to a substantial $3.82 million based on current market valuations.

- Source of Information: This information is derived from on-chain data analysis, which tracks cryptocurrency transactions on the blockchain. Platforms like Etherscan and others provide tools to monitor wallet activity and token movements, making such observations possible.

To put these figures into perspective, a $3.82 million deposit is a considerable amount, especially for a token like WCT. Such large movements often indicate strategic actions by significant players in the market, further fueling the market maker theory.

Crypto Market Analysis: Implications and Speculations

The potential involvement of GSR Markets as the market maker for WCT raises several interesting questions and implications for crypto market analysis:

What are the Potential Benefits of a Market Maker for WCT?

- Enhanced Liquidity: Perhaps the most immediate benefit is improved liquidity for WCT. With a market maker actively managing order books, traders should experience tighter spreads and reduced slippage, making it easier to execute trades at desired prices.

- Price Stability: Market makers can contribute to price stability by smoothing out volatility. Their continuous buying and selling activity can help to absorb large buy or sell orders, preventing drastic price swings.

- Increased Trading Volume: Improved liquidity and stability can attract more traders to WCT, potentially leading to an increase in trading volume. This, in turn, can enhance the overall health and vibrancy of the WCT market.

- Institutional Interest: The involvement of a reputable firm like GSR Markets could signal to institutional investors that WCT is a more mature and reliable asset, potentially attracting larger capital inflows in the future.

Are There Any Challenges or Concerns?

- Centralization Risks: While market makers provide benefits, there’s a potential centralization aspect to consider. A single market maker wielding significant influence over a token’s trading could, in theory, manipulate prices, although reputable firms like GSR Markets are heavily regulated and incentivized to maintain fair market practices.

- Transparency and Disclosure: Ideally, formal announcements and transparency regarding market maker agreements are beneficial. While on-chain data provides clues, official confirmation would enhance trust and clarity within the community.

- Dependence on a Single Entity: Over-reliance on a single market maker could pose risks if the relationship were to dissolve abruptly. However, market maker agreements are typically structured to ensure a smooth and orderly transition if changes occur.

Actionable Insights for WCT Holders and Traders

For those holding or trading WCT, understanding the potential role of a market maker can inform trading strategies and risk assessment:

- Monitor Trading Activity: Keep an eye on WCT’s order book depth and spreads on exchanges like Binance. Tighter spreads and deeper order books could be indicative of market maker activity.

- Stay Informed: Follow reputable crypto news sources and on-chain data analysts like The Data Nerd for further updates and insights on WCT and GSR Markets.

- Manage Risk: As always, practice prudent risk management when trading cryptocurrencies. Market maker involvement can improve market conditions, but inherent crypto market volatility remains.

Conclusion: A Shocking Revelation or Business as Usual?

The on-chain data strongly suggests that GSR Markets is likely serving as the market maker for WalletConnect Token (WCT), particularly after the recent Binance deposits. While this revelation might seem shocking to some, in the sophisticated world of cryptocurrency markets, such arrangements are often a sign of maturity and a step towards greater market efficiency. The potential benefits for WCT, including enhanced liquidity and price stability, could be substantial. As always, the crypto market is dynamic, and staying informed and adaptable is key. Keep watching this space for further developments in the evolving story of WCT and its potential market maker, GSR Markets.