Big news from the world of crypto asset management! Grayscale Investments, a major player in bringing digital assets to traditional investment structures, recently announced key changes to some of its prominent funds. This **Grayscale fund update** follows their standard quarterly review process, specifically for the second quarter of 2025.

Understanding the Grayscale Fund Update

Grayscale manages various investment products that allow investors to gain exposure to cryptocurrencies without directly holding the assets. These funds track specific indexes or baskets of digital assets. Periodically, Grayscale reviews and rebalances these funds based on defined methodologies or market conditions. The latest announcement details adjustments made to two specific funds: the Decentralized Finance (DeFi) Fund (DEFG) and the Smart Contract Platform Fund (GSC).

The **DEFG Fund** Welcomes **ONDO Crypto**

The Grayscale Decentralized Finance Fund (DEFG) aims to provide investors with exposure to the leading protocols powering the DeFi ecosystem. Its composition is guided by the CoinDesk DeFi Select Index methodology. As part of the Q2 2025 review, Grayscale rebalanced the DEFG fund. This involved:

- Proportionally liquidating existing holdings within the fund.

- Using the proceeds from these liquidations to purchase a new asset.

- The newly added asset is **ONDO crypto**, the native token of the Ondo Finance protocol.

Ondo Finance is a protocol focused on bringing real-world assets (RWAs) onto the blockchain, a growing area within the DeFi space. Its inclusion in the DEFG fund reflects its increasing prominence and eligibility based on the index’s criteria.

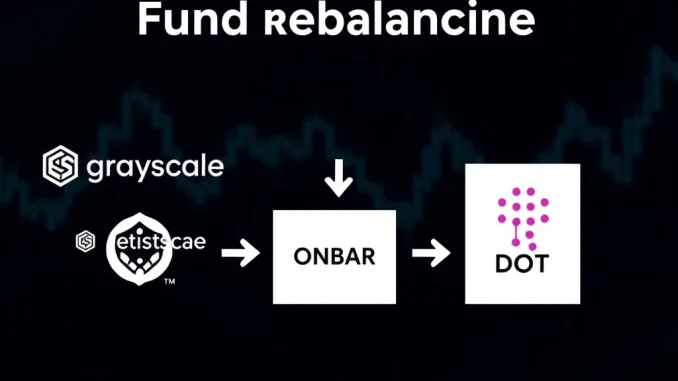

Changes to the **GSC Fund**: **HBAR Crypto** Joins, DOT Exits

The Grayscale Smart Contract Platform Fund (GSC) is designed to track the performance of a selection of leading smart contract platforms, which are foundational layers for many decentralized applications. The Q2 2025 review brought specific changes to this fund’s composition:

- Hedera (**HBAR crypto**) was added to the GSC fund. HBAR is the native cryptocurrency of the Hedera network, known for its unique Hashgraph consensus mechanism.

- Polkadot (DOT) was removed from the GSC fund. Polkadot is a blockchain protocol designed to connect and secure a network of specialized blockchains called parachains.

These changes indicate Grayscale’s assessment, based on their review methodology, regarding the current landscape and future potential of various smart contract platforms represented in the fund.

Why These **Grayscale** Adjustments Matter

Grayscale is one of the largest digital asset managers globally. Their decisions regarding fund composition can have an impact on the market perception and potentially the liquidity of the assets they add or remove. For projects like Ondo Finance (ONDO) and Hedera (HBAR), inclusion in a Grayscale fund can be seen as a significant validation and can potentially increase exposure to institutional and accredited investors. Conversely, removal, as seen with Polkadot (DOT) from the GSC fund, can lead to selling pressure from the fund’s rebalancing activities.

These adjustments highlight the dynamic nature of the crypto market and how index-based funds adapt to changes in market capitalization, liquidity, and eligibility criteria defined by their underlying indexes or review processes.

In Summary

Grayscale’s Q2 2025 fund rebalancing has resulted in notable shifts for its DEFG and GSC products. The **DEFG fund** now includes **ONDO crypto**, reflecting its growing importance in the DeFi and RWA sectors, guided by the CoinDesk DeFi Select Index. Meanwhile, the **GSC fund** saw the addition of **HBAR crypto** and the removal of Polkadot (DOT). These strategic changes underscore Grayscale’s ongoing process of aligning its funds with defined methodologies and market developments, offering investors exposure to the evolving digital asset landscape.