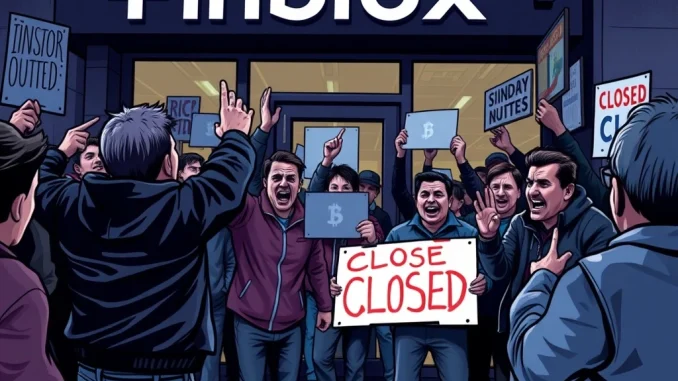

The sudden shutdown of Finblox, a cryptocurrency yield platform, has left investors furious and questioning the integrity of the platform’s founders. Launched in 2021, Finblox promised high returns but collapsed on July 7, 2024, amid allegations of fraud and mismanagement. Here’s what happened and why customers are outraged.

Why Did Finblox Shut Down?

Finblox cited ‘market changes’ as the reason for its abrupt closure, but investors suspect deeper issues. Reports from DL News reveal that the platform had extended uncollateralized loans to the now-defunct Three Arrows Capital (3AC), a hedge fund that collapsed in 2022. Many believe Finblox operated like a Ponzi scheme, using new deposits to pay older investors.

Customer Backlash and Fraud Allegations

Angry users have taken to social media, accusing Finblox’s founders of deceit. Key complaints include:

- Withdrawals frozen without warning

- Lack of transparency about 3AC exposure

- Delayed communication about financial troubles

The Three Arrows Capital Connection

Finblox’s downfall is closely tied to its risky lending practices. The platform reportedly funneled user funds into 3AC without proper safeguards. When 3AC imploded, Finblox was left holding worthless IOUs, leading to insolvency.

Lessons for Cryptocurrency Investors

This debacle highlights the dangers of unregulated yield platforms. Investors should:

- Verify collateralization of loans

- Avoid platforms promising unrealistic returns

- Diversify across trusted exchanges

What’s Next for Finblox Users?

With the platform shut down, recovery prospects look grim. Legal action is possible, but many fear funds are irrecoverable. This serves as a stark reminder of the risks in decentralized finance.

FAQs

1. What was Finblox?

Finblox was a cryptocurrency yield platform that promised high returns on crypto deposits.

2. Why did Finblox collapse?

It collapsed due to exposure to Three Arrows Capital and allegations of mismanagement.

3. Can investors recover their funds?

Recovery is unlikely, as the platform lacked sufficient reserves.

4. Was Finblox a Ponzi scheme?

While not confirmed, many users allege it operated similarly by using new deposits to pay old investors.

5. What should investors do now?

Document transactions and consider legal advice, but expectations should be low.