In the dynamic world of digital assets, few events capture attention quite like a sudden, dramatic price movement. Recently, the FIDA price experienced an astonishing surge, jumping by an incredible +475.34% in just 24 hours. This explosive short-term rally, however, unfolds against a backdrop of significant long-term decline, painting a complex picture of extreme market volatility. What does this mean for investors, and is this a sign of recovery or a fleeting anomaly?

FIDA Price: A Rollercoaster Ride Through Market Dynamics

The FIDA token, the native cryptocurrency of the Bonfida platform, certainly made headlines on July 28, 2025. Its remarkable 24-hour leap saw its value reach $0.1172, sparking considerable interest across the crypto community. This wasn’t an isolated incident, either; the token showed significant short-term momentum:

- 24-Hour Surge: +475.34%

- 7-Day Climb: +695.97%

- 1-Month Ascent: +4,747.47%

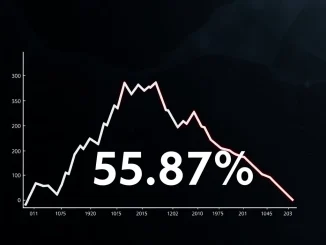

These figures, while impressive, stand in stark contrast to its performance over a longer horizon. The past 12 months have seen a substantial drop of 5,203.29%, highlighting the unpredictable nature and significant risks associated with this particular digital asset.

Understanding FIDA Token’s Short-Term Gains

The recent surge in the FIDA token‘s value has naturally brought a wave of optimism for some market participants. The rapid increase over the last month, especially, has been a focal point, drawing eyes from traders and analysts. This short-term reversal in sentiment could be attributed to various factors, including speculative trading, minor positive news, or even a coordinated buying effort. Such rapid gains often create a “fear of missing out” (FOMO) among potential investors, leading to increased trading volume and further price appreciation in the short run. However, it’s crucial to remember that these spikes, while exciting, do not automatically signal a sustained recovery, especially when viewed against the backdrop of its historical performance.

Navigating Crypto Volatility: Long-Term Challenges

Despite the recent uptick, the long-term outlook for FIDA remains shadowed by significant challenges. The 12-month decline of over 5,000% is a critical concern, indicating that the asset has lost the vast majority of its value over the past year. This level of depreciation raises fundamental questions about the project’s underlying viability and future prospects. Analysts frequently point out that while short-term crypto volatility can indeed present lucrative trading opportunities, the foundational issues that lead to such a drastic long-term decline must be addressed for any sustainable growth. Investors are advised to look beyond the immediate gains and consider the broader trajectory and inherent risks.

Decoding the Cryptocurrency Surge: What’s Driving It?

A sudden cryptocurrency surge like FIDA’s can be influenced by several market dynamics. Often, these sharp movements are fueled by low liquidity, where even relatively small buy orders can significantly impact price. Speculative trading, where traders bet on short-term price movements rather than long-term value, also plays a major role. Social media sentiment and community hype can amplify these effects, creating a self-fulfilling prophecy in the short term. However, without a strong fundamental catalyst—such as significant technological advancements, major partnerships, or increased adoption—such surges can be unsustainable and prone to rapid corrections. The market will be closely watching FIDA in the coming weeks to determine if this upward momentum can solidify or if it will revert to its established longer-term trend.

Assessing Digital Asset Performance: A Word of Caution

The stark contrast between FIDA’s recent gains and its annual decline underscores the unpredictable nature of digital asset performance. For new and experienced investors alike, this serves as a powerful reminder of the importance of thorough research and risk management. While the allure of quick profits can be strong, the potential for equally rapid losses is ever-present in highly volatile markets. Before making any investment decisions, consider the following:

- Historical Context: Always review an asset’s performance over various timeframes, not just the most recent.

- Underlying Fundamentals: Investigate the project’s technology, team, use case, and community support.

- Market Sentiment: Understand that market sentiment can shift quickly and dramatically.

- Risk Tolerance: Only invest what you can afford to lose, especially in volatile assets.

The next few weeks will be pivotal in determining FIDA’s immediate future. Market participants should remain vigilant, informed, and prepared for further price swings. The crypto market is inherently sensitive to news, sentiment shifts, and broader economic conditions, all of which can influence FIDA’s trajectory.

Conclusion: Navigating the Waves of Volatility

FIDA’s recent +475.34% surge is a compelling case study in the extreme volatility that defines the cryptocurrency market. While short-term gains can be exhilarating, they must always be weighed against the broader, long-term performance and underlying fundamentals. This dramatic price action serves as a crucial reminder for investors to approach digital assets with caution, diligence, and a clear understanding of both the immense opportunities and significant risks involved. Staying informed and exercising prudent risk management are paramount to navigating these unpredictable waters successfully.

Frequently Asked Questions (FAQs)

Q1: What caused FIDA’s recent 24-hour price surge?

A1: The exact cause of such a rapid surge can be multifaceted, often involving speculative trading, increased short-term interest from retail investors, low market liquidity, and potentially minor positive news or community hype. It’s a short-term phenomenon amid broader trends.

Q2: Does the recent FIDA price surge indicate a long-term recovery?

A2: While the short-term gains are significant, the asset’s 12-month decline of over 5,000% suggests deep-rooted challenges. A single surge, no matter how dramatic, does not automatically signify a sustained long-term recovery. Investors should look for consistent positive trends and fundamental improvements.

Q3: What are the risks associated with investing in a volatile asset like FIDA?

A3: The primary risks include rapid and substantial capital loss due to extreme price swings, market manipulation, and the potential for the asset to revert to its long-term downtrend. High volatility means both high potential rewards and high potential losses.

Q4: How can investors protect themselves when trading highly volatile cryptocurrencies?

A4: Investors should practice robust risk management, including setting stop-loss orders, diversifying portfolios, only investing capital they can afford to lose, and conducting thorough due diligence on the project’s fundamentals. Avoiding emotional trading and staying informed are also crucial.

Q5: Where can I find reliable information to assess FIDA’s long-term viability?

A5: To assess long-term viability, look beyond price charts. Research the Bonfida project’s whitepaper, development roadmap, team, community engagement, partnerships, and real-world utility. Reputable crypto news outlets and analytical platforms can also provide deeper insights.