The cryptocurrency market often reacts strongly to shifts in global economic policy. Investors closely watch statements from central banks worldwide. Recently, a significant announcement came from the Federal Reserve. This news could impact financial markets, including digital assets. Understanding these macro trends is vital for crypto enthusiasts.

Federal Reserve’s Shifting Focus on Employment

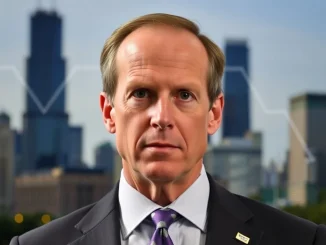

Federal Reserve Governor Michelle Bowman recently offered a crucial assessment. She stated the US labor market is showing signs of weakness. This observation marks a potential turning point for central bank policy. For a long time, the Fed’s primary concern was controlling inflation. Now, Bowman suggests a necessary re-evaluation. She believes the focus must shift. It should move from inflation stabilization to strengthening employment. This pivot could signal changes in future monetary decisions.

Bowman’s remarks highlight evolving economic conditions. The central bank constantly monitors key indicators. These include job growth, wage trends, and unemployment rates. A weaker labor market can impact consumer spending. It also affects overall economic stability. Therefore, this shift in emphasis is quite significant. It signals a potential change in the Fed’s immediate priorities.

Understanding the Current US Labor Market Dynamics

What exactly does “weaker than expected” mean for the US labor market? Several metrics contribute to this assessment. Firstly, job creation might be slowing. Companies could be hiring fewer new employees. Secondly, unemployment rates might tick upwards. More people could be actively seeking work without success. Finally, wage growth could be moderating. This indicates less competition for workers. These factors collectively paint a picture of cooling labor demand.

Historically, a strong labor market supported economic expansion. It provided stability and consumer confidence. Conversely, a weakening market raises concerns. It can signal broader economic slowdowns. The Federal Reserve uses this data to guide its actions. Their goal is to achieve maximum employment and stable prices. Thus, Bowman’s comments reflect careful analysis of current data.

Implications for Monetary Policy and the Economic Outlook

A change in the Federal Reserve’s focus carries significant implications. If employment becomes the priority, the Fed might adopt a more dovish stance. This could mean pausing interest rate hikes. It might even lead to rate cuts in the future. Such actions aim to stimulate economic activity. Lower interest rates can encourage borrowing and investment. They make it cheaper for businesses to expand. This, in turn, can create more jobs.

The overall economic outlook depends heavily on these policy decisions. Investors worldwide pay close attention. A dovish shift often boosts risk assets. These include stocks and, importantly, cryptocurrencies. Conversely, aggressive tightening can dampen market sentiment. Therefore, Bowman’s comments offer a glimpse into potential future Fed actions. This insight helps market participants prepare.

Michelle Bowman’s Stance and Broader Economic Views

Michelle Bowman is a key voice within the Federal Reserve. Her views carry weight. She has consistently emphasized data-driven decisions. Her recent statements underscore a pragmatic approach. She acknowledges the evolving economic landscape. The Fed must adapt its strategy. They aim to best serve the nation’s economic health. Her perspective adds to the ongoing debate. Policymakers are constantly weighing inflation risks against employment needs.

Her focus on employment reflects broader concerns. Many economists worry about potential recession risks. Sustaining a robust job market is critical. It helps avoid a significant economic downturn. Therefore, her call for a shift is timely. It reflects a growing consensus among some experts. The current economic environment demands flexibility.

Crypto Market Reactions to Economic Shifts

How might these developments affect the crypto market? A more dovish monetary policy from the Federal Reserve is generally positive for digital assets. When interest rates are lower, traditional investments like bonds yield less. This makes riskier assets, such as Bitcoin and altcoins, more attractive. Investors seek higher returns elsewhere. Consequently, capital often flows into these growth-oriented sectors.

Moreover, a focus on employment over inflation can ease liquidity conditions. This means more money might circulate in the economy. Increased liquidity can fuel asset prices across the board. The crypto market, known for its volatility, can see significant upward movement. This is especially true during periods of accommodative monetary policy. Crypto investors should monitor Fed communications closely.

Navigating the Current Economic Climate

The current economic outlook remains complex. Geopolitical events and supply chain issues still present challenges. However, the Federal Reserve’s potential shift is a key factor. It offers a new dimension for market analysis. Investors should consider diversified portfolios. They should also stay informed about global economic indicators. Understanding the interplay between central bank policy and asset performance is crucial.

Market participants should also remember volatility. Cryptocurrency markets are inherently unpredictable. While a dovish Fed can be bullish, other factors exist. Regulatory changes, technological advancements, and market sentiment also play roles. A well-rounded investment strategy considers all these elements. It prepares for various economic scenarios.

In conclusion, Federal Reserve Governor Michelle Bowman’s comments are highly significant. They signal a potential shift in the central bank’s priorities. The focus may now move from inflation control to employment support. This change in monetary policy could have wide-ranging effects. It will influence the broader economy. Furthermore, it holds implications for the cryptocurrency market. Staying informed about these macro-economic developments is essential for all investors.

Frequently Asked Questions (FAQs)

Q1: What did Federal Reserve Governor Michelle Bowman say?

A1: Governor Michelle Bowman stated that the US labor market is weaker than anticipated. She suggested the Federal Reserve should now prioritize employment over solely focusing on inflation control.

Q2: How does a weaker US labor market affect the economy?

A2: A weaker US labor market typically means slower job creation, potentially higher unemployment rates, and moderating wage growth. This can lead to reduced consumer spending and overall economic slowdowns, impacting the broader economic outlook.

Q3: What is the significance of the Federal Reserve shifting its focus?

A3: A shift in focus from inflation to employment suggests the Federal Reserve might adopt a more accommodative (dovish) monetary policy. This could involve pausing interest rate hikes or even implementing rate cuts to stimulate economic activity and support job growth.

Q4: How might this impact the cryptocurrency market?

A4: A more dovish monetary policy from the Federal Reserve is generally seen as positive for the crypto market. Lower interest rates make traditional investments less attractive, potentially driving capital into riskier assets like cryptocurrencies in search of higher returns.

Q5: Who is Michelle Bowman within the Federal Reserve?

A5: Michelle Bowman is a Governor on the Federal Reserve Board. Her statements and views are influential in shaping the central bank’s monetary policy decisions and economic outlook discussions.

Q6: What should investors do in response to this news?

A6: Investors should stay informed about Federal Reserve communications and broader economic indicators. They should consider how potential changes in monetary policy might affect their portfolios. Diversification and a clear understanding of risk tolerance remain crucial.