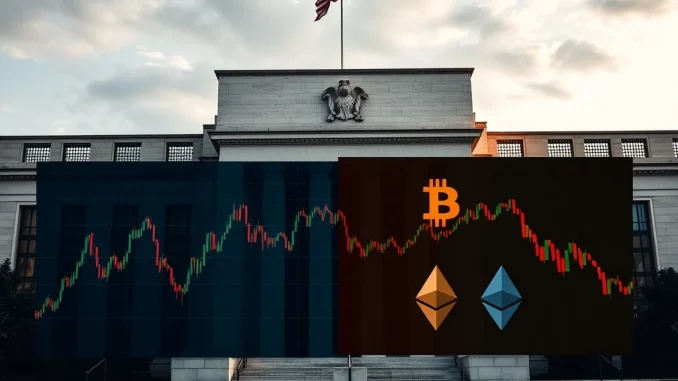

The Federal Reserve’s latest meeting has left markets on edge, with internal divisions over potential Fed rate cuts creating uncertainty. For crypto investors, this could mean heightened volatility for Bitcoin and Ethereum as monetary policy shifts loom.

Why the Fed’s Rate Decision Matters for Crypto

The Federal Reserve’s decision to hold rates steady at 4.25%-4.5% comes amid significant internal disagreements:

- Two governors prepared to dissent, signaling potential policy shifts

- Three distinct camps emerging on inflation interpretation

- September emerging as possible timeline for Fed rate cuts

Crypto Volatility Expected as Fed Signals Uncertainty

Historical data shows crypto markets often react strongly to Federal Reserve policy changes:

| Asset | Potential Impact |

|---|---|

| Bitcoin | Increased volatility as liquidity expectations shift |

| Ethereum | Potential rally if risk appetite increases |

| Altcoins | Higher sensitivity to macroeconomic conditions |

What the Fed’s Internal Split Means for Investors

The Federal Reserve’s cautious approach creates both challenges and opportunities:

- Dovish signals could boost crypto markets

- Political pressures adding complexity to policy decisions

- Clearer data needed before any policy pivot

September Fed Meeting: The Next Crypto Catalyst?

With markets pricing in 70% probability of year-end cuts, the September Federal Reserve meeting becomes crucial:

- Potential for Bitcoin and Ethereum rallies if cuts materialize

- Continued uncertainty may prolong crypto volatility

- Investors should watch labor market and inflation data

The Federal Reserve’s delicate balancing act between inflation control and economic growth continues to shape market expectations. For crypto investors, understanding these monetary policy dynamics remains critical for navigating potential volatility in Bitcoin and Ethereum markets.

Frequently Asked Questions

How do Fed rate decisions affect cryptocurrency prices?

Federal Reserve policies influence liquidity conditions and risk appetite, which directly impact crypto markets. Lower rates typically benefit risk assets like Bitcoin and Ethereum.

Why is there disagreement within the Fed about rate cuts?

Officials interpret inflation and economic data differently, with some seeing sufficient cooling and others demanding more evidence before easing policy.

What crypto assets are most sensitive to Fed policy changes?

Bitcoin and Ethereum show the strongest correlation to macroeconomic policy shifts, while altcoins may experience amplified volatility.

When might the Fed actually cut interest rates?

September appears the earliest possible window, but this depends on upcoming inflation and employment data.

How should crypto investors prepare for Fed meetings?

Monitor economic indicators, maintain diversified positions, and be prepared for potential volatility around policy announcements.