Could a delayed Fed rate cut now lead to a more aggressive move in September? U.S. Treasury Secretary Scott Bessent has raised eyebrows with his latest warning. For crypto investors, this could mean significant market shifts ahead.

Why the Fed Rate Cut Timing Matters

The Federal Reserve’s decisions on interest rates ripple across all financial markets, including cryptocurrencies. Here’s what you need to know:

- Lower rates typically weaken the dollar, potentially boosting crypto prices

- Delayed action might force the Fed to make bigger moves later

- Market uncertainty could increase volatility in both directions

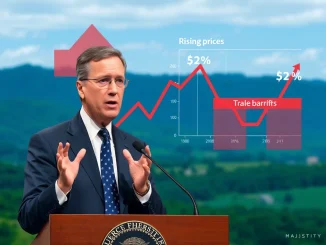

Treasury Secretary’s Stark Warning on September Rate Cut

Scott Bessent’s comments suggest the Federal Reserve might be painting itself into a corner. By postponing rate cuts now, they may need to implement a larger reduction in September to stabilize the economy. This scenario presents both risks and opportunities for crypto traders.

How Federal Reserve Decisions Impact Crypto Markets

The relationship between interest rates and cryptocurrency values isn’t always straightforward, but some patterns emerge:

| Fed Action | Potential Crypto Impact |

|---|---|

| Rate Cut | Possible dollar weakness boosting crypto |

| Rate Hold | Continued pressure on risk assets |

| Delayed Cut | Increased future uncertainty |

What Crypto Investors Should Watch For

As the Federal Reserve weighs its options, cryptocurrency market participants should monitor:

- Fed meeting minutes for clues on future policy

- Dollar index movements

- Institutional crypto investment flows

- Market sentiment indicators

The Treasury Secretary’s warning serves as a crucial reminder that central bank policies don’t operate in isolation. For crypto markets that often move opposite to traditional finance, understanding these dynamics could mean the difference between capitalizing on opportunities or getting caught in volatility.

Frequently Asked Questions

Why would the Fed delay a rate cut?

The Federal Reserve might postpone rate cuts if they believe inflation remains stubbornly high or if employment data stays strong.

How do interest rates affect Bitcoin?

Lower rates generally weaken the dollar, which can make Bitcoin more attractive as an alternative store of value.

What’s the historical relationship between Fed cuts and crypto?

While not perfectly correlated, major crypto rallies have often occurred during periods of monetary easing.

Should crypto investors fear a delayed rate cut?

Not necessarily, but they should prepare for potential increased volatility as markets adjust expectations.

What other economic indicators should crypto traders watch?

CPI data, employment reports, and GDP growth all influence Fed decisions and consequently crypto markets.

Could a larger September cut actually benefit crypto?

Yes, if it leads to significant dollar weakness and renewed risk appetite among investors.