The financial world is currently buzzing. A **Fed rate cut** in October now appears highly probable. This development could significantly impact global markets. For cryptocurrency investors, understanding these shifts is crucial. Changes in **monetary policy** often create ripple effects. Therefore, monitoring Federal Reserve actions is essential.

Decoding the Rising October Rate Cut Probability

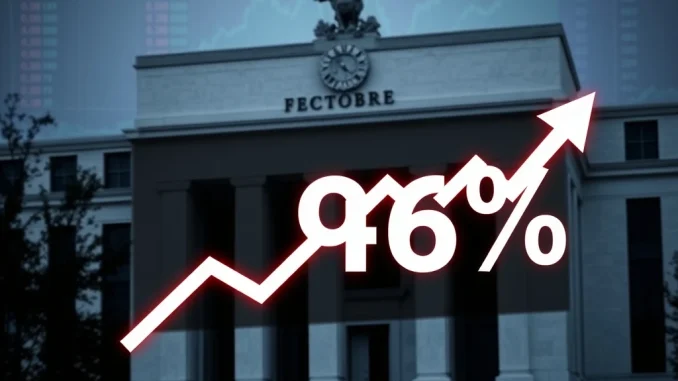

Expectations for a Federal Reserve interest rate cut have dramatically increased. Following today’s **FOMC statement**, the U.S. **interest rate futures** market priced in a 94% chance of a rate cut in October. This figure represents a substantial jump. Previously, the probability stood at 71.6% before the announcement. Such a significant increase signals a strong market conviction. Investors are clearly anticipating a policy adjustment.

What exactly does this 94% probability signify? It indicates that market participants believe a rate reduction is almost certain. Furthermore, these probabilities are derived from trading activity in federal funds futures contracts. These contracts allow investors to bet on the future direction of the federal funds rate. Consequently, their pricing reflects collective market sentiment. A higher probability suggests strong agreement among traders.

The Influence of the Recent FOMC Statement

The Federal Open Market Committee (FOMC) issues statements periodically. These statements communicate the Fed’s outlook on the economy and its **monetary policy** decisions. Today’s **FOMC statement** likely contained language or signals that shifted market expectations. Analysts meticulously scrutinize every word. They look for hints about future actions. A dovish tone, for instance, might suggest a greater willingness to ease policy. Conversely, a hawkish stance indicates a preference for tighter conditions.

Several factors might have contributed to this shift. These often include:

- Economic Data: Recent reports on inflation, employment, or GDP growth could indicate a slowdown.

- Global Headwinds: International economic uncertainties can pressure the Fed.

- Central Bank Commentary: Speeches or interviews from Fed officials can also influence market sentiment.

Therefore, the market interprets these signals. This interpretation directly translates into the increased **October rate cut** probability. The market reacts swiftly to new information.

Monetary Policy Shifts and Market Dynamics

A **Fed rate cut** typically has broad implications for financial markets. Lower interest rates generally reduce the cost of borrowing. This can stimulate economic activity. Businesses might invest more, and consumers might spend more. In the bond market, existing bond prices tend to rise. This occurs because newly issued bonds offer lower yields. Consequently, investors seek higher-yielding older bonds. This makes them more valuable.

For the stock market, a rate cut can also be a positive catalyst. Lower borrowing costs can boost corporate profits. Furthermore, a rate cut makes equities more attractive compared to bonds. This is because bond yields become less competitive. As a result, investors often shift capital into stocks. This drives up stock prices. However, these effects are not always immediate. Market reactions can vary based on underlying economic conditions.

The Cryptocurrency Connection: A Potential Boost?

The potential **October rate cut** holds significant relevance for cryptocurrency markets. Historically, lower interest rates tend to favor risk assets. Cryptocurrencies, like Bitcoin and Ethereum, are often considered risk assets. When traditional investments offer lower returns, investors seek alternatives. They might look for higher growth potential. This phenomenon is known as the ‘search for yield.’

Therefore, a **Fed rate cut** could:

- Increase Liquidity: More money flows into the financial system.

- Boost Risk Appetite: Investors become more willing to take on risk.

- Weaken the Dollar: Lower rates can make the U.S. dollar less attractive. A weaker dollar can make dollar-denominated assets, including Bitcoin, appear cheaper to international buyers.

Consequently, this environment could create a more favorable backdrop for digital assets. Increased investor confidence in riskier ventures often benefits the crypto space. However, cryptocurrency markets also have unique drivers. These include technological developments and regulatory news. Therefore, a rate cut is one of many factors influencing crypto prices.

Looking Ahead: Future of Interest Rate Futures and Economic Indicators

While the 94% probability for an **October rate cut** is high, it is not absolute. The Federal Reserve remains data-dependent. This means future **monetary policy** decisions will hinge on incoming economic data. Key indicators the Fed will monitor include:

- Inflation Data: Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) reports.

- Employment Figures: Non-farm payrolls, unemployment rates, and wage growth.

- GDP Growth: Overall economic expansion or contraction.

- Manufacturing and Services PMIs: Indicators of economic activity in various sectors.

Any significant changes in these metrics could alter the Fed’s trajectory. Therefore, market participants will closely watch these releases. Future **interest rate futures** probabilities will continue to evolve. They will reflect each new piece of economic information. This ongoing evaluation is a core part of the Fed’s strategy. It ensures flexibility in response to changing conditions.

The market also considers the potential for subsequent rate cuts. Some analysts may already be pricing in further reductions beyond October. This long-term view impacts investment strategies. It also shapes expectations for the broader economic outlook. Understanding these dynamics is vital for informed decision-making.

Navigating the Evolving Economic Landscape

The Federal Reserve’s actions have far-reaching consequences. A potential **Fed rate cut** in October signals a notable shift. It suggests the central bank is prepared to act. This action aims to support economic stability or growth. Investors across all asset classes must remain vigilant. They need to adapt their strategies. The interplay between traditional finance and emerging markets like crypto is complex. Yet, it offers unique opportunities. Staying informed about **monetary policy** is more important than ever. This proactive approach helps in navigating market volatility. It also assists in identifying potential growth areas.

Frequently Asked Questions (FAQs)

1. What is an FOMC statement?

An **FOMC statement** is a press release from the Federal Open Market Committee. It outlines the committee’s decisions regarding interest rates and **monetary policy**. It also provides an economic outlook. These statements are crucial for market participants. They offer insights into the Fed’s future actions.

2. How do interest rate futures predict Fed actions?

**Interest rate futures** are financial contracts. They allow investors to speculate on the future direction of interest rates. The pricing of these contracts reflects the collective probability that traders assign to different rate outcomes. Therefore, they serve as a real-time gauge of market expectations for Fed actions.

3. Why does a Fed rate cut matter for cryptocurrency?

A **Fed rate cut** can make traditional investments, like bonds, less attractive. This encourages investors to seek higher returns in riskier assets. Cryptocurrencies, often considered risk assets, can benefit from this ‘search for yield.’ Lower rates can also increase overall market liquidity and investor risk appetite, favoring crypto.

4. What does a 94% probability of a rate cut mean?

A 94% probability means that the **interest rate futures** market strongly anticipates a rate cut. It reflects a high degree of confidence among traders. They believe the Federal Reserve will indeed reduce rates in October. While not 100%, it indicates near certainty based on current information.

5. What factors could change the October rate cut probability?

Future economic data releases are key. Significant changes in inflation, employment, or GDP figures could alter the Fed’s stance. Unexpected global events or new statements from Fed officials could also shift market expectations. The Fed remains data-dependent in its **monetary policy** decisions.