Major economic announcements from central banks often send ripples across global financial markets. This includes the dynamic cryptocurrency space. Recently, a significant statement emerged regarding potential shifts in the United States’ monetary strategy. This news directly impacts traditional assets and can indirectly influence digital currencies.

Understanding the Proposed Fed Rate Cut

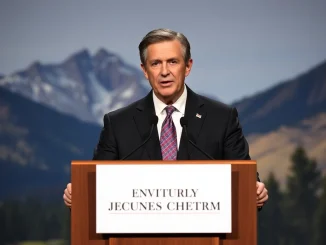

U.S. Federal Reserve Governor Stephen Miran has made a notable declaration. He stated that a 50 basis point rate cut would be appropriate in December. This announcement suggests a more aggressive approach to monetary easing than some market participants anticipated. Miran, a known ally of President Trump, further emphasized the necessity of at least a 25 basis point reduction. Therefore, a substantial shift in the Federal Reserve policy seems to be on his agenda.

A ‘basis point’ represents one-hundredth of a percentage point. Thus, a 50 basis point cut equals a 0.50% reduction in the benchmark interest rate. This move would significantly lower borrowing costs across the economy. Consequently, it could stimulate economic activity. The Federal Reserve uses such tools to manage inflation and employment levels.

Stephen Miran’s Stance and Rationale

Governor Miran’s comments highlight a specific perspective within the Federal Reserve. His close ties to former President Trump suggest an alignment with policies often favoring lower interest rates. Supporters of this view argue that lower rates encourage investment and consumer spending. This ultimately boosts economic growth. However, critics often worry about potential inflationary pressures.

Miran believes an immediate and substantial interest rate reduction is crucial. He likely assesses current economic conditions as needing a significant stimulus. This proactive stance contrasts with more cautious approaches. Many policymakers prefer gradual adjustments. Miran’s statement certainly injects a new dynamic into the ongoing debate about the future direction of monetary policy.

The Broader Context of Interest Rate Reduction

Central banks typically adjust interest rates to achieve specific economic goals. An interest rate reduction aims to make borrowing cheaper for businesses and consumers. This encourages spending and investment. When rates are lower, companies find it more affordable to expand. Consumers also face lower costs for mortgages and loans. This can inject liquidity into the economy.

Conversely, higher interest rates discourage borrowing and spending. This helps to cool down an overheating economy and combat inflation. Therefore, the Fed constantly balances these competing objectives. Miran’s call for a cut indicates a belief that the economy needs more stimulus. It suggests concerns about growth or potential deflationary pressures. Economic data, including inflation figures and employment reports, heavily influence these decisions.

Implications for the December Rate Cut

A potential December rate cut carries several implications. Firstly, it signals a possible pivot in the Fed’s stance. This could move from a tightening cycle to an easing one. Markets often react strongly to such signals. Investors may adjust their portfolios based on expectations of cheaper money. Secondly, a larger-than-expected cut (50 basis points) could be interpreted as the Fed acknowledging significant economic headwinds. This might include slowing growth or other challenges.

Moreover, the timing in December is noteworthy. It falls at the end of the year, providing a clear signal for the upcoming economic cycle. Businesses and individuals make financial plans based on these expectations. A decisive move could instill confidence or, conversely, raise questions about underlying economic vulnerabilities. The magnitude of the proposed cut makes it a significant point of discussion among economists and investors.

Navigating Federal Reserve Policy Shifts

The Federal Reserve operates independently to guide U.S. monetary policy. Its decisions impact global finance. The Federal Open Market Committee (FOMC) makes these key decisions. The FOMC comprises twelve members. These include the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and presidents of four other Federal Reserve Banks on a rotating basis. Each member brings a unique perspective to the table.

Federal Reserve policy aims for maximum employment and stable prices. Achieving these dual mandates often requires careful calibration. Debates within the Fed are common. Different governors hold varying views on the appropriate path forward. Stephen Miran’s outspoken advocacy for a substantial cut highlights these internal discussions. His comments provide insight into potential future actions, even if they do not represent a consensus view.

Potential Market Reactions and Crypto Outlook

Traditional financial markets would likely react significantly to a Fed rate cut. Stock markets often rally on expectations of lower borrowing costs. This makes corporate profits potentially higher. Bond yields, conversely, tend to fall. This reflects the lower interest rate environment. The U.S. dollar might also weaken against other currencies, making exports more competitive.

For the cryptocurrency market, the impact is often indirect but notable. Lower interest rates generally make traditional safe-haven assets, like bonds, less attractive. This could push investors towards higher-risk, higher-reward assets, including cryptocurrencies. Furthermore, a weaker dollar can make dollar-denominated assets, like Bitcoin, more appealing to international investors. However, broader economic uncertainty, which might prompt a rate cut, could also lead to risk-off sentiment. This might temporarily dampen enthusiasm for volatile assets like crypto. Market participants will closely watch how these macro-economic shifts unfold.

Federal Reserve Governor Stephen Miran’s proposal for a 50 basis point December rate cut represents a bold call for significant monetary easing. His emphasis on a substantial interest rate reduction underscores a particular viewpoint within the Fed. This perspective advocates for proactive measures to stimulate the economy. As markets anticipate the FOMC’s next moves, all eyes remain on economic data and official statements. The future direction of Federal Reserve policy will undoubtedly shape the financial landscape for months to come. This includes potential ripple effects on the evolving cryptocurrency ecosystem.

Frequently Asked Questions (FAQs)

Q1: What is a basis point in the context of interest rates?

A: A basis point (bp) is a common unit of measure in finance, equal to one-hundredth of a percentage point (0.01%). Therefore, a 50 basis point rate cut means the interest rate would be reduced by 0.50%.

Q2: Why would the Federal Reserve consider an interest rate reduction?

A: The Federal Reserve considers an interest rate reduction to stimulate economic growth. Lower rates make borrowing cheaper for businesses and consumers, encouraging investment, spending, and job creation. It can also be a response to slowing economic activity or concerns about deflation.

Q3: Who is Stephen Miran, and why are his comments significant?

A: Stephen Miran is a U.S. Federal Reserve Governor. His comments are significant because he is a policymaker within the Fed. His statements offer insight into potential shifts in Federal Reserve policy. His advocacy for a substantial cut suggests a strong stance on the need for economic stimulus.

Q4: How might a Fed rate cut indirectly affect cryptocurrency markets?

A: A Fed rate cut can indirectly affect crypto markets by making traditional investments less attractive due to lower returns. This might encourage investors to seek higher yields in riskier assets, including cryptocurrencies. Additionally, a weaker U.S. dollar, often a consequence of rate cuts, can make dollar-denominated crypto assets more appealing to international buyers.

Q5: What is the Federal Open Market Committee (FOMC)?

A: The FOMC is the monetary policy-making body of the Federal Reserve System. It comprises Federal Reserve Board Governors and presidents of the Federal Reserve Banks. The FOMC meets regularly to assess economic conditions and decide on the appropriate level for the federal funds rate, influencing overall interest rates.