Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Like many other altcoins, Fantom’s (FTM) price struggles to recover from its quarter-long decline. On-chain data highlights specific factors keeping the token from reaching a higher value.

FTM’s highest price this quarter was $1.03 on April 10. While there were attempts to trade higher, the token faced rejection on several occasions.

Fantom Finds It Difficult to Break Out

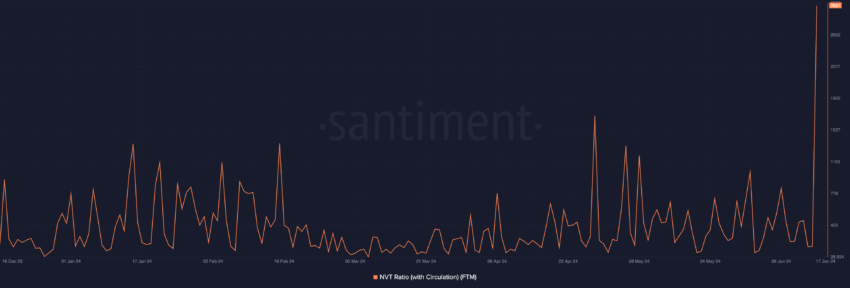

There has been speculation that FTM has entered an opportunity zone for market participants to accumulate. But, according to the Network Value to Transactions (NVT) Ratio, bearish forces continue to seize control of the token’s direction.

NVT Ratio: The NVT Ratio measures whether a blockchain’s network is overvalued or not. To get this insight. If this value is too high, it means that the market cap has outpaced the transaction volume. Conversely, a low reading suggests that the transaction volume is growing faster than the market cap. In this instance, the network is considered undervalued.

According to data from Santiment, the NVT Ratio on the Fantom network suddenly jumped to 2,997 on June 17. This unprecedented spike implies that the cryptocurrency is overvalued compared to the circulating tokens on the blockchain.

Concerning the price, this condition has historically been associated with a local top. Therefore, FTM’s price, which was $0.61 at press time, may drop further.

Read More: 9 Best Fantom (FTM) Wallets In 2024

Last week, BeInCrypto reported that demand for FTM dropped to a yearly low. The inference from that analysis was that the price would drop below $0.60.

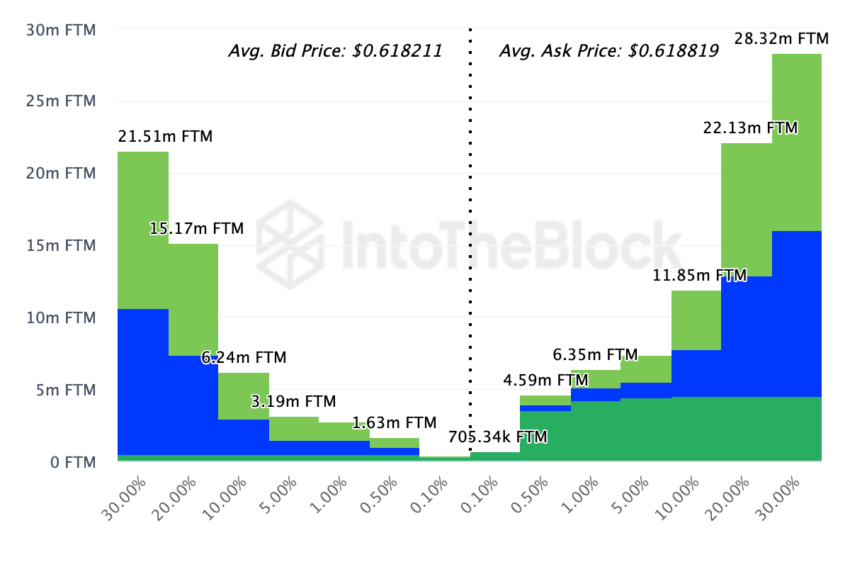

That prediction seems ready to become a reality. The Exchange-Onchain Market Depth reinforces this forecast.

Exchange-Onchain Market Depth: This metric tracks potential buying and selling orders on exchanges. The column on the left represents the bid volume, which indicates the total buying potential. On the right is the ask volume, which indicates the number of tokens prepared for sale.

Data from IntoTheBlock shows that 50.63 million FTM tokens were on the bid side. However, the ask side has 81.35 million tokens in line to be sold.

FTM Price Prediction: Losses May Be Bigger

The disparity in the orders reveals that the token looks set to experience high selling pressure. If this continues over the next few days, FTM’s price may drop below $0.60, and the value may change hands at $0.58.

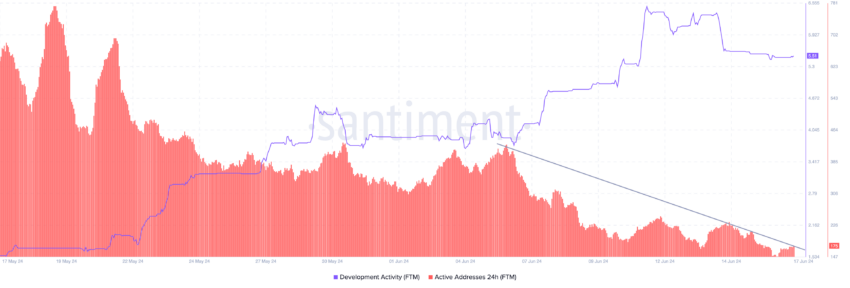

Another crucial metric for Fantom is development activity. As a smart contract platform, development activity measures whether developers are shipping new features to solve challenges on the network.

According to on-chain data from Santiment, development activity has been dropping since June 14. This means that developers’ commitment to polishing the network has been low. In addition, the 24-hour active addresses fell, suggesting a decrease in the number of unique addresses interacting with FTM.

Read More: Top 5 Yield Farms on Fantom

Should these metrics continue to decline, bulls may be unable to save FTM from another downturn. However, the Sonic upgrade, which is projected to happen in the third quarter (Q3), may save the token from further losses.

But Fantom has not yet set a date for the Mainnet event. If the team does, buying pressure may increase, and FTM can return to $1.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link