A mysterious force is making waves in the cryptocurrency market. An anonymous entity, often referred to as an **Ethereum whale**, has significantly increased its holdings. This massive accumulation could signal important shifts in market dynamics. Such large-scale movements frequently capture the attention of investors worldwide. They often prompt questions about potential future price trends.

Unveiling the Ethereum Whale’s Strategic Moves

Since June 22, an unidentified wallet address has quietly amassed a substantial amount of Ether. This **Ethereum whale** now holds 68,000 ETH. This impressive sum is valued at approximately $120 million. The average purchase price for these holdings stands at $2,597. This data comes from insights shared by on-chain analyst @ai_9684xtpa on X. Such a concentrated acquisition by a single entity is noteworthy. It suggests a strong conviction in Ethereum’s long-term value. Furthermore, the timing of this accumulation, starting in late June, aligns with specific market conditions. This period may have presented a strategic entry point for large investors.

The sheer volume of 68,000 ETH represents a significant portion of the daily trading volume on many exchanges. Consequently, such a large purchase can absorb considerable market liquidity. This action can also influence supply-demand dynamics. The whale’s consistent buying over weeks indicates a deliberate, planned strategy. It is not a single, impulsive transaction. This methodical approach suggests a sophisticated understanding of market cycles. Moreover, the chosen average price point could indicate a perceived value level. Many analysts watch these large accumulations closely. They often interpret them as bullish signals for the asset. This particular whale’s actions are no exception, drawing considerable speculation.

On-Chain Analysis: Tracking Large ETH Transactions

The details of this significant accumulation became public thanks to **on-chain analysis**. This specialized field examines data directly from the blockchain. Blockchain data is transparent and immutable. This allows analysts to track every transaction. They can identify large movements of funds. They can also trace wallet addresses. @ai_9684xtpa, a prominent on-chain analyst, identified this specific whale’s activity. Such analysts use sophisticated tools. These tools process vast amounts of blockchain data. They then highlight unusual or significant patterns. This includes large transfers or accumulations.

Approximately 30 minutes before the analyst’s report, the whale’s address made a notable move. It withdrew 8,745 ETH from Binance Exchange. This withdrawal is particularly important. Moving funds off an exchange often suggests a long-term holding strategy. Investors typically transfer assets to private wallets for security. They do this when they intend to hold rather than trade. This specific **large ETH transaction** reinforces the idea of a strategic accumulation. It reduces the immediate selling pressure on exchanges. Therefore, it indicates the whale’s intention to keep these assets off the market for an extended period. On-chain analysis provides crucial insights. It helps market participants understand the true flow of capital within the crypto ecosystem. This transparency is unique to blockchain technology.

Impact of Crypto Whale Activity on ETH Price

**Crypto whale activity** can significantly influence market sentiment and price. When a large investor accumulates substantial amounts of an asset, it often signals confidence. This confidence can then ripple through the broader market. Other investors may interpret such moves as a precursor to a price increase. This can lead to increased buying pressure. Conversely, large sell-offs by whales can trigger fear and sell-offs. Therefore, tracking these movements is vital for many traders.

An accumulation of 68,000 ETH is substantial. It could potentially absorb significant sell-side liquidity. This absorption helps stabilize the price. It might even push it upwards. However, the immediate impact can vary. It depends on overall market conditions. It also depends on other concurrent news. Nevertheless, the presence of a large buyer provides underlying support. It indicates that strong hands believe in Ethereum’s future. This can prevent sharp downturns. It can also contribute to a more positive market outlook. Many market participants closely monitor these whale alerts. They use them as one data point among many. This helps them make informed investment decisions.

Understanding Ethereum Accumulation Trends

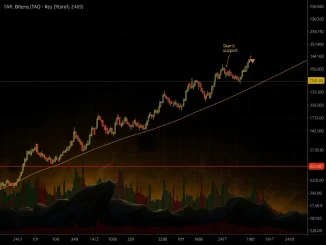

The recent **ETH accumulation** by this anonymous whale fits into broader market trends. Large investors often accumulate assets during periods of price consolidation or dips. They aim to buy low. This strategy positions them for potential future price appreciation. Ethereum, as the second-largest cryptocurrency, frequently sees such large-scale interest. Its robust ecosystem and ongoing development attract significant capital. Network upgrades, like the upcoming Dencun, also contribute to this interest. These upgrades aim to enhance scalability and efficiency. This makes Ethereum even more attractive for long-term holding.

Historical data shows patterns of accumulation preceding significant price rallies. While not a guarantee, these patterns provide context. They suggest that experienced investors are positioning themselves. They anticipate future growth. The motivations behind such large accumulations are varied. They might include institutional interest. They could also involve high-net-worth individuals. Some might be seeking portfolio diversification. Others might be making a strategic long-term bet on decentralized finance (DeFi) and NFTs built on Ethereum. Regardless of the specific motivation, sustained **ETH accumulation** indicates strong underlying demand for the asset.

Decoding the Whale’s Strategy and Market Implications

The anonymous whale’s actions reveal a calculated investment strategy. Their average purchase price of $2,597 suggests a specific valuation belief. This price point was likely identified as a favorable entry. It positioned the whale for potential gains. Such a large-scale entry implies a long-term outlook. Short-term traders rarely amass such vast quantities. Instead, they typically focus on smaller, faster trades. This long-term view can be reassuring for other investors. It suggests that major players see intrinsic value in Ethereum. They are willing to commit significant capital.

Furthermore, the withdrawal from Binance is a critical detail. It removes the ETH from the immediate reach of exchange trading bots. It also takes it out of the general exchange liquidity pool. This action reduces potential selling pressure. It solidifies the whale’s commitment to holding. This move is often seen as a bullish indicator. It reduces the circulating supply available on exchanges. Consequently, if demand remains constant or increases, the price could respond positively. The whale’s strategy, therefore, appears designed for capital preservation and growth. It aligns with a belief in Ethereum’s foundational strength.

Historical Precedents of Large ETH Movements

Looking at past market cycles reveals similar instances. Large **Ethereum whale** movements have often preceded significant price shifts. For example, during the 2020-2021 bull run, substantial accumulations were observed. These accumulations were followed by dramatic price surges. Similarly, periods of heavy selling by whales often correlated with market corrections. These historical patterns provide context. They show how impactful individual large holders can be. However, each market cycle is unique. Many factors influence cryptocurrency prices. These include global economic conditions and regulatory news. Therefore, current whale activity is one data point among many. It should not be the sole basis for investment decisions. Investors must always conduct their own thorough research. This ensures a comprehensive understanding of market risks.

Navigating the Volatility: Insights for Investors

The cryptocurrency market remains highly volatile. While **large ETH transactions** by whales offer intriguing insights, retail investors should exercise caution. Following whale movements blindly carries inherent risks. Whales often have access to superior information. They also possess different risk tolerances. Their strategies may not align with individual investor goals. Instead, focus on fundamental analysis. Understand Ethereum’s technology, its use cases, and its development roadmap. Diversify your portfolio. Do not put all your capital into a single asset. Set clear investment goals. Use stop-loss orders to manage potential losses. These practices provide a more robust approach to navigating the crypto market. They reduce reliance on speculative whale tracking. Ultimately, personal financial goals and risk capacity should guide all investment choices.

The recent accumulation of 68,000 ETH by an anonymous whale highlights significant market confidence in Ethereum. This substantial **ETH accumulation**, valued at $120 million, demonstrates a long-term strategic play. On-chain analysis provides crucial transparency into these movements. It allows the public to observe significant **crypto whale activity**. While these large transactions offer valuable insights, they are just one piece of the complex market puzzle. Investors should combine such information with their own research. They should also consider broader market trends. This approach helps make informed decisions in the dynamic world of cryptocurrency.

Frequently Asked Questions (FAQs)

1. What is an Ethereum whale?

An Ethereum whale is an individual or entity holding a very large amount of Ethereum (ETH). These holders possess enough ETH to potentially influence market prices with their transactions. Their movements are closely watched by market participants.

2. How do on-chain analysts track large transactions?

On-chain analysts use specialized software and tools to monitor public blockchain data. They track wallet addresses, transaction volumes, and fund movements. This allows them to identify significant accumulations, transfers, or sales by large holders.

3. What impact does ETH accumulation have on the market?

Large ETH accumulation often indicates strong investor confidence. It can signal a bullish sentiment. Such buying absorbs supply, potentially leading to price increases if demand remains high. It can also provide market stability by reducing available supply on exchanges.

4. Is it wise to follow crypto whale activity?

While tracking crypto whale activity offers insights, it is not always wise to follow blindly. Whales have different objectives and resources. Retail investors should conduct their own research, understand market fundamentals, and manage their own risk. Whale movements are one data point among many.

5. What is the current value of 68,000 ETH?

Based on the average purchase price mentioned, 68,000 ETH was valued at approximately $120 million (68,000 ETH * $2,597/ETH). The exact current value fluctuates with the live market price of Ethereum.

6. When did this anonymous whale begin accumulating ETH?

According to on-chain data, this anonymous whale began accumulating 68,000 ETH since June 22. This period of accumulation has continued, indicating a sustained investment strategy.