Are you watching the crypto markets? If so, you might have seen a fascinating report making waves. According to crypto analytics firm CryptoQuant, Ethereum (ETH) is now extremely undervalued compared to Bitcoin (BTC). This isn’t just a slight dip; CryptoQuant states this hasn’t happened since way back in 2019.

What Does ‘ETH Undervalued’ Really Mean?

When analysts say ETH undervalued compared to BTC, they are typically referring to the ETH/BTC ratio. This ratio measures Ethereum’s price relative to Bitcoin’s price. A lower ratio suggests ETH is cheaper relative to BTC than its historical or fundamental value might suggest.

CryptoQuant’s analysis indicates this ratio has hit a point not seen in years, signaling a potential disconnect between Ethereum’s fundamentals and its market price when benchmarked against Bitcoin. Think of it like comparing the stock price of two major tech companies; if one company’s price falls significantly relative to the other, despite both having strong performance, it might be considered undervalued.

Historical Precedent: What Happened Last Time ETH Was Undervalued vs BTC?

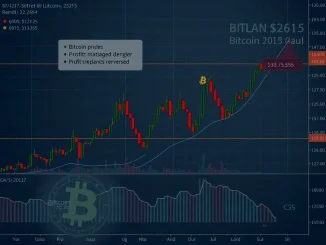

The report highlights a crucial point: the last time ETH was this undervalued relative to BTC was in 2019. Historically, periods where the ETH/BTC ratio hits such lows have often preceded periods of significant Ethereum outperformance.

Why might this be the case? Often, after a major Bitcoin-led rally, market attention and capital tend to flow into other large-cap altcoins like Ethereum, causing their prices to catch up or even surpass Bitcoin’s percentage gains. This rotation of capital is a common theme in crypto bull cycles.

The Big Question: Will Ethereum Price Rebound This Time?

While history offers a promising narrative, CryptoQuant’s report isn’t entirely bullish. They point out significant headwinds that could prevent a straightforward rebound for the Ethereum price despite the undervaluation signal.

Here are the key challenges identified:

- Supply Pressure: Factors like increased staking on the Ethereum network (locking up ETH) and potential selling pressure from various sources could be weighing on the price. While staking reduces circulating supply, other market dynamics can offset this.

- Weak Demand: Despite the network’s activity, overall market demand for ETH might not be strong enough to absorb selling pressure and drive the price up significantly relative to BTC. This could be reflected in trading volumes or institutional interest levels.

- Flat Activity: Network activity, while foundational, might not be showing the explosive growth needed to justify a rapid price increase. This could include metrics like daily active addresses, transaction counts, or gas usage remaining relatively stable rather than surging.

These factors suggest that while the *relative* valuation signal is flashing green for ETH against BTC, the *absolute* market conditions might not be ripe for a massive breakout just yet. The macro environment, regulatory news, and overall crypto market sentiment also play crucial roles.

Understanding the ETH vs BTC Dynamic

The relationship between ETH vs BTC is central to the crypto market. Bitcoin is often seen as the market leader and a store of value, while Ethereum is the leading smart contract platform, powering DeFi, NFTs, and dApps. Their relative performance is a key indicator of market phases.

A strong ETH/BTC ratio often signifies risk-on sentiment and an ‘altcoin season’ where capital flows down the market cap ladder. A declining ratio, as observed by CryptoQuant, can indicate a flight to quality (towards BTC) or simply that ETH hasn’t kept pace during a BTC rally.

Insights from the CryptoQuant Report

The key takeaway from the CryptoQuant analysis is a nuanced one:

- Historical Signal: The ETH/BTC ratio is at a level that has historically favored Ethereum outperformance.

- Current Reality: Significant market structure challenges (supply, demand, activity) could dilute the impact of this historical signal.

- What to Watch: Investors should monitor these fundamental and on-chain metrics closely rather than relying solely on the historical valuation comparison.

This isn’t a simple ‘buy ETH now’ signal. It’s a call to pay attention to a potentially significant valuation gap, but also to exercise caution given the current market dynamics.

Conclusion: Navigating the Undervaluation Signal

The report that ETH undervalued relative to Bitcoin price is a compelling data point, harkening back to conditions last seen in 2019. While historical patterns suggest this could be a precursor to Ethereum outperforming Bitcoin, the current market landscape presents tangible obstacles. Supply pressure, subdued demand, and stable network activity are factors that could cap any potential rebound. For investors, this means the signal is worth noting, but it must be weighed against prevailing market conditions and fundamental strength. Keep a close eye on those on-chain metrics and broader market sentiment.