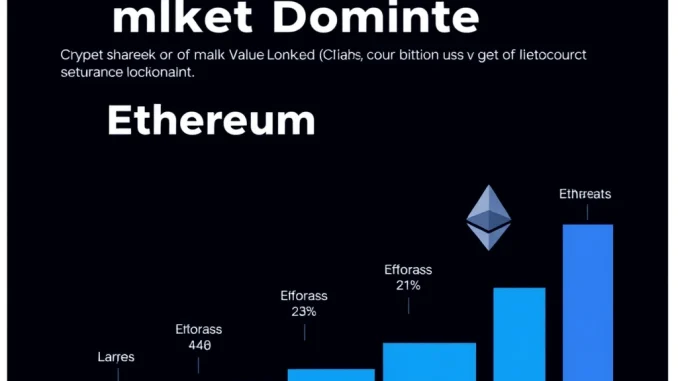

The world of decentralized finance (DeFi) is constantly evolving, and recent data highlights a significant shift: Ethereum’s (ETH) dominance in Total Value Locked (TVL) is waning. According to data shared by Unfolded on X, Ethereum’s TVL market share recently dipped to 50.88%, a level not seen since 2022. This development in the Ethereum TVL landscape warrants a closer look.

Understanding the Significance of DeFi TVL

Total Value Locked (TVL) represents the total value of crypto assets deposited in decentralized finance protocols. It’s a key metric used to gauge the health and growth of the DeFi ecosystem and individual blockchain networks. A higher DeFi TVL generally indicates more user activity, confidence, and capital flowing into the protocols built on that chain.

For years, Ethereum has been the undisputed king of DeFi TVL, hosting the vast majority of protocols and locked capital. Its first-mover advantage, robust developer community, and extensive network effects established it as the primary hub for decentralized applications.

What Does the ETH TVL Drop Indicate?

The recent data showing ETH TVL market share falling below 51% signals increased competition and shifting dynamics within the broader Crypto TVL space. While Ethereum still holds the largest single share, its shrinking percentage points to several potential factors:

- Rise of Competing Layer 1 Chains: Blockchains like Binance Smart Chain, Solana, Avalanche, and others have invested heavily in attracting DeFi protocols and users, often offering lower transaction fees and faster speeds than Ethereum’s mainnet.

- Growth of Layer 2 Solutions: Ethereum’s own scaling solutions, such as Arbitrum, Optimism, Polygon, and zkSync, are attracting significant TVL. While built *on* Ethereum, the TVL locked on these L2s is often tracked separately, diluting Ethereum mainnet’s direct share percentage.

- Cross-Chain Interoperability: As bridges and cross-chain protocols improve, capital is becoming more fluid, moving between different networks in search of better yields or lower costs.

- Specific Protocol Migrations or Growth on Other Chains: Certain popular DeFi protocols may see explosive growth on non-Ethereum chains, pulling TVL dominance away.

Analyzing Ethereum Market Share Trends

The dip below 51% isn’t just a number; it reflects a trend in Ethereum Market Share relative to its peers. While Ethereum’s absolute TVL might still be high or even growing, other chains are growing faster in terms of the capital locked in their DeFi ecosystems. This competitive pressure is a natural part of a maturing market.

Consider the landscape:

| Network | Role in DeFi | Impact on ETH TVL Share |

|---|---|---|

| Ethereum Mainnet | Historical DeFi hub, high security | Directly tracked TVL, percentage is falling |

| Ethereum Layer 2s (Arbitrum, Optimism, etc.) | Scaling solutions for Ethereum, lower fees | Attract TVL that might otherwise be on mainnet; tracked separately often |

| Competing Layer 1s (Solana, Avalanche, etc.) | Alternative blockchain ecosystems | Directly compete for protocols and user TVL |

This dynamic shows that the expansion of DeFi isn’t solely happening on Ethereum’s base layer anymore. It’s spreading across its own scaling solutions and entirely separate blockchain networks.

What Does This Mean for Ethereum’s Future?

Does a declining Ethereum Market Share in TVL spell trouble for the network? Not necessarily. It forces Ethereum to adapt and highlights the success of its ecosystem’s scaling efforts (L2s). Ethereum’s focus is increasingly on being a secure, decentralized settlement layer, with much of the user activity and TVL potentially migrating to faster, cheaper Layer 2 networks built on top of it.

Challenges include maintaining network effects and ensuring seamless interoperability between L1 and L2s, as well as competing effectively with innovative L1 chains. Opportunities lie in the continued development of scaling technology (like zk-rollups), protocol innovation, and Ethereum’s strong brand recognition and security track record.

Conclusion: A Shifting Crypto TVL Landscape

The drop in Ethereum’s mainnet TVL market share below 51% is a significant data point reflecting the maturing and increasingly competitive nature of the Crypto TVL space. While Ethereum remains a dominant force, the growth of Layer 2 solutions and competing Layer 1 blockchains means that the distribution of locked value is becoming more fragmented. This trend is likely to continue, pushing all networks, including Ethereum, to innovate and compete for users and capital in the dynamic world of decentralized finance.