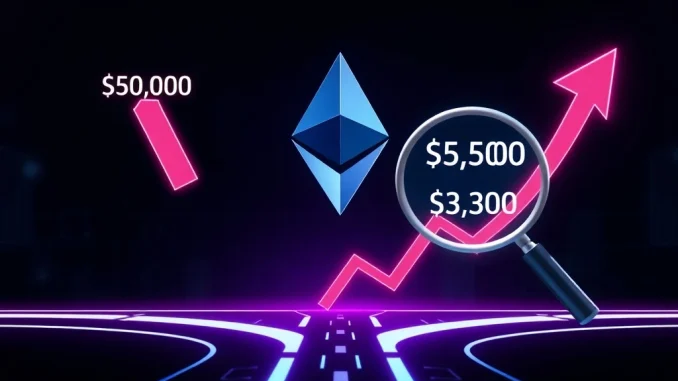

Are you watching Ethereum’s every move? If so, you’re not alone. The second-largest cryptocurrency by market capitalization, Ethereum, finds itself at a pivotal moment, trading precariously near the $3,700 mark. This isn’t just another price point; it’s a historically significant threshold that could dictate its next major move. Will we see a thrilling surge towards $4,000, or a challenging retreat to $3,300? Let’s dive into the latest Ethereum news and uncover what the technical indicators are signaling for the asset’s near-term trajectory.

Decoding Ethereum’s Current Standoff: Conflicting Technical Indicators

The current Ethereum price action is a fascinating study in market indecision. Technical indicators are painting a mixed picture, presenting both cautious warnings and optimistic forecasts. This dual narrative is keeping traders on the edge of their seats, wondering which way the scales will tip.

Bearish Undercurrents: What’s Signaling a Potential Dip?

Bearish Divergence: Renowned crypto analyst Michaël van de Poppe has pointed out a bearish divergence following Ethereum’s recent $1,200 rally. This occurs when the price makes a higher high, but an oscillator (like the RSI) makes a lower high, suggesting weakening momentum. Van de Poppe specifically notes a lower high in ETH’s price, which could precede a correction.

Liquidation Risks: Failure to decisively breach the $3,800 resistance could trigger a decline towards $3,300. This downward pressure might be exacerbated by liquidity dynamics, potentially leading to the liquidation of numerous long positions, creating a cascade effect.

Waning Trading Volume & Neutral RSI: The market’s hesitation is further underscored by shrinking trading volume and a neutral Relative Strength Index (RSI). These technical indicators suggest a ‘wait-and-see’ phase, often preceding significant price movements, but also indicating a lack of strong buying conviction at current levels.

Bullish Whispers: Why $4,000 and Beyond Might Be Possible

Confirmed Bear Trap & MACD Bullish Crossover: According to COINOTAG sources, a confirmed bear trap (a false breakdown designed to trick bearish traders) combined with a MACD (Moving Average Convergence Divergence) bullish crossover are strong signals of renewed buying momentum. These patterns often precede significant upward movements.

Fractal Analysis Parallels: Intriguingly, some analysts are drawing parallels between Ethereum’s current chart and Bitcoin’s monumental 2020 breakout cycle. Bitcoinsensus highlights similarities in patterns like false breakdowns, prolonged sideways movement, and triangle consolidations. If Ethereum follows this fractal, a substantial rally could be on the horizon.

The $9,000 Target: Merlijn The Trader reinforces the bullish outlook, citing the MACD crossover and bear trap confirmation. If Ethereum can decisively close above the critical $4,000 resistance level, a rally towards an ambitious $9,000 becomes increasingly plausible. This would mark a significant milestone for the asset.

Key Price Levels to Watch: Your Guide to the Next Move

Understanding the critical price points is paramount for any trader or investor navigating this volatile period. Here’s a quick overview:

| Price Level | Significance | Implication |

|---|---|---|

| $3,700 | Current Resistance / Pivotal Threshold | Breakout or Pullback trigger |

| $3,800 | Immediate Resistance | Failure to breach could lead to decline |

| $4,000 | Major Resistance / Inflection Point | Decisive breakout target for strong rally |

| $3,300 | Potential Support / Correction Target | Target if resistance is not broken |

| $2,630 | Robust Support | Strong historical support level |

What Does This Mean for Your ETH Price Prediction?

The interplay between volume and momentum indicators further complicates the outlook for ETH price prediction. Ethereum’s shrinking volume, coupled with a neutral RSI, points to a market in a wait-and-see phase. Such conditions often precede decisive price movements, either validating a breakout or confirming a retracement. Traders are advised to closely monitor these technical indicators in the coming sessions to anticipate Ethereum’s next directional shift.

The $4,000 resistance zone stands as a critical inflection point. A successful breakout would likely attract heightened buying interest, potentially catalyzing a strong rally. Conversely, a failure to surpass this level could result in a retracement to the $3,300 support area, reshaping Ethereum’s near-term trend. Market participants are urged to consider broader factors, including Bitcoin’s performance and macroeconomic conditions, which could influence Ethereum’s dynamics.

Navigating the Crypto Market Analysis: Actionable Insights for Traders

Ethereum’s current positioning reflects a dual narrative of potential correction or breakout, driven by conflicting technical signals. While bearish divergences and volume contractions hint at a short-term pullback, fractal patterns and bullish MACD signals offer compelling arguments for a substantial rally if key resistance is breached.

For those engaged in crypto market analysis, vigilance is key. Here are some actionable insights:

Monitor Key Levels Closely: Pay close attention to the $3,700, $3,800, and especially the $4,000 resistance levels. A clear break above $4,000 with strong volume would be a significant bullish confirmation.

Watch for Volume Confirmation: Any decisive price movement, whether up or down, should ideally be accompanied by significant trading volume to confirm its sustainability.

Implement Risk Management: Given the conflicting signals, setting stop-loss orders is crucial to protect capital in case of a sudden downturn. Avoid overexposure to either scenario.

Stay Updated on Broader Market Trends: Bitcoin’s performance often influences the broader altcoin market, including Ethereum. Keep an eye on BTC’s movements and global macroeconomic news.

Conclusion: Ethereum at the Crossroads

Ethereum stands at a fascinating crossroads, with its future direction hanging in the balance. The conflicting signals from technical indicators create a landscape of both immense opportunity and potential risk. While a powerful surge towards $4,000 and beyond remains a tantalizing possibility, the risk of a retracement to $3,300 or even $2,630 cannot be ignored. For traders and investors, this is a time for careful observation, strategic planning, and agile decision-making. The next few sessions will be crucial in revealing Ethereum’s path forward in the ever-evolving crypto market analysis.

Frequently Asked Questions (FAQs)

Q1: What is the significance of the $3,700 level for Ethereum?

The $3,700 level is a pivotal resistance point for Ethereum. It’s a historically significant threshold that could determine whether the price breaks out into a bullish rally or experiences a temporary pullback. A decisive move above or below this level will likely dictate its near-term trajectory.

Q2: What are the main bearish signals for Ethereum’s price?

Key bearish signals include a bearish divergence noted by analysts (where price makes a lower high but momentum indicators suggest weakness), the risk of failing to breach $3,800 leading to a drop towards $3,300 due to liquidity dynamics and potential long liquidations, and waning trading volume coupled with a neutral RSI indicating market indecision.

Q3: What are the main bullish signals for Ethereum’s price?

Bullish signals include a confirmed bear trap and a MACD bullish crossover, suggesting renewed buying momentum. Additionally, fractal analysis drawing parallels to Bitcoin’s 2020 breakout cycle implies a similar upward trajectory. If Ethereum decisively closes above $4,000, some analysts foresee a rally towards $9,000.

Q4: What is fractal analysis in crypto trading?

Fractal analysis in crypto trading involves identifying recurring patterns in price charts that have led to similar outcomes in the past. For Ethereum, analysts are comparing its current chart patterns (like false breakdowns, triangle consolidations, and sideways movement) to Bitcoin’s behavior before its significant 2020 rally, suggesting a potential similar upward trajectory for ETH.

Q5: What should traders do given the mixed signals for Ethereum’s price?

Traders should remain vigilant and focus on risk management. This includes closely monitoring key resistance ($3,700, $3,800, $4,000) and support ($3,300, $2,630) levels, looking for volume confirmation on any price move, setting stop-loss orders to protect capital, and staying updated on broader market trends like Bitcoin’s performance and macroeconomic conditions.