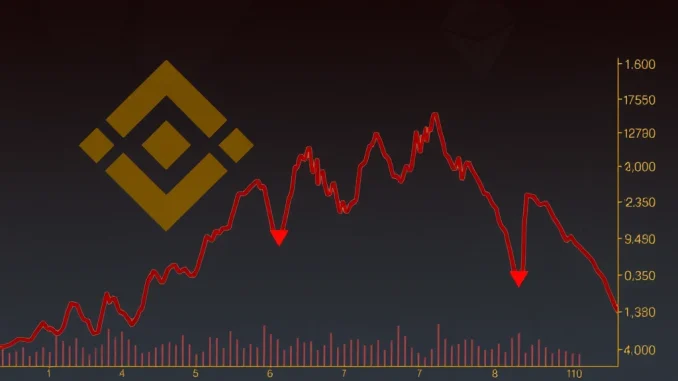

Is the Ethereum party on Binance officially over? Recent analysis reveals a shocking downturn in Ethereum’s open interest on the world’s largest crypto exchange, Binance. Crypto analyst Darkfost’s observation, highlighted in a CryptoQuant post, paints a concerning picture: Binance traders are overwhelmingly bearish on ETH. This isn’t just a minor dip; it’s a dramatic halving of open interest in just four months. Let’s dive into what this means for Ethereum and the broader crypto market.

Why is Ethereum Open Interest on Binance Plummeting?

To understand the gravity of this situation, let’s first clarify what “open interest” signifies. In simple terms, Ethereum open interest represents the total number of outstanding derivative contracts, like futures and options, that are yet to be settled or closed. A rising open interest typically suggests growing market participation and interest, while a declining open interest, as we are seeing with ETH on Binance, often indicates the opposite – traders are closing positions and potentially exiting the market.

Darkfost’s analysis points to a significant and rapid decrease. Consider these key points:

- Peak Open Interest: ETH’s open interest on Binance reached a staggering peak of $7.78 billion on December 16th. This was a period of high optimism and market exuberance.

- Dramatic Decline: Fast forward just four months, and this figure has plummeted by over 50%. Nearly $4 billion has vanished from ETH’s open interest on Binance.

- Below 365-Day Average: The current open interest has now sunk below its 365-day average, a strong indicator of a sustained downtrend rather than a temporary fluctuation.

[table]

| Metric | December 16th Peak | Current Status | Change |

|————————-|——————–|——————–|—————|

| ETH Open Interest on Binance | $7.78 Billion | Over 50% Decrease | Nearly $4 Billion Shed |

[/table]

[/center>

This sharp and consistent decline is not just a number on a chart; it has real implications for ETH price and market dynamics.

The Bearish Sentiment: What’s Driving Traders Away from ETH on Binance?

The core message from Darkfost’s analysis is clear: Binance traders are exhibiting a strong bearish ETH outlook. But what’s fueling this pessimism? Several factors could be at play:

- Risk Aversion: The broader crypto market has experienced periods of volatility and uncertainty. Traders might be reducing their exposure to riskier assets like ETH, especially in a fluctuating macroeconomic environment.

- Extensive Liquidations: A declining open interest can be both a cause and effect of liquidations. As prices fall, leveraged positions get liquidated, further reducing open interest and potentially exacerbating price drops.

- Shifting Market Focus: Capital and attention within the crypto space are constantly shifting. Perhaps traders are moving towards other cryptocurrencies or sectors, reducing their engagement with ETH on Binance.

- Profit Taking: After periods of gains, some traders might be taking profits and reducing their positions in ETH, contributing to the open interest decline.

Impact on ETH Price and Market Stability

The significant drop in Binance ETH open interest is not just an isolated event; it has tangible consequences for Ethereum’s price and overall market stability. Here’s how:

- Downward Pressure on Price: Reduced open interest, particularly when coupled with bearish sentiment, can exert downward pressure on ETH’s price. Fewer open positions might mean less buying interest and potentially more selling pressure.

- Increased Volatility: Periods of sharp open interest decline can sometimes be associated with increased price volatility as markets adjust to the changing sentiment and reduced liquidity.

- Sign of Weakening Momentum: A consistently declining open interest can be interpreted as a sign of weakening bullish momentum and potentially a shift towards a more bearish market phase for Ethereum.

Can Ethereum Turn the Tide? Is There Hope for Reversal?

Darkfost’s analysis suggests that without a reversal of this downward trend in open interest, ETH’s prospects for stability appear “bleak.” However, the crypto market is known for its rapid shifts and unexpected turns. What could trigger a potential turnaround for Ethereum’s open interest on Binance?

- Positive Market Catalysts: Broadly positive news for the crypto market, such as regulatory clarity, institutional adoption, or breakthroughs in blockchain technology, could reignite interest in ETH.

- Ethereum Network Upgrades: Successful and impactful upgrades to the Ethereum network itself could boost investor confidence and attract traders back to ETH.

- Shifting Sentiment: Market sentiment is fluid. A change in overall market mood, perhaps driven by macroeconomic factors or positive developments within the Ethereum ecosystem, could reverse the current bearish trend.

- Undervaluation Perception: If ETH’s price drops significantly, some traders might view it as an undervalued asset and start accumulating, potentially increasing open interest again.

Actionable Insights: Navigating the Bearish ETH Market

For traders and investors navigating this landscape, here are some actionable insights:

- Monitor Open Interest: Keep a close eye on Ethereum’s open interest on Binance and other major exchanges. A sustained reversal in the downtrend could signal a potential shift in market sentiment.

- Assess Risk Tolerance: In a potentially bearish market, carefully assess your risk tolerance and adjust your portfolio accordingly. Consider reducing leverage and managing position sizes.

- Stay Informed: Keep abreast of market news, Ethereum network developments, and broader macroeconomic trends that could influence ETH’s price and market sentiment.

- Consider DCA: For long-term investors, periods of price weakness can be opportunities for dollar-cost averaging (DCA) into ETH, but always with careful consideration of market risks.

Conclusion: A Critical Juncture for Ethereum on Binance

The halving of Ethereum’s open interest on Binance is a powerful signal that cannot be ignored. It reflects a significant shift in trader sentiment towards a bearish outlook. While the situation appears concerning, the crypto market is dynamic and unpredictable. Whether this marks a prolonged period of bearishness for ETH or a temporary dip before a resurgence remains to be seen. What is clear is that Ethereum, particularly on Binance, is at a critical juncture, and careful monitoring of market trends and developments is essential for navigating the path ahead.