The cryptocurrency market recently experienced a dramatic 24-hour period. It was marked by **massive crypto liquidations** across major digital assets. This turbulence particularly impacted derivatives traders. Specifically, **Ethereum liquidations** led the charge, wiping out millions from leveraged positions.

Understanding Crypto Perpetual Futures and Liquidations

To fully grasp the recent market events, understanding **crypto perpetual futures** is essential. These are derivatives contracts that allow traders to speculate on the future price of a cryptocurrency. Unlike traditional futures, perpetual futures do not have an expiry date. Consequently, traders can hold them indefinitely, provided they maintain sufficient margin.

Liquidations occur when a trader’s leveraged position fails to meet the margin requirements. This happens as the market moves against their trade. When a position is liquidated, the exchange forcibly closes it to prevent further losses. This mechanism protects both the exchange and other market participants. Essentially, it is a forced sale. A significant volume of liquidations often signals heightened **market volatility** and can exacerbate price movements.

Ethereum Leads the Devastating Wave of Liquidations

Over the past 24 hours, **Ethereum liquidations** were notably high. ETH perpetual futures alone accounted for a staggering $97.71 million in liquidations. This figure underscores the intense pressure on Ethereum traders. Of this substantial amount, 68.6% involved long positions. This indicates that a majority of traders were betting on an increase in the **ETH price**. Their optimism, however, was met with sharp price declines, leading to widespread forced closures.

This high proportion of long liquidations often acts as a bearish signal. It suggests that market participants were caught off guard by a downward price movement. The sheer volume of ETH liquidations can also create a cascading effect. As more positions are closed, selling pressure increases, further driving down the **ETH price** and triggering even more liquidations.

Bitcoin and Solana Also Face Significant Losses

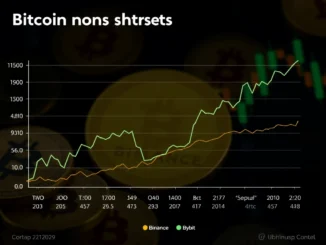

While Ethereum took the lead, other major cryptocurrencies also experienced substantial liquidations. Bitcoin (BTC) perpetual futures saw $77.37 million liquidated. Long positions constituted 51.98% of these liquidations. This shows a more balanced, yet still significant, impact on both bullish and bearish BTC traders. The numbers highlight the broad market downturn affecting even the largest digital asset.

Furthermore, Solana (SOL) perpetual futures recorded $13.19 million in liquidations. Here, long positions accounted for a higher 68.99% of the total. This percentage is quite similar to Ethereum’s. It reflects a similar sentiment among SOL traders, who were largely positioned for price increases. The widespread nature of these **long position liquidations** across top altcoins points to a broader market correction.

The Critical Role of Long Position Liquidations

The predominance of **long position liquidations** is a critical aspect of this recent market event. When long positions are liquidated, it means traders who anticipated price increases were forced to sell their assets. This selling pressure then pushes prices even lower. Consequently, it triggers more liquidations in a chain reaction known as a liquidation cascade. Such cascades amplify market downturns, creating a cycle of selling and price depreciation.

This dynamic significantly contributes to **market volatility**. It makes price movements more aggressive and less predictable. For instance, if many traders use high leverage, a small price dip can lead to massive liquidations. This quickly transforms a minor correction into a significant market crash. Understanding this mechanism is crucial for traders navigating volatile crypto markets.

Navigating Market Volatility and Risk Management

The recent wave of liquidations serves as a stark reminder of the inherent risks in trading **crypto perpetual futures**. High leverage, while offering magnified gains, also carries magnified losses. Prudent risk management strategies are therefore paramount. Traders should always consider using stop-loss orders to limit potential losses. Moreover, avoiding excessive leverage can prevent premature liquidations during periods of heightened **market volatility**.

Diversifying portfolios and conducting thorough research before entering leveraged positions are also advisable. Market participants must remain vigilant. They should monitor funding rates and open interest data. These metrics can provide insights into market sentiment and potential future movements. Ultimately, informed decisions and disciplined trading are key to surviving and thriving in the volatile crypto landscape.

Conclusion

The past 24 hours have underscored the significant risks associated with leveraged trading in the cryptocurrency market. **Ethereum liquidations** led a widespread wave, wiping out millions from traders’ portfolios. Bitcoin and Solana also faced substantial losses. The high percentage of **long position liquidations** indicates a market caught off guard by downward price action. Consequently, this contributed to increased **market volatility**. Traders must prioritize robust risk management strategies to navigate these turbulent conditions effectively. Understanding the mechanics of **crypto perpetual futures** and liquidations remains crucial for all market participants.

Frequently Asked Questions (FAQs)

Q1: What are crypto perpetual futures?

A1: Crypto perpetual futures are derivative contracts that allow traders to speculate on the future price of a cryptocurrency without an expiry date. They are distinct from traditional futures contracts.

Q2: What causes crypto liquidations?

A2: Liquidations occur when a trader’s leveraged position fails to meet the required margin. This happens when the market moves significantly against their trade, forcing the exchange to close the position.

Q3: Why were long positions liquidated more in this event?

A3: A higher percentage of long position liquidations indicates that more traders were betting on price increases. When prices unexpectedly fell, these bullish positions were forced to close, leading to substantial losses.

Q4: How do liquidations affect crypto prices?

A4: Liquidations, especially large volumes, can amplify price movements. Forced selling from liquidated long positions adds downward pressure, potentially leading to further price drops and a ‘liquidation cascade’.

Q5: How can traders manage the risk of liquidation?

A5: Traders can manage liquidation risk by using prudent leverage, setting stop-loss orders, diversifying their portfolios, and conducting thorough market analysis. Avoiding over-leveraging is a primary defense against forced closures.